- United States

- /

- Hospitality

- /

- NYSE:H

Hyatt Hotels (H): Assessing Valuation After a Recent Rebound in Share Price

Reviewed by Simply Wall St

Hyatt Hotels (H) has been quietly grinding higher, with the stock up about 18% over the past month and 11% in the past 3 months, even after a slight pullback this week.

See our latest analysis for Hyatt Hotels.

That recent surge has helped offset a softer year to date, with Hyatt’s 30 day share price return of just over 18% contrasting with a far more modest 3 year total shareholder return near 71%. This suggests momentum is rebuilding after a quieter stretch.

If Hyatt’s rebound has you thinking about where capital could work harder next, it is worth scouting fast growing stocks with high insider ownership as a source of fresh ideas with skin in the game.

With the shares now hovering just shy of analyst targets and trading at a modest intrinsic discount despite rapid revenue and earnings growth, investors face a key question: is there still a buying opportunity here, or is the market already pricing in Hyatt’s next leg of growth?

Most Popular Narrative Narrative: 3.5% Undervalued

With Hyatt closing at $161.28 versus a narrative fair value just above $167, the story hinges on how aggressively future growth and margins evolve.

The strong development pipeline, with approximately 138,000 rooms and several new signings in diverse locations like India, Italy, and the U.S., is likely to drive revenue growth as these new properties come online. The addition of over 2 million new World of Hyatt loyalty members, increasing the member base to approximately 56 million, indicates higher expected direct bookings, which can positively impact both revenue and net margins.

Want to see what kind of revenue surge and margin reset this pipeline is banking on? The narrative leans on bold growth math you have not seen yet.

Result: Fair Value of $167.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting U.S. booking patterns and lingering uncertainty around the Playa acquisition could easily derail the upbeat growth assumptions that underpin this valuation.

Find out about the key risks to this Hyatt Hotels narrative.

Another View: Multiples Flash a Richer Picture

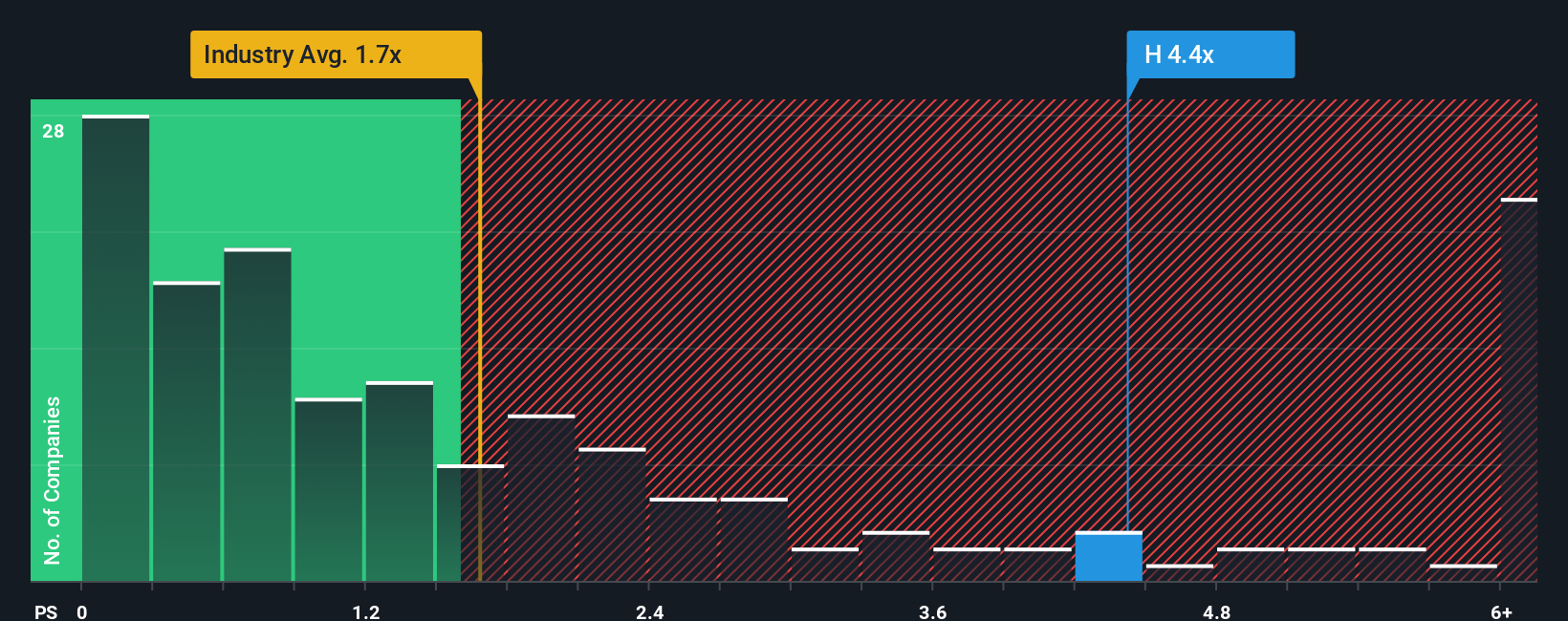

While the narrative fair value implies Hyatt is 3.5% undervalued, the price to sales angle tells a tighter story. At 4.6x sales, Hyatt trades well above the US Hospitality industry at 1.6x and peers at 3.8x, and even above its 3.3x fair ratio, raising the risk of a valuation squeeze if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hyatt Hotels Narrative

If you see the story differently or prefer to lean on your own diligence, you can develop a full narrative in just minutes with Do it your way.

A great starting point for your Hyatt Hotels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Before you move on, consider your next move by scanning a few hand picked stock ideas through the Simply Wall Street Screener right now.

- Explore potential mispricings by targeting quality businesses trading at attractive valuations through these 915 undervalued stocks based on cash flows, which is designed to surface opportunities the broader market may be overlooking.

- Focus on innovative companies reshaping industries with these 25 AI penny stocks, where scalable growth and disruptive products may be key drivers of long term performance.

- Reinforce your portfolio’s income potential by filtering for companies with a history of making regular dividend payments via these 14 dividend stocks with yields > 3%, so your returns are not based solely on price movements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026