- United States

- /

- Hospitality

- /

- NYSE:FUN

Could Six Flags (FUN) Unlock Value by Spinning Off Its Real Estate Portfolio?

Reviewed by Sasha Jovanovic

- In late September 2025, activist investor Land & Buildings Investment Management publicly urged Six Flags Entertainment to consider spinning off or selling its real estate portfolio, following concerns over the Cedar Fair merger, increased short interest, and recent financial challenges including disappointing Q2 results and upcoming leadership transition.

- This move signals renewed external pressure for major structural changes within Six Flags, amid heightened shareholder scrutiny and ongoing legal and operational headwinds.

- We’ll explore how renewed calls for a real estate spin-off could reshape Six Flags’ investment outlook and future earnings profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Six Flags Entertainment Investment Narrative Recap

To be a shareholder in Six Flags Entertainment, you need to believe in the company's ability to unlock value from its extensive real estate portfolio and successfully harness the benefits of its merger with Cedar Fair. The recent activist pressure for a real estate spin-off increases external scrutiny, but the most immediate catalyst remains delivering on cost savings and synergy targets, while ongoing high leverage continues to represent the biggest risk to near-term performance.

Among recent announcements, the company's agreement to incur US$500,000,000 in new loans to refinance existing debt stands out, as this underscores Six Flags' considerable balance sheet pressures and highlights why activist investors are concerned about debt levels and asset utilization in the current environment.

However, what many investors may not realize is just how much Six Flags' elevated leverage and interest burden could limit flexibility if...

Read the full narrative on Six Flags Entertainment (it's free!)

Six Flags Entertainment's narrative projects $3.7 billion revenue and $269.4 million earnings by 2028. This requires 5.0% yearly revenue growth and a $753 million increase in earnings from -$483.6 million.

Uncover how Six Flags Entertainment's forecasts yield a $31.23 fair value, a 31% upside to its current price.

Exploring Other Perspectives

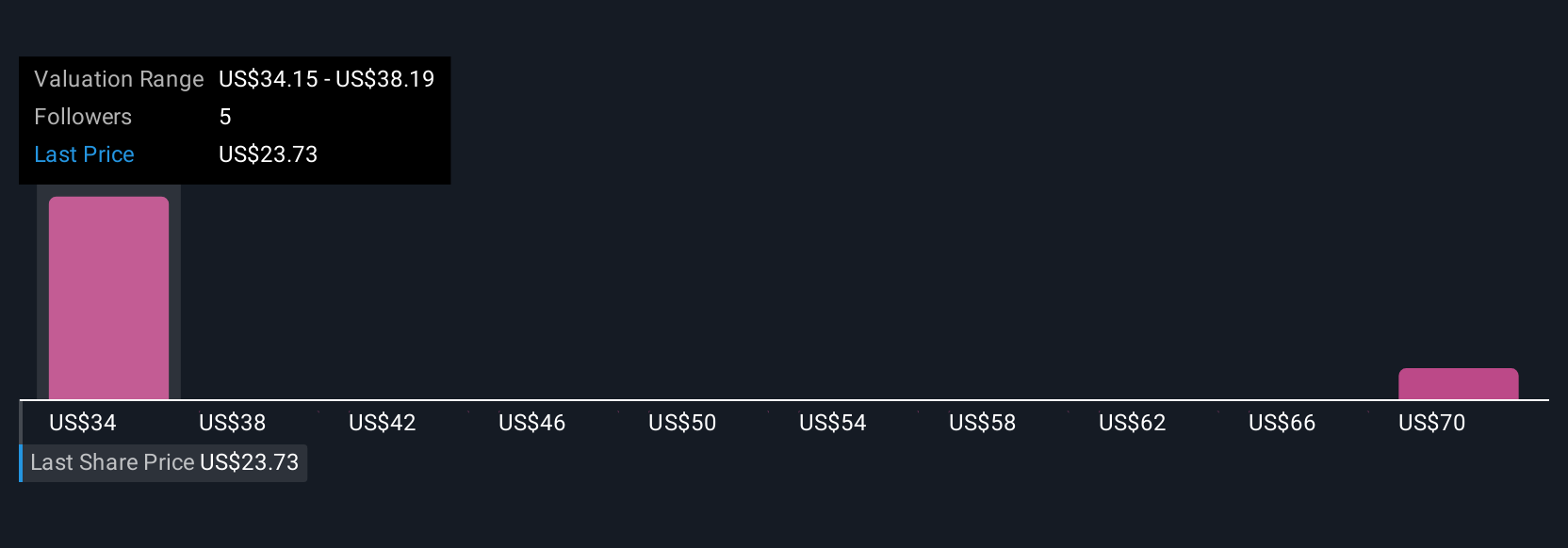

Simply Wall St Community members produced three unique fair value estimates for Six Flags, ranging from US$31.23 to US$73.01 per share. Many are watching to see if ongoing high leverage and interest costs could dampen the company’s ability to meet earnings goals, underscoring the value of considering multiple viewpoints on future performance.

Explore 3 other fair value estimates on Six Flags Entertainment - why the stock might be worth just $31.23!

Build Your Own Six Flags Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Six Flags Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Six Flags Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Six Flags Entertainment's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUN

Six Flags Entertainment

Operates amusement parks and resort properties in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives