- United States

- /

- Hospitality

- /

- NYSE:EAT

Did Recent Volatility and Resilient Earnings Just Shift Brinker International's (EAT) Investment Narrative?

Reviewed by Sasha Jovanovic

- Brinker International recently experienced heightened analyst and media attention following a significant drop in its share price, coinciding with concerns about falling U.S. consumer confidence and industry challenges facing casual dining operators.

- Amid renewed debate over the company's prospects, Brinker was recognized for its strong earnings performance, ongoing expansion initiatives, and operational improvements, even as inflationary pressures and softer consumer sentiment weigh on the sector.

- We’ll explore how Brinker’s robust same-store sales growth and improved operational execution reported in recent earnings may affect its investment narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Brinker International Investment Narrative Recap

Being a Brinker International shareholder means believing in the company’s ability to drive sales and profit growth through operational improvement, brand strength, and ongoing expansion, even as casual dining faces macro pressures. Recent concerns over declining U.S. consumer confidence and falling share price heighten the risk of softer dine-in demand, but don’t fundamentally alter the near-term focus on sustaining strong same-store sales and earnings results. For now, the main catalyst remains Brinker's record of growing core sales despite sector-wide caution.

Amid the recent market volatility, Brinker’s Q4 earnings announcement stands out: the company posted strong sales of US$1,448.9 million and net income of US$107 million, a substantial year-over-year improvement reflecting robust store traffic and improved margins. This result highlighted operational gains at Chili’s and progress on efficiency initiatives, which together have underpinned both recent earnings growth and management’s optimistic guidance for the coming year. These financial achievements remain especially relevant as investors weigh short-term risks affecting discretionary spending.

However, in contrast to these positive results, investors should also be aware that rising costs and the risk of margin compression remain critical factors to watch...

Read the full narrative on Brinker International (it's free!)

Brinker International's outlook projects $6.2 billion in revenue and $562.8 million in earnings by 2028. This forecast is based on an annual revenue growth rate of 4.7% and a $179.7 million increase in earnings from the current level of $383.1 million.

Uncover how Brinker International's forecasts yield a $180.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

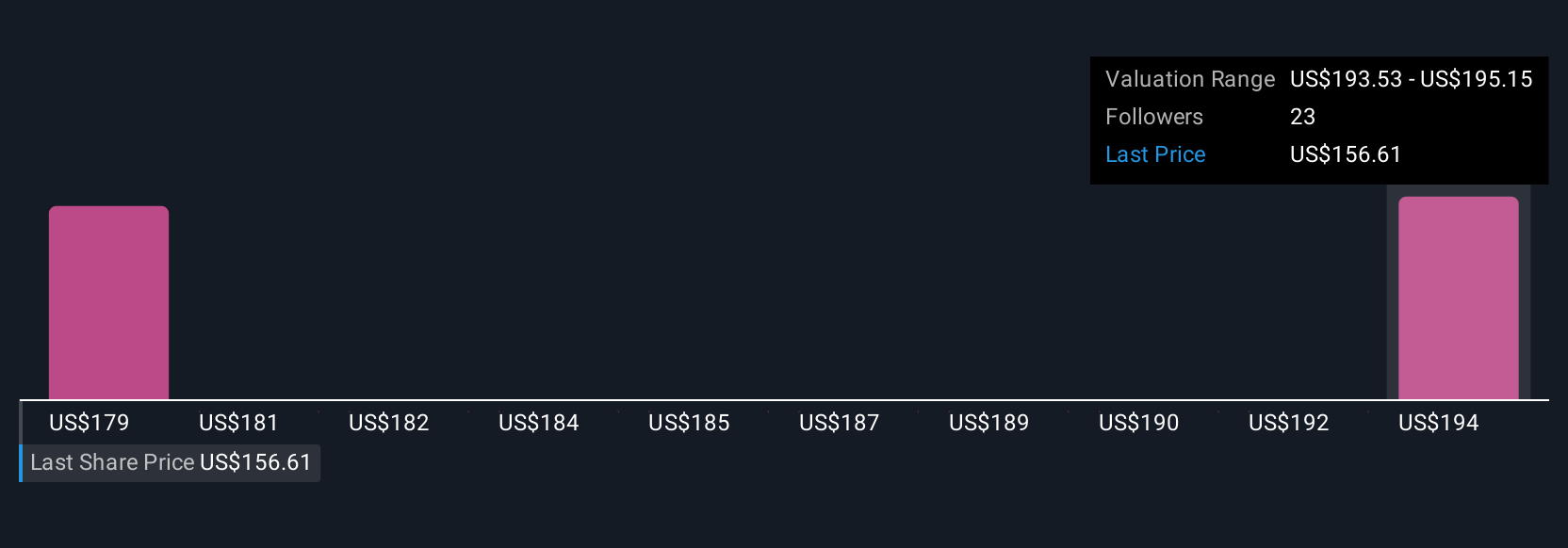

Two Simply Wall St Community members estimate Brinker’s fair value between US$180.25 and US$192.08 per share, well above the recent market price. With commodity and labor cost pressures still at the forefront, these contrasting opinions remind you to explore all sides of the debate about future profitability.

Explore 2 other fair value estimates on Brinker International - why the stock might be worth just $180.25!

Build Your Own Brinker International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brinker International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brinker International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brinker International's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brinker International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EAT

Brinker International

Owns, develops, operates, and franchises casual dining restaurants in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives