- United States

- /

- Hospitality

- /

- NYSE:CMG

A Fresh Look at Chipotle Mexican Grill’s (CMG) Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

Chipotle Mexican Grill (CMG) has drawn fresh attention from investors this week following its recent stock movement. With shares shifting direction compared to previous months, market watchers are eyeing the underlying factors that are driving sentiment around the fast-casual chain.

See our latest analysis for Chipotle Mexican Grill.

Chipotle’s share price has slid 30.5% since the start of the year, though the past month brought a 3.7% share price rebound as sentiment shifts and investors weigh the company’s longer-term potential. Total shareholder returns remain impressive over three and five years, which suggests momentum could return if growth picks up again.

If Chipotle’s recent swings have you thinking about broader market trends, now’s a great time to discover fast growing stocks with high insider ownership.

With Chipotle trading well below analyst targets despite a rebound in recent weeks, the big question arises: is this a compelling entry point for long-term investors, or is the promise of future growth already baked in?

Most Popular Narrative: 23.2% Undervalued

Chipotle’s most widely followed valuation puts its fair value well above the recent close, suggesting significant upside if narrative projections play out. The narrative weighs up long-term international expansion and operational innovation against ongoing consumer and cost headwinds.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026 and exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth.

What exactly is fueling this high target price? It is driven by bold assumptions around global restaurant growth, efficiency gains, and a future profit multiple comparable to industry giants. Ready to see the numbers and reasoning behind this bullish fair value? Unlock the full story to find out what’s really behind the optimism.

Result: Fair Value of $54.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if consumer spending weakens or ingredient costs rise, these factors could quickly dampen the upbeat growth narrative investors are currently relying on.

Find out about the key risks to this Chipotle Mexican Grill narrative.

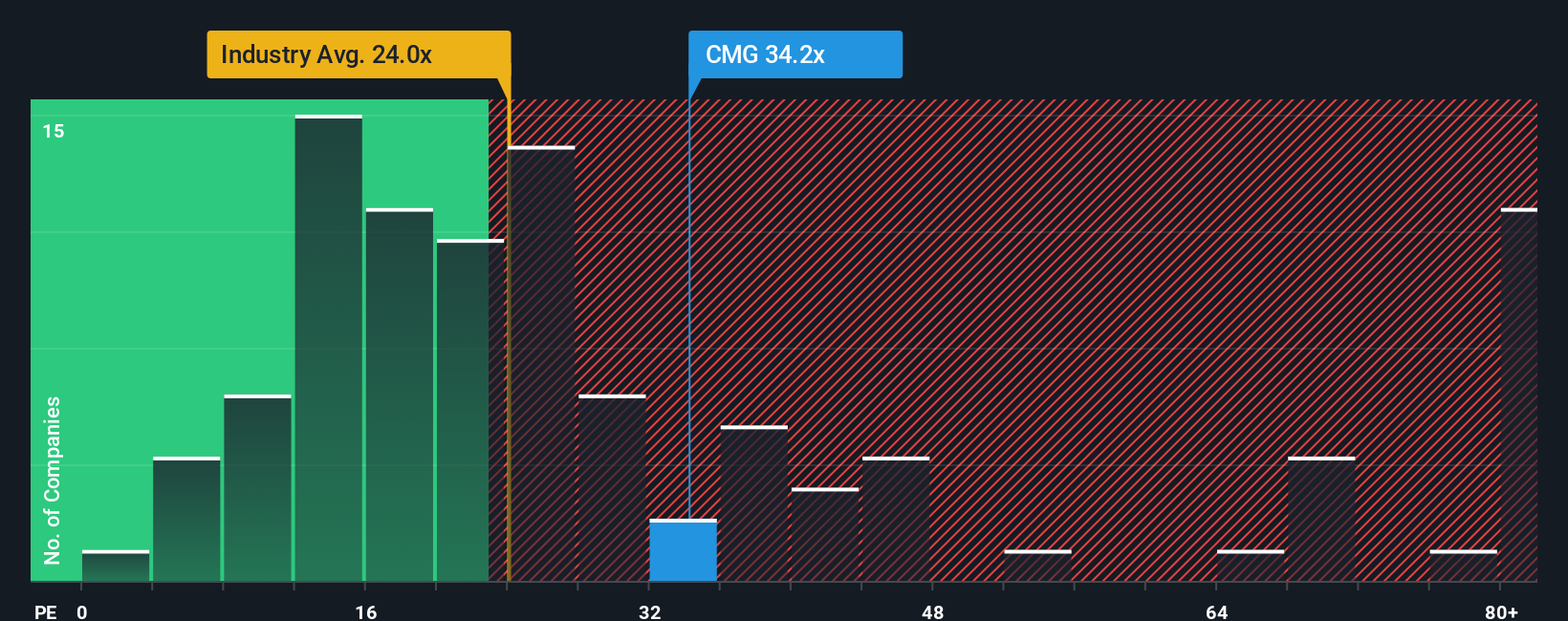

Another View: Multiples Tell a Cautionary Tale

While the fair value narrative suggests upside, a simple comparison using the price-to-earnings ratio reveals a different story. Chipotle trades at 36.2 times earnings, which is much higher than the Hospitality industry average of 24.3 and above its fair ratio of 29.9. Compared to peers, it is actually priced lower. This premium highlights potential risks if growth slows or investor optimism fades. Could the market soon adjust to a more reasonable level?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

Prefer your own deep dive into Chipotle’s outlook? Take a few minutes to examine the data, question assumptions, and craft your own perspective. Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity. If you want to stay ahead of the curve, check out these handpicked stock ideas directly from the Simply Wall Street Screener and keep your portfolio sharp.

- Boost your income potential by tracking these 17 dividend stocks with yields > 3%, offering impressive yields above 3%. This can be a good option if you appreciate consistent returns.

- Uncover leading-edge opportunities in transformative healthcare by checking out these 33 healthcare AI stocks, where artificial intelligence is reshaping patient outcomes.

- Capitalize on innovation in the digital finance sector and see which disruptors make the cut in these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives