- United States

- /

- Hospitality

- /

- NYSE:GBTG

Will GBTG’s SAP Concur Partnership Redefine Its Competitive Edge in Travel Tech Integration?

Reviewed by Sasha Jovanovic

- American Express Global Business Travel (Amex GBT) announced a partnership with SAP Concur to develop an integrated Concur Expense solution for Egencia customers and co-create a next-generation travel management platform called Complete.

- This collaboration focuses on leveraging AI and combined travel and expense data to improve policy compliance and deliver a unified user experience across booking, expense, payments, and servicing functions.

- We'll explore how this AI-driven partnership with SAP Concur could further support Global Business Travel Group's ongoing digital transformation and efficiency initiatives.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Global Business Travel Group Investment Narrative Recap

To be a shareholder in Global Business Travel Group, you need confidence in the company's ability to successfully digitize corporate travel, improve earnings, and operate efficiently even in slower-growth industry conditions. The recent Amex GBT and SAP Concur partnership, while promising for long-term digital innovation, is unlikely to materially affect the most immediate catalysts like CWT acquisition synergies or the most pressing risks, such as persistent margin pressure from shifting to digital transactions. Among other recent announcements, the clearance of the CWT acquisition by US regulators remains the most relevant in context. This deal represents a tangible near-term catalyst by offering scale and potential cost benefits, directly impacting earnings power, whereas the SAP Concur alliance supports longer-term tech and efficiency initiatives. In contrast, investors should not overlook that while digital solutions may improve margins, there remains a risk that higher sales costs and ongoing price competition...

Read the full narrative on Global Business Travel Group (it's free!)

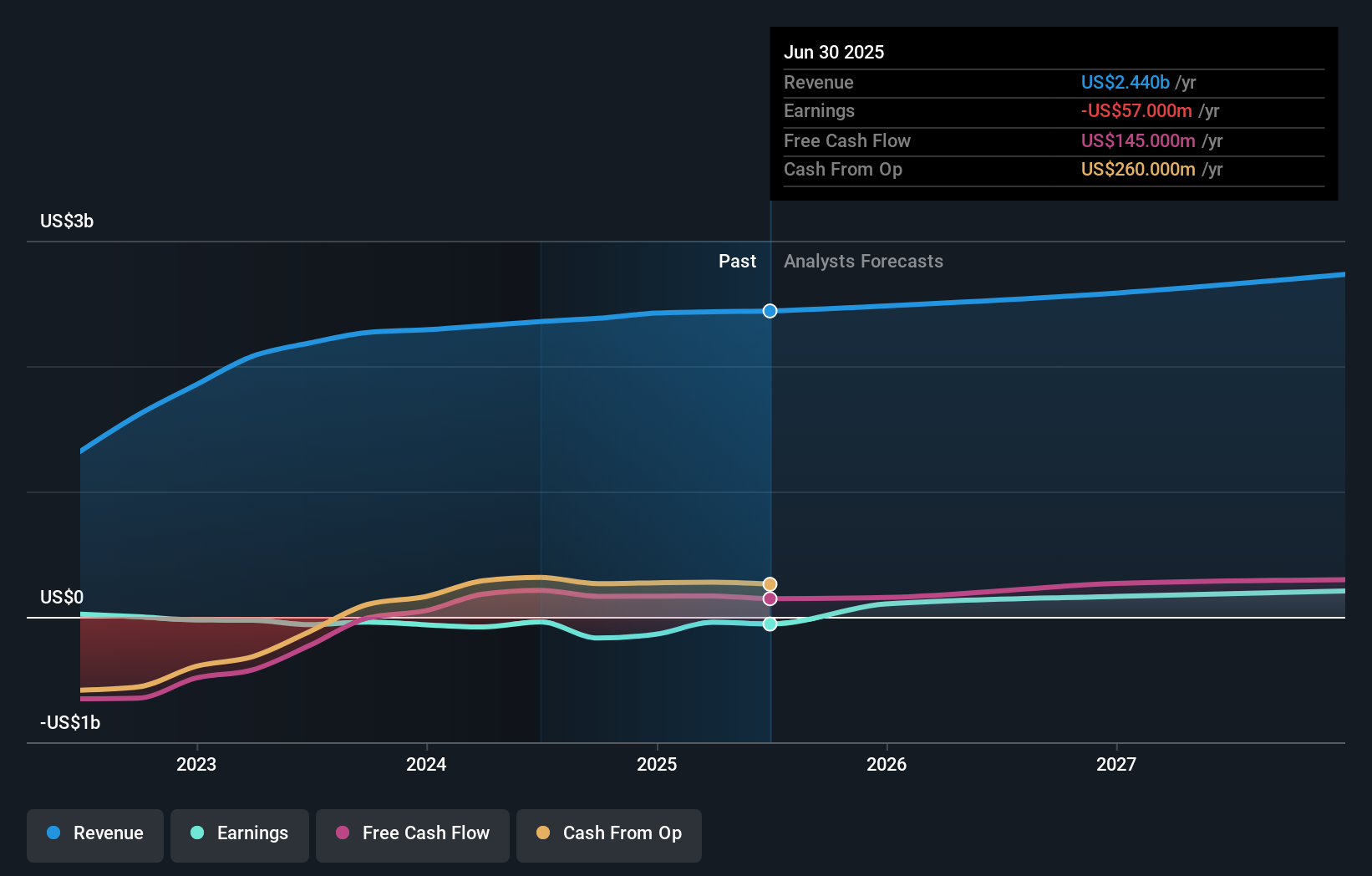

Global Business Travel Group's narrative projects $2.8 billion in revenue and $324.4 million in earnings by 2028. This requires 5.0% yearly revenue growth and an increase in earnings of $381.4 million from the current -$57.0 million.

Uncover how Global Business Travel Group's forecasts yield a $9.91 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have a single fair value estimate for GBTG at US$21.46, suggesting little diversity among retail perspectives. Meanwhile, analyst consensus points to the critical impact of digital margin pressure on future results, so you may want to compare these views yourself.

Explore another fair value estimate on Global Business Travel Group - why the stock might be worth just $21.46!

Build Your Own Global Business Travel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Business Travel Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Global Business Travel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Business Travel Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBTG

Global Business Travel Group

Provides business-to-business (B2B) travel platform in the United States, the United Kingdom, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)