- United States

- /

- Hospitality

- /

- NYSE:EAT

How Investors May Respond To Brinker International (EAT) Beating Expectations With Strong Q4 2025 Results

Reviewed by Simply Wall St

- Brinker International announced its fourth-quarter 2025 earnings results on August 13, highlighting a period in which the company exceeded analysts’ revenue expectations and outperformed on key operational metrics.

- Analyst optimism ahead of the announcement was supported by Brinker's prior strong revenue growth, ongoing menu innovation, and effective marketing strategies driving positive revisions to earnings forecasts.

- We'll examine how growing analyst confidence, bolstered by strong prior earnings and operational improvements, shapes Brinker’s current investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Brinker International Investment Narrative Recap

To be a Brinker International shareholder, you need to believe in the company's ability to sustain operational improvements and menu innovation to drive traffic and margin growth. The recent revenue and earnings beat affirmed analyst confidence and strengthens the case for continued positive momentum, but does not fully resolve the key risk of competitive promotional pressures that could challenge pricing power in the near term. Among recent announcements, the launch of the Big QP burger under the Chili’s 3 For Me menu is particularly relevant. This product innovation directly addresses the company’s short-term traffic and revenue catalysts by aiming to attract new customers and optimize same-store sales growth. Yet, in contrast to the upbeat results, pricing power remains subject to intense competition, making it vital for investors to be aware of...

Read the full narrative on Brinker International (it's free!)

Brinker International’s outlook anticipates $6.2 billion in revenue and $579.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 6.7% and a $246 million increase in earnings from $333.4 million currently.

Uncover how Brinker International's forecasts yield a $174.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

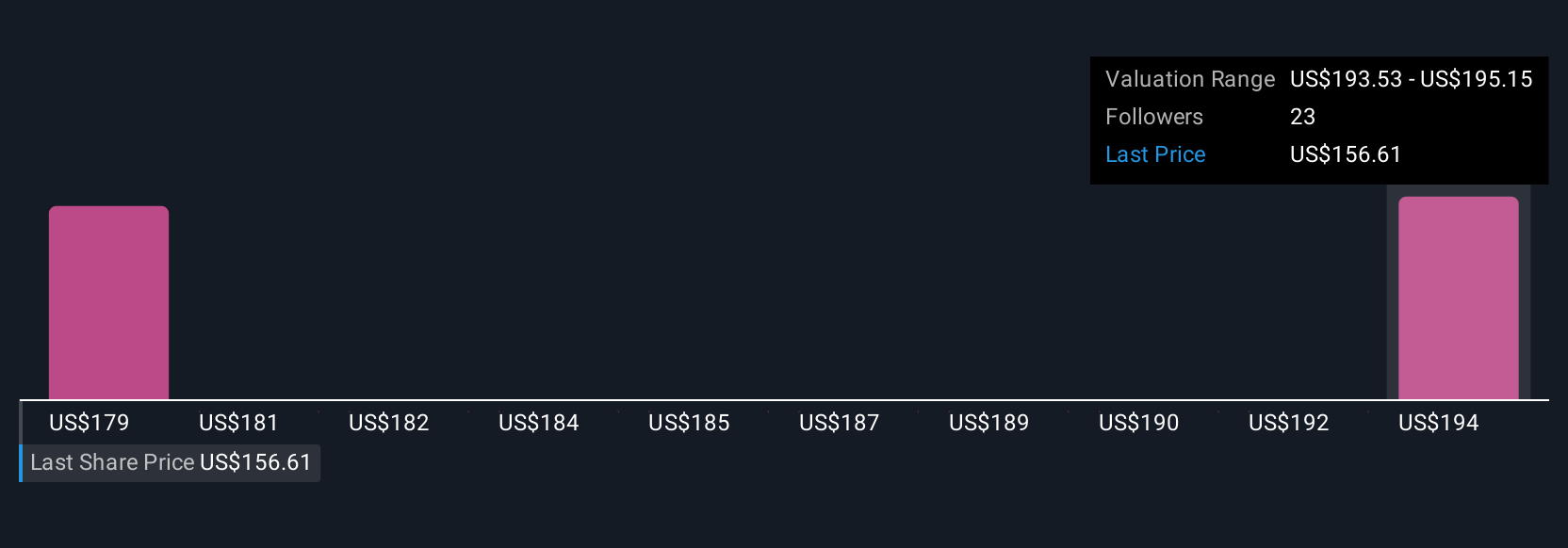

Fair value estimates from the Simply Wall St Community range from US$174.93 to US$183.49, with two individual perspectives contributing their analysis. Against this backdrop, the risk of pricing pressure from industry-wide promotions could challenge even optimistic outlooks and is important for your ongoing research.

Explore 2 other fair value estimates on Brinker International - why the stock might be worth as much as 18% more than the current price!

Build Your Own Brinker International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brinker International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brinker International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brinker International's overall financial health at a glance.

No Opportunity In Brinker International?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brinker International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EAT

Brinker International

Owns, develops, operates, and franchises casual dining restaurants in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives