- United States

- /

- Hospitality

- /

- NYSE:FUN

Six Flags: Evaluating Valuation After Peanuts Partnership Extension and New Investments in Parks

Reviewed by Simply Wall St

Most Popular Narrative: 22.9% Undervalued

The prevailing narrative sees Six Flags Entertainment as notably undervalued, with analysts projecting upside based on future earnings and operational improvements. This outlook is powered by assumptions about digital innovation, efficiency, and margin recovery driving stronger financials.

“Integration of advanced digital platforms, including a reengineered ticketing system, upgraded mobile app, and enhanced e-commerce functionality promises greater operational efficiency, better guest personalization, and dynamic pricing. These improvements are expected to lift per-capita guest spend and expand operating margins.”

Want to see what’s fueling the double-digit upside forecast? The narrative rests on bold shifts: new tech, reimagined products, and a radical profit transformation. There’s one key financial metric at the heart of it all, but only those who dive into the full details will uncover how ambitious analyst assumptions shape this valuation story.

Result: Fair Value of $31.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high debt levels and weather-related disruptions remain significant risks. These factors could challenge the optimistic outlook for Six Flags Entertainment.

Find out about the key risks to this Six Flags Entertainment narrative.Another View: SWS DCF Model

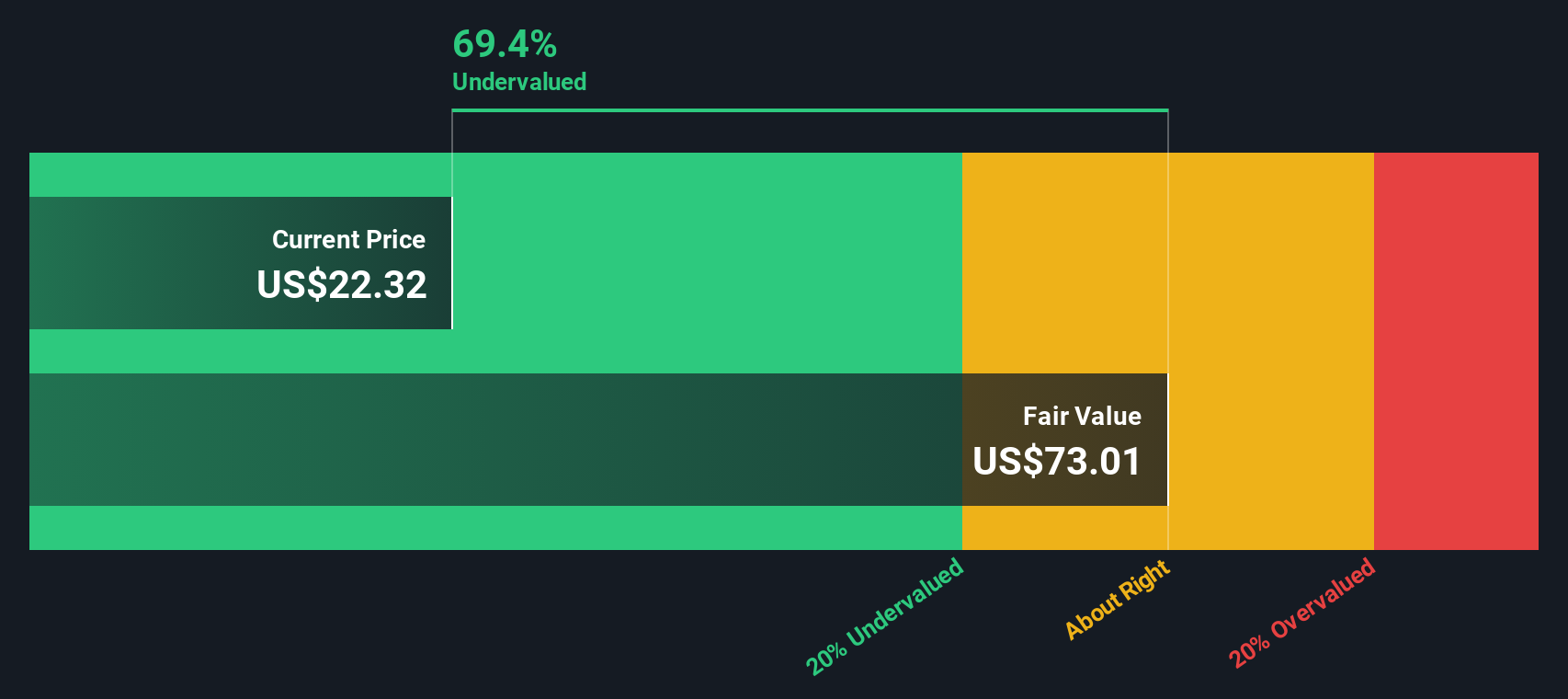

Looking at Six Flags Entertainment through the lens of our DCF model provides a similarly optimistic picture and reinforces the argument that the stock might be trading at a significant discount. However, does this method capture all the risks and real-world twists facing the business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Six Flags Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Six Flags Entertainment Narrative

If you have a different perspective or want to dig deeper into the numbers, you can shape your own investment view with just a few minutes’ effort. Do it your way.

A great starting point for your Six Flags Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead by scanning the horizon for unique opportunities. Why settle for just one stock? Start unlocking more potential with these hand-picked strategies below.

- Spot up-and-coming companies with strong fundamentals by checking out the penny stocks with strong financials that are reshaping the market from the ground up.

- Capture high-yield opportunities in today’s low-rate world by targeting dividend stocks with yields > 3% to pursue a reliable stream of income for your portfolio.

- Capitalize on the artificial intelligence revolution by seeking out the most promising innovations among AI penny stocks set to influence tomorrow’s economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUN

Six Flags Entertainment

Operates amusement parks and resort properties in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives