- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle Mexican Grill's (NYSE:CMG) 34% CAGR outpaced the company's earnings growth over the same five-year period

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Chipotle Mexican Grill, Inc. (NYSE:CMG) shares for the last five years, while they gained 326%. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 13% in thirty days. We note that Chipotle Mexican Grill reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Chipotle Mexican Grill

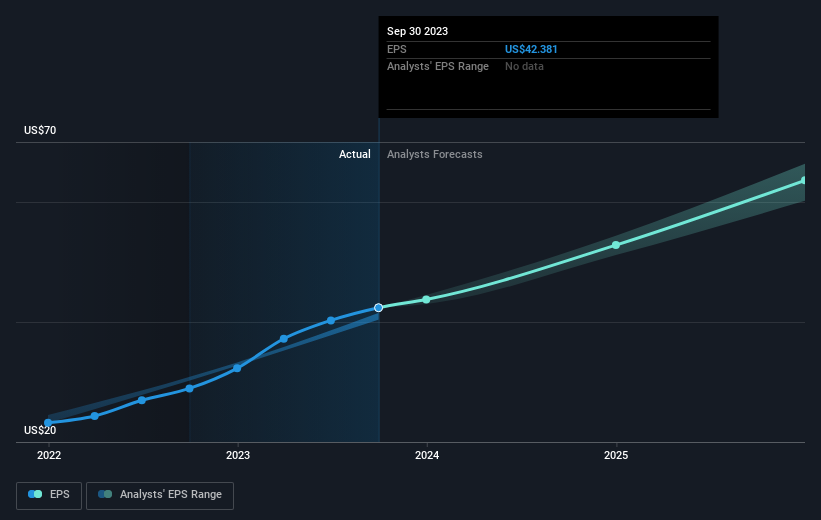

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Chipotle Mexican Grill managed to grow its earnings per share at 45% a year. The EPS growth is more impressive than the yearly share price gain of 34% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Chipotle Mexican Grill has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Chipotle Mexican Grill shareholders have received a total shareholder return of 49% over the last year. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Chipotle Mexican Grill it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Solid track record with excellent balance sheet.