- United States

- /

- Hospitality

- /

- NYSE:CMG

Is Chipotle’s Stock Still Justified After Q1 2025 Surge and New Menu Launch?

Reviewed by Bailey Pemberton

If you are sizing up Chipotle Mexican Grill’s stock right now, you are definitely not alone. For many investors still weighing their options, there has been plenty to think about. On one hand, the company’s stock is up 4.2% in the past week, suggesting some renewed optimism. Yet those numbers come after a much tougher stretch. Over the last month, Chipotle’s price was effectively flat, and if you zoom out just a little farther, the year-to-date return stands at -30.3%. That is a pretty significant pullback, especially compared to its longer-term record. A five-year gain of 62.9% demonstrates there is historical muscle behind the brand, despite the recent stumbles.

Some of these moves reflect broader changes in how investors are assessing restaurant stocks in today’s environment. Shifting consumer habits and evolving industry trends have all played a part. Interestingly, when I ran Chipotle through our valuation model, it scored a 1 out of 6. That means the company is undervalued on just one of the six key checks we use. This suggests there are a few flags worth unpacking if you are looking for a bargain.

Let’s walk through how Chipotle stacks up using the most common valuation tools investors rely on. Along the way, stay tuned for a deeper perspective on valuation that might help you cut through the noise and make a more confident decision, no matter what the current headlines say.

Chipotle Mexican Grill scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company's true worth by projecting how much cash it will generate in the future and then discounting those streams back to today’s value. For Chipotle Mexican Grill, this model uses a 2 Stage Free Cash Flow to Equity approach to chart the next decade of expected performance.

Currently, Chipotle posts annual Free Cash Flow of about $1.45 Billion. Analyst coverage goes out five years, with Simply Wall St providing cautious extrapolations after that. By 2029, forecasted Free Cash Flow is set to reach approximately $2.63 Billion. Over the next ten years, the projections reflect steady growth, supported by both analyst forecasts and measured long-term trends.

According to this DCF analysis, Chipotle’s fair intrinsic value is estimated at $35.14 per share. However, when you compare that to the current share price, the implied valuation shows the stock is about 18.8% above this fair value marker. In short, while the company’s fundamentals are healthy and growing, the market price is running ahead of what these future cash flows might justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chipotle Mexican Grill may be overvalued by 18.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Chipotle Mexican Grill Price vs Earnings

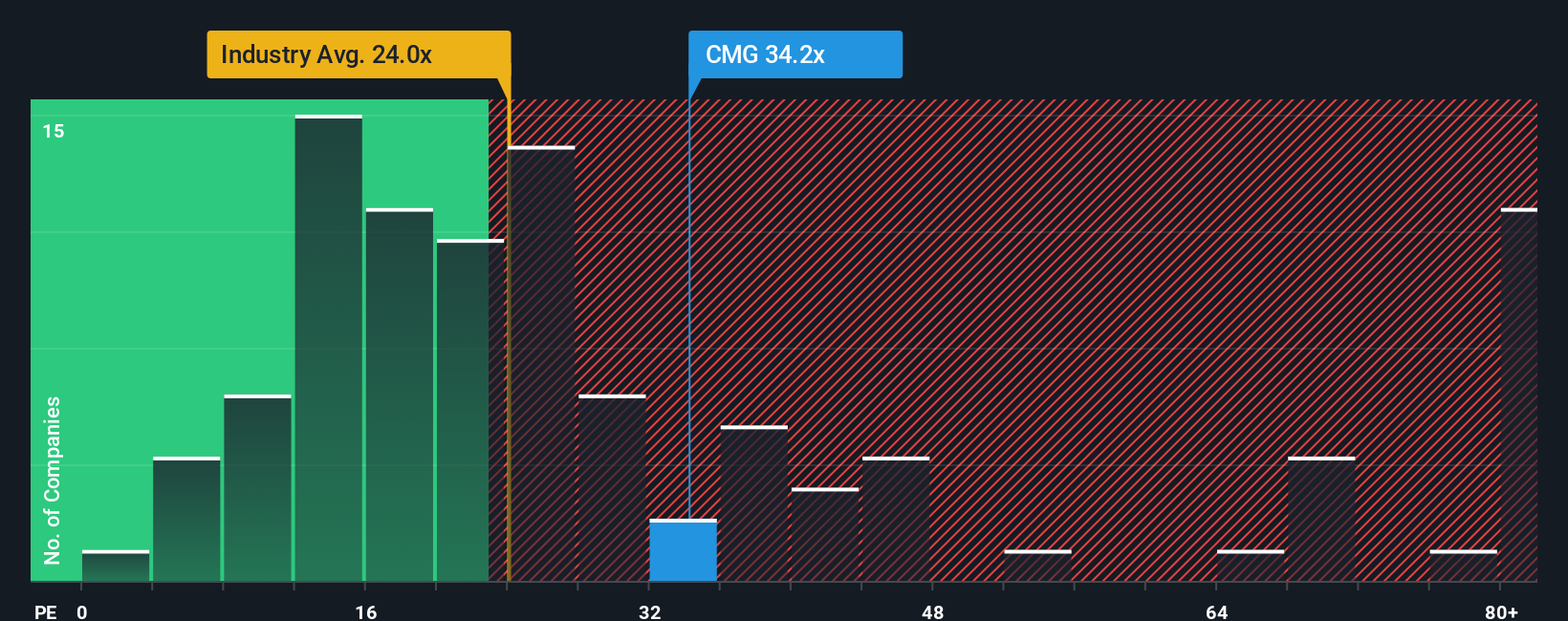

The Price-to-Earnings (PE) ratio is often the preferred way to value profitable companies like Chipotle Mexican Grill. It gives a sense of how much investors are willing to pay for every dollar of earnings today, reflecting expectations for future profit growth and the risks associated with the business. Generally, companies with stronger growth prospects or lower risk profiles will trade at higher PE ratios, while slower-growing or riskier companies command lower ones.

For Chipotle, the current PE ratio stands at 36.3x. That is noticeably higher than the hospitality industry average of 24.4x and above the average for Chipotle’s peers at 28.2x. On the surface, this premium might suggest the stock is expensive. However, multiple benchmarks tell only part of the story, as they do not account for unique dynamics that can affect what is considered “fair” for one company versus another.

This is where Simply Wall St’s “Fair Ratio” comes in, providing a more tailored assessment than generic industry or peer multiples. The Fair Ratio for Chipotle is set at 30.1x, incorporating not just industry factors but also Chipotle’s earnings trajectory, market capitalization, profit margins, and risk profile. By weighing these company-specific details, the Fair Ratio delivers a sharper perspective on whether the current valuation is justified.

Compared to its actual PE of 36.3x, Chipotle trades noticeably above its Fair Ratio of 30.1x, suggesting investors are paying a premium that the underlying fundamentals do not quite support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, a way to bring together your views on what lies ahead for Chipotle Mexican Grill, combine them with your assumptions about its future revenue, margins, and earnings, and connect those forecasts directly to a fair value estimate. Narratives help you step beyond static ratios by linking the company’s real-world business story directly to what you think its stock is worth.

Narratives are available as an easy, dynamic tool used by millions of investors on Simply Wall St’s Community page. Here, you do not just see the numbers; you understand the beliefs behind them. When you create or follow a Narrative, it automatically recalculates fair value whenever news or earnings come out, enabling you to decide instantly if Chipotle is overvalued or undervalued based on facts that matter most to you.

For example, some investors may believe international expansion will propel Chipotle to a fair value of $65.0 per share. Others, navigating industry risks and economic headwinds, might justify a more cautious outlook at $46.0. Narratives make it simple to compare your fair value to today’s price and act accordingly.

Do you think there's more to the story for Chipotle Mexican Grill? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives