- United States

- /

- Hospitality

- /

- NYSE:EAT

Is Now the Moment to Revisit Brinker International After Its Latest 20% Pullback?

Reviewed by Bailey Pemberton

If you have ever wondered whether now is the right moment to make a move on Brinker International stock, you are not alone. Many investors are taking a closer look after an attention-grabbing run, up 51.0% in the past year and an incredible 397.8% over three years. Only recently has the wind shifted a little, with the share price sliding 4.2% over the past week and shedding 20.0% in the last month. Still, at a last close of $126.59, there is a compelling story behind these swings that goes well beyond the latest headline or market blip.

What really stands out is Brinker's score on our valuation checks. The company earned a perfect 6 out of 6, meaning it is considered undervalued by every major metric we track. That is not something we see every day, and it tells us there might be more going on below the surface than recent dips would suggest. Whether you are weighing the long-term growth narrative or looking for smart entry points, understanding how this value is assessed can make a real difference in your investment decision.

Next, let us dig into the valuation approaches behind this score and see what they reveal about Brinker's position. Stay tuned because at the end of this article, we will introduce a better way to cut through the noise and get to the heart of what the valuation really means for investors like you.

Approach 1: Brinker International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to their present value. This method relies on expected performance, giving a clearer picture of underlying worth than just looking at earnings or book value.

For Brinker International, analysts reported Free Cash Flow (FCF) of $428.2 million over the last twelve months. Looking ahead, analyst projections reach $497.2 million by 2027. While firm estimates only go out five years, Simply Wall St extends these projections for the next decade and ultimately forecasts an FCF of about $694.9 million in 2035. These recurring cash inflows in millions of dollars form the foundation of the DCF calculation.

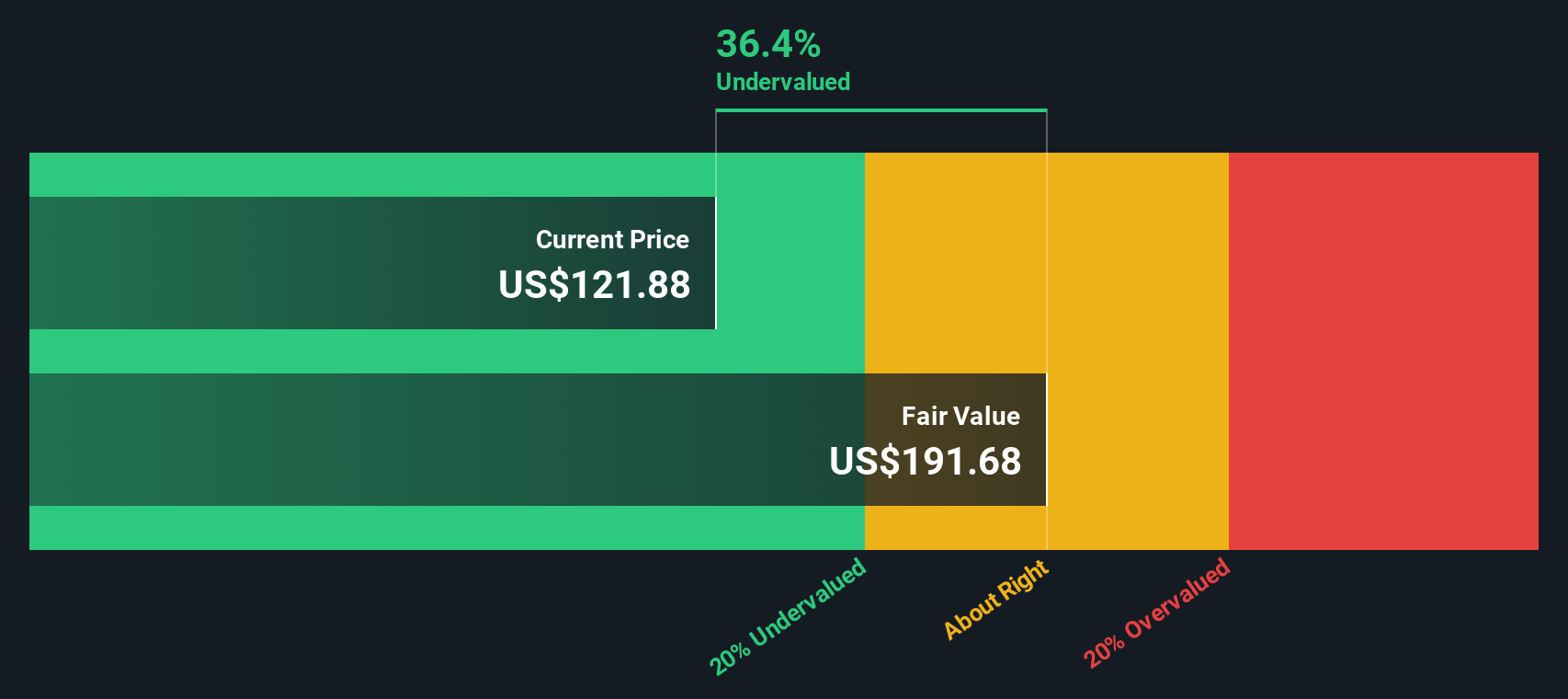

Based on this model, Brinker's estimated intrinsic value lands at $192.60 per share. This is significantly higher than the last closing price of $126.59, meaning the stock is trading at a 34.3% discount to its true value. The implication is clear: despite recent share price volatility, Brinker International appears materially undervalued when looking at long-term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brinker International is undervalued by 34.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Brinker International Price vs Earnings

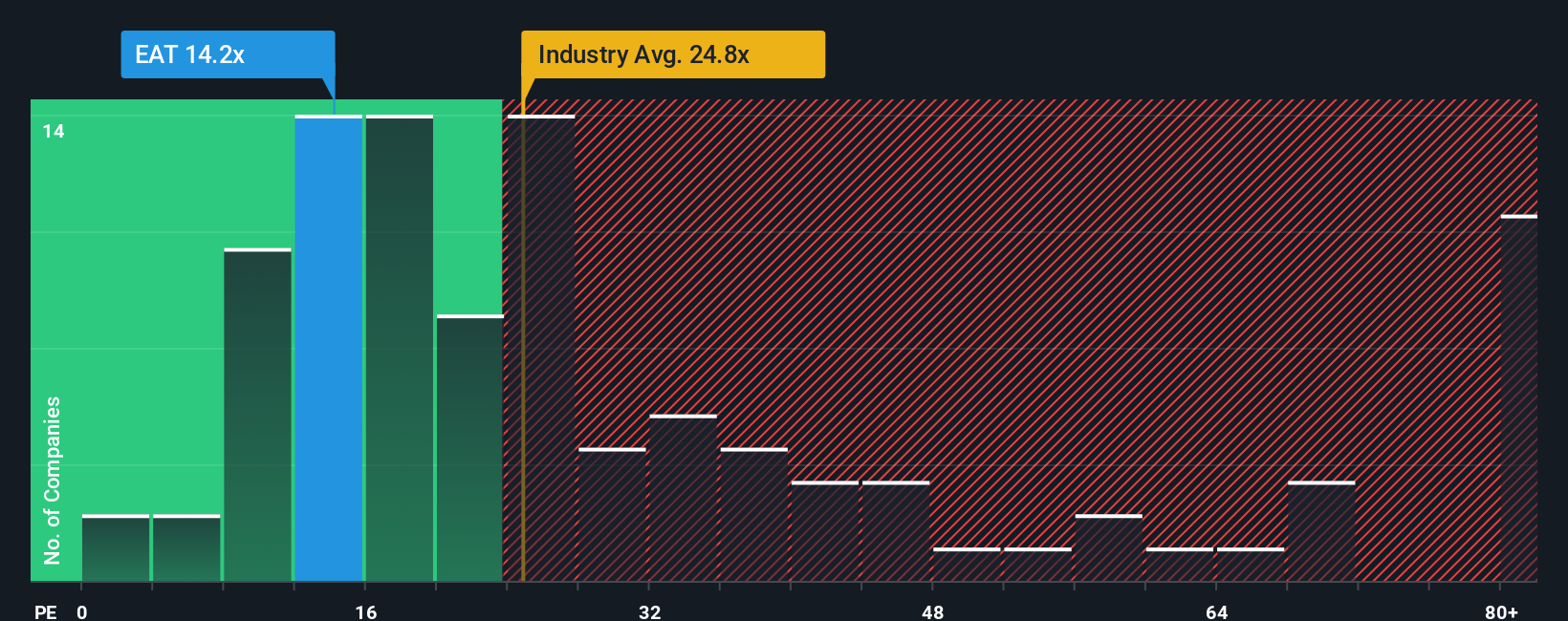

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Brinker International because it relates the company’s share price to its actual earnings, providing a clear measure of how much the market is willing to pay for each dollar of profit. For companies that consistently generate profits, the PE ratio is useful in measuring market expectations and comparing valuations across similar businesses.

Deciding what a “normal” or “fair” PE ratio should be depends not only on the company's current performance but also on growth expectations and risk. Higher growth companies usually warrant higher PE ratios, while increased risks or lower growth prospects tend to push the ratio down. Therefore, it is not enough to compare one company’s PE in isolation or only against industry benchmarks.

Currently, Brinker International has a PE ratio of 14.7x, which is well below both the Hospitality industry average of 24.4x and the peer average of 79.4x. At first glance, this significant discount makes the stock appear attractively priced. However, Simply Wall St’s proprietary “Fair Ratio” model offers a more comprehensive view by factoring in Brinker's earnings growth, profit margins, risks, market cap, and its position within the industry. Brinker's calculated Fair Ratio is 23.3x, suggesting the stock could reasonably trade at a higher multiple given its specific strengths and risks. Since the current PE is notably lower than the Fair Ratio, this analysis indicates the stock may be undervalued at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brinker International Narrative

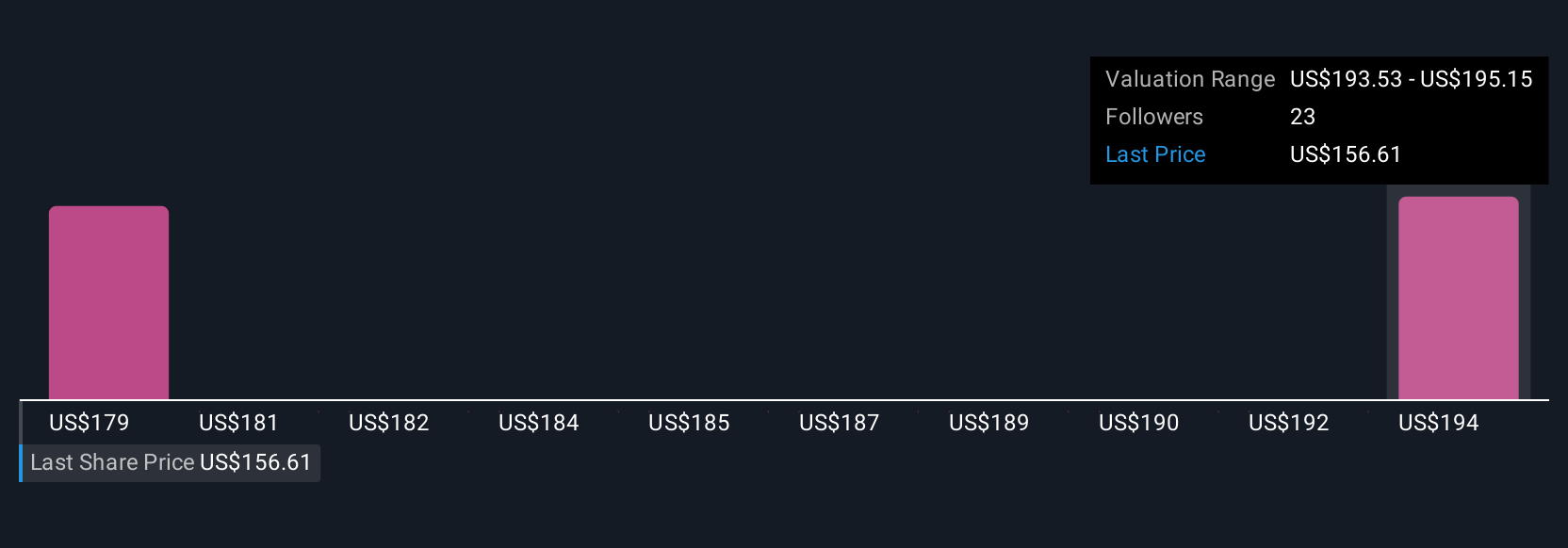

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is the story behind an investment, the unique perspective you or others hold about Brinker International’s future, expressed in numbers like fair value estimates, future revenue, and profit margins. Narratives directly link a company’s real-world story to financial forecasts and ultimately to what you believe is a fair price for the stock.

This approach is powerful because it helps you go beyond formulas by clearly connecting the “why” behind your assumptions, making your investment decisions smarter and more personal. Available to anyone on Simply Wall St’s Community page, which is used by millions worldwide, Narratives allow you to see and compare a range of viewpoints about Brinker International, from bullish to bearish, and to track how the Fair Value changes as news or earnings come in. With Narratives, you can easily decide when to buy or sell by comparing your fair value reasoning to the current share price, and your views will update dynamically as the facts change.

For example, one investor’s Narrative for Brinker may highlight digital upgrades and menu innovation leading to strong margin growth and a fair value of $215, while another may worry about rising labor costs and slowing dine-in trends, supporting a lower fair value of $160.

Do you think there's more to the story for Brinker International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brinker International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EAT

Brinker International

Owns, develops, operates, and franchises casual dining restaurants in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives