- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle Mexican Grill (NYSE:CMG) Should Reconsider Pursuing Quick Growth

After losing over 30% over the last few months, Chipotle Mexican Grill ( NYSE: CMG ) finally shows hints of recovery.

Yet, relying on growth to outperform can be a double-edged sword, as a minor slip can have dire consequences down the road.

View our latest analysis for Chipotle Mexican Grill

Q4 Earnings

- Non-GAAP EPS: US$5.58 (beat by US$0.29)

- Revenue: US$2b (beat by US$40m)

- Revenue growth: US$24.2% Y/Y

Other highlights:

- Comparable sales increased 15.2%

- Operating margin increased by 0.8% (7.3% to 8.1%)

- FY 2022 guidance growth mid to high single digits

- FY 2022 new restaurants opening 235-250

While the company increased comparable sales, it also increased the prices to offset wage inflation and higher commodity costs. Food for thought (pun intended) is the elasticity of demand regarding the dining industry as the competition is fierce and margins traditionally slim? What if consumers switch to competitors who didn't raise prices as much?

Furthermore, Chipotle opened 78 new restaurants during the quarter and expects to open 235-250 new restaurants in the year. Down the road, the company sees at least 7,000 Chipotle restaurants in North America , up from the previous goal of 6,000. Meanwhile, they had just 2,788 locations in 2021.

Technically Speaking

Here is Chipotle's chart of the previous 1 year:

Like a majority of growth stocks, CMG had a considerable decline since October, but recently it bounced 8% from the last year's lows.

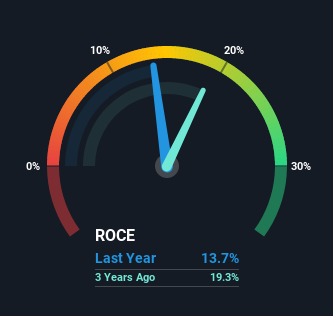

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business.The formula for this calculation on Chipotle Mexican Grill is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = US$792m ÷ (US$6.6b - US$851m) (Based on the trailing twelve months to September 2021) .

Therefore, Chipotle Mexican Grill has a ROCE of 14%.In absolute terms, that's a satisfactory return, but compared to the Hospitality industry average of 9.1%, it's much better.

Above, you can see how the current ROCE for Chipotle Mexican Grill compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting from now on, you should check out our free report for Chipotle Mexican Grill .

What Does the ROCE Trend For Chipotle Mexican Grill Tell Us?

Chipotle Mexican Grill is displaying some positive trends.The numbers show that the returns generated on capital employed have grown considerably to 14% in the last five years.The amount of capital employed has increased too, by 223%.The increasing returns on a growing amount of capital are common amongst multi-baggers, and that's why we're impressed.

The Bottom Line

Looking back, the stock has returned a staggering 248% to shareholders over the last five years, and it seems like investors recognize the ROCE outperformance compared to the broader industry. Furthermore, the company carries virtually no debt and could easily boost the returns if the opportunity arises.

However, the company just laid out some big growth plans that can be slightly concerning, given the cost and effort they require. Almost tripling up the total number of locations is an immense challenge, especially given the current inflationary environment and labor market pressures. Such expansion would likely have a negative impact on the rate of return as well.

Growth for the growth's sake is a dangerous reverse gambit that might please in the short-term but get severely punished upon even a tiny disappointment down the road.

Speaking of danger, we've spotted 2 warning signs facing Chipotle Mexican Grill that you might find interesting.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives