- United States

- /

- Hospitality

- /

- NYSE:HGV

How Investors Are Reacting To Hilton Grand Vacations (HGV) Shares Rising on Strong Sector Peers' Results

Reviewed by Sasha Jovanovic

- Shares of Hilton Grand Vacations rose after strong third-quarter financial results from Hilton Worldwide Holdings and Travel + Leisure Co. improved market sentiment toward the vacation ownership sector.

- Stronger partner licensing revenue noted by Hilton Worldwide, combined with Travel + Leisure Co.'s outperformance, pointed to continued robust consumer demand in leisure travel, benefiting sector peers like Hilton Grand Vacations.

- With sector confidence buoyed by positive partner earnings, we'll examine how rising leisure demand shapes Hilton Grand Vacations' investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Hilton Grand Vacations Investment Narrative Recap

Owning Hilton Grand Vacations means believing in sustained growth for vacation ownership fueled by resilient leisure travel demand, strong brand partnerships, and expanding premium offerings. The recent share rally on positive sector earnings fits this outlook, yet does not materially shift the spotlight from short-term catalysts such as ongoing contract sales momentum or the most pressing risk: the challenge of keeping loan defaults and bad debt allowances in check as interest rates and economic conditions remain variable.

Among recent developments, Hilton Grand Vacations’ completion of a US$400 million timeshare loan securitization in August 2025 stands out, as it strengthens liquidity and supports the company’s capacity to fund new contracts and growth. This move aligns with management’s push to optimize financing costs and unlock additional free cash flow, directly supporting continued investment in sales expansion and premium member experiences.

Yet, in contrast to the upbeat market sentiment, investors should be mindful of continued risks from rising customer delinquencies that could...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations' narrative projects $6.4 billion revenue and $785.5 million earnings by 2028. This requires 12.6% yearly revenue growth and a $728.5 million earnings increase from $57.0 million today.

Uncover how Hilton Grand Vacations' forecasts yield a $53.44 fair value, a 18% upside to its current price.

Exploring Other Perspectives

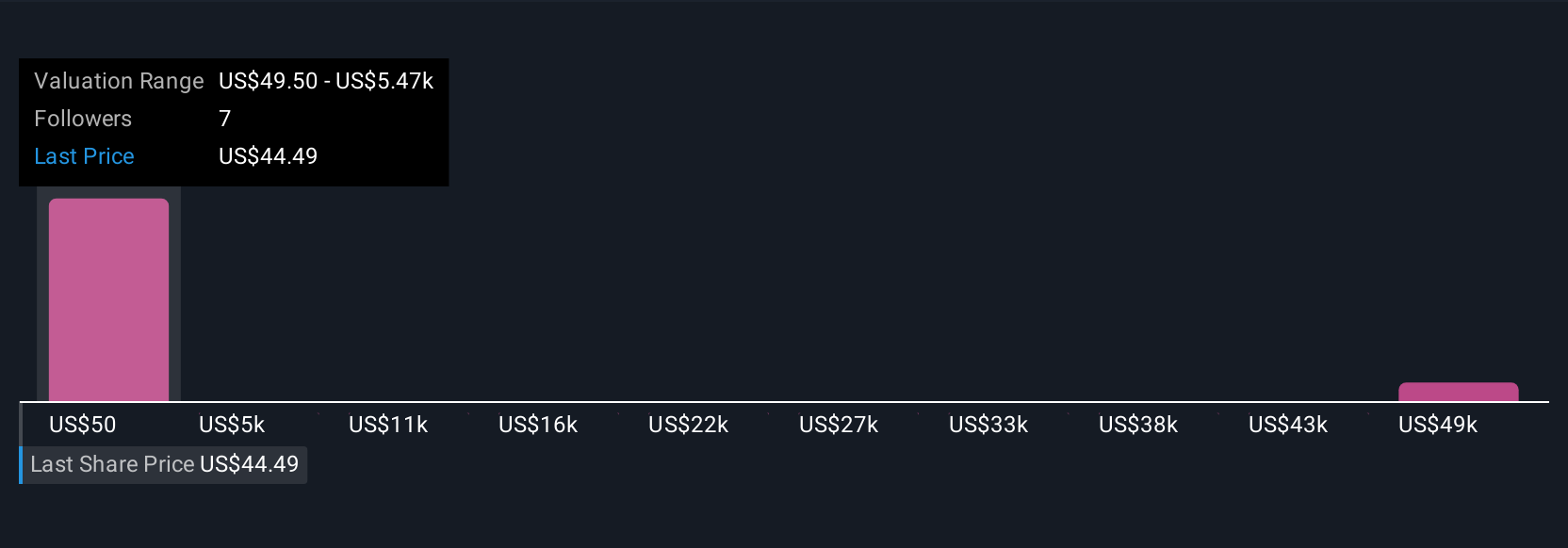

Four fair value estimates from the Simply Wall St Community span US$53 to an outlier of over US$54,000 per share. With sector confidence currently high on robust partner results, these wide-ranging views highlight the need to consider both upside catalysts and significant default-related risks when evaluating Hilton Grand Vacations’ outlook.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $53.44!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives