- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle Mexican Grill (NYSE:CMG) Appoints New COO Amid Executive Team Transition

Reviewed by Simply Wall St

Chipotle Mexican Grill (NYSE:CMG) has announced a significant executive reshuffling with Jason Kidd set to become COO, aiming to optimize operations across nearly 3,800 restaurants. This leadership change, along with the planned transitions of high-ranking officials like Jack Hartung, indicates strategic succession planning within the company. Despite these internal adjustments, the 6% price increase in Chipotle's stock over the past month aligns closely with the broader market, which has remained flat. These updates in leadership seemingly supported Chipotle’s stock trajectory, trimming concerns of potential disruption during a period of economic focus on interest rates and trade discussions.

Chipotle Mexican Grill's leadership transition, marked by Jason Kidd's appointment as COO, has been a focal point for investors keen on gauging its influence on the company’s narrative of expansion and efficiency. This reshuffle complements Chipotle's international growth plans, particularly in Mexico and Europe, potentially bolstering the company's operational execution and market presence. While some might view such internal changes with caution, the stable short-term stock rise suggests confidence in the new leadership's ability to steer Chipotle toward its revenue and earnings objectives amid economic uncertainties.

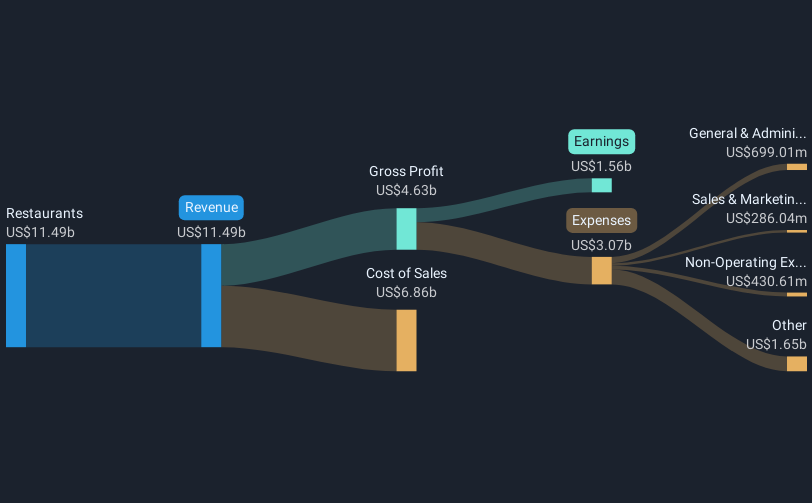

Over the past five years, Chipotle's total shareholder returns, encompassing share price appreciation and dividends, reached a significant 170.80%. This impressive run provides a robust background to the more modest 6% increase in the stock price last month. However, Chipotle has lagged behind the US Hospitality industry's annual performance, indicating the complexities that may challenge its market stance. Analysts project revenues to grow annually by 10.9%, slightly faster than the broader US market at 8.4%. Earnings forecasts anticipate gradual improvement, supported by planned international expansions and operational efficiencies.

With the stock currently priced at US$50.65, the consensus analyst price target sits at US$57.94, indicating a potential upside of 12.6%. This optimism is underpinned by analyst expectations of continued earnings and revenue growth, though such targets remain contingent on key external factors and the effective execution of strategic initiatives. Investors might consider these developments cautiously, reflecting on both the historical performance and projected growth avenues to form their own assessments regarding Chipotle's potential trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives