- United States

- /

- Hospitality

- /

- NYSE:CHH

Did MainStay Suites’ Australian Debut Just Shift Choice Hotels International's (CHH) Global Expansion Narrative?

Reviewed by Sasha Jovanovic

- Choice Hotels International recently launched the MainStay Suites™ brand in Australia, marking its first expansion of this extended stay brand outside North America, with seven hotels opening across the country through a partnership with Extended STAY Australasia.

- This move highlights Choice Hotels’ increasing focus on the fast-growing international extended stay sector and further secures its position among the largest direct franchise operators in the Australian hospitality market.

- We'll explore how MainStay Suites' Australian launch could reinforce Choice Hotels' global portfolio growth and investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Choice Hotels International Investment Narrative Recap

To be a shareholder in Choice Hotels International, investors need to believe in the company’s ability to expand profitably into fast-growing global lodging segments, especially extended stay, while managing short-term revenue pressures linked to weaker government and international travel. The recent MainStay Suites launch in Australia supports long-term international growth ambitions but is not likely to materially offset near-term risks such as lower RevPAR and lingering macroeconomic uncertainty for the remainder of the year.

Among recent announcements, the master franchising agreement in China stands out for its scale and relevance as it adds over 9,500 rooms to the portfolio and aligns with the core catalyst of accelerating international growth, both from direct franchising and strategic brand partnerships. These efforts could, over time, help counterbalance revenue headwinds and deepen Choice Hotels’ market penetration in key regions.

However, offsetting these catalysts are persistent risks from ongoing softness in government and inbound international travel, which is information every investor should be aware of, because if recovery continues to lag, ...

Read the full narrative on Choice Hotels International (it's free!)

Choice Hotels International's outlook anticipates $1.8 billion in revenue and $354.2 million in earnings by 2028. This scenario requires annual revenue growth of 30.6% and a $48 million increase in earnings from the current $306.2 million.

Uncover how Choice Hotels International's forecasts yield a $121.79 fair value, a 19% upside to its current price.

Exploring Other Perspectives

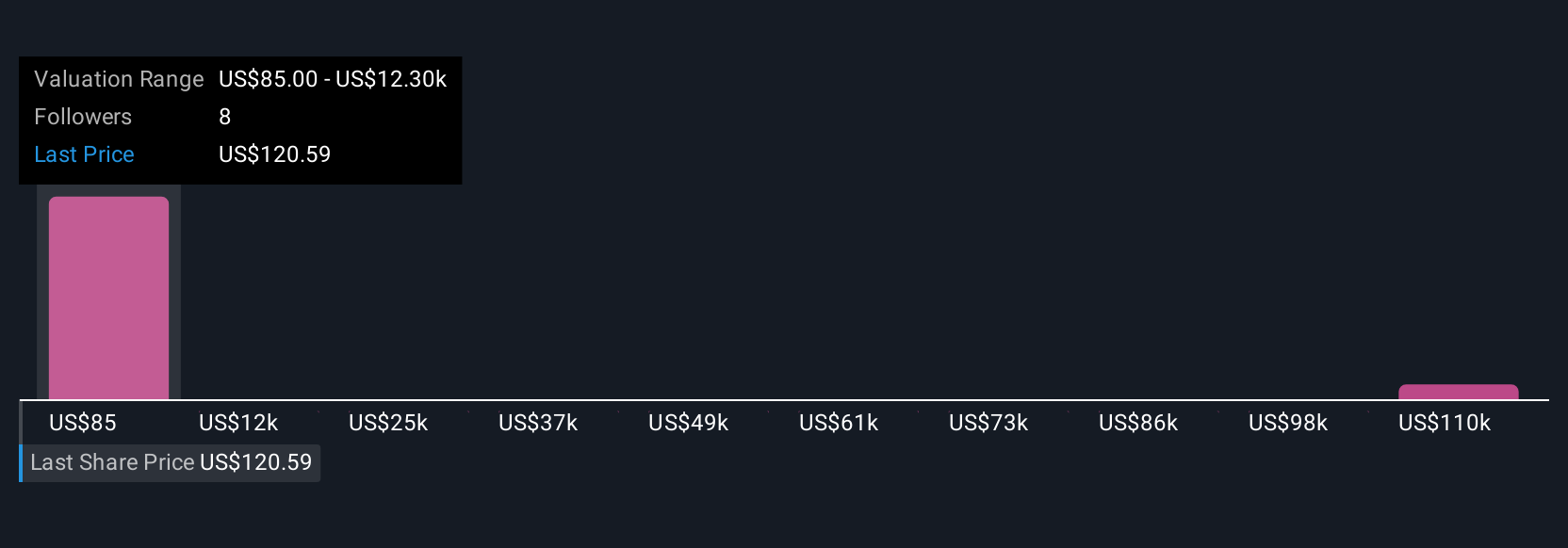

Individual fair value estimates from four Simply Wall St Community members range from US$121.79 to a striking US$122,273.07 per share. While many look to international expansion as a growth engine, persistent softness in specific travel segments may weigh on near-term financial results, so it pays to examine a wide range of opinions.

Explore 4 other fair value estimates on Choice Hotels International - why the stock might be a potential multi-bagger!

Build Your Own Choice Hotels International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Choice Hotels International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Hotels International's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHH

Choice Hotels International

Operates as a hotel franchisor in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives