- United States

- /

- Hospitality

- /

- NYSE:CHH

Assessing Choice Hotels After 11% Share Slide and Wyndham Acquisition Setback in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with your Choice Hotels International stock? You're not alone. With so much going on in the market, it can be tough to know whether it's a good time to stick with CHH, make a move, or sit tight and watch. The past year has put investors to the test, with those holding CHH seeing shares slip by about 18.3% over the last twelve months, and they're down more than a quarter since January. Just in the last month, the stock dropped nearly 11%, with a softer week knocking off another 3.9%. These numbers might sound discouraging on the surface, but movements like these can also point to opportunity, whether that's the broader travel sector recalibrating after a boom phase or investors rethinking risk as demand and supply chains shift.

Despite a rocky stretch, long-term holders know CHH stock has still delivered a positive return of 17.2% over five years. So, does this mean now could be an opportunity hiding in plain sight or a signal to wait out more turbulence? This is exactly where valuation checks come in, and here's where it gets really interesting: on our scale, where a company earns 1 point for each of the 6 main signs it is undervalued, Choice Hotels International racks up a perfect 6 out of 6. We will break down which valuation approaches drive this strong score, and at the end, we will also share a more insightful way to size up CHH’s true worth that goes beyond the typical models.

Why Choice Hotels International is lagging behind its peers

Approach 1: Choice Hotels International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today based on its expected future cash flows. It projects how much money Choice Hotels International could generate in coming years and brings those figures back to present value using a discount rate. This approach aims to capture both the current earning power and growth outlook of the company.

For Choice Hotels International, the DCF model begins with its latest reported Free Cash Flow (FCF), which stands at $206.2 Million. Analysts supply FCF projections up to 2027, estimating this figure will grow to $358 Million by then. Looking even further ahead, Simply Wall St extends the analysis using growth rates derived from the past and sector averages. They forecast that FCF could reach around $636.5 Million by 2035. These long-term projections help anchor the intrinsic value calculation and provide a broader view than short-term market sentiment alone.

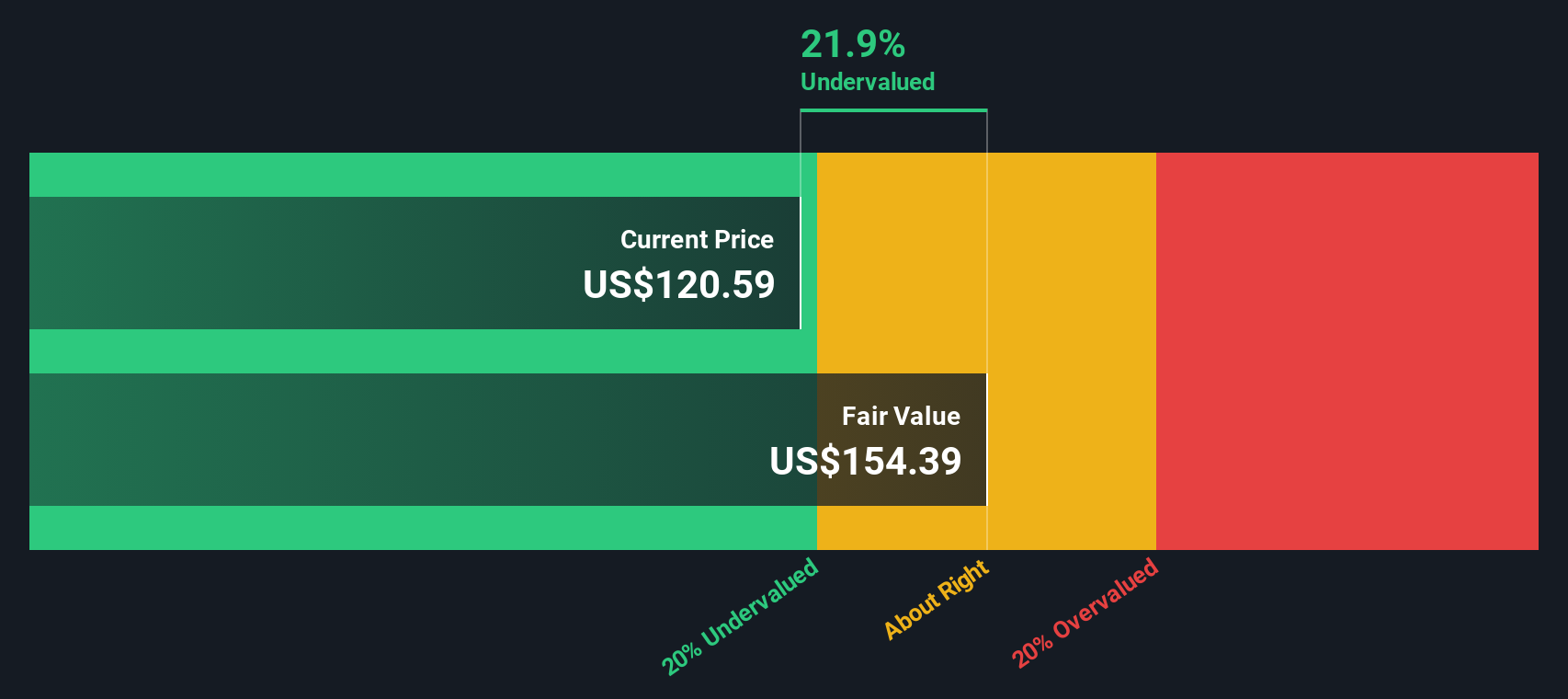

Based on this approach, the DCF model estimates Choice Hotels International’s intrinsic value at $153.90 per share. With the stock currently trading at a 32.3% discount to this fair value, the analysis suggests that CHH is notably undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Choice Hotels International is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Choice Hotels International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric to value profitable companies like Choice Hotels International because it connects the company’s share price directly to its bottom-line earnings. It is especially useful here, as CHH remains well in the black despite recent stock volatility, making PE a meaningful lens for assessing value.

Growth expectations and risk levels influence what counts as a "normal" or "fair" PE ratio. Companies that are growing quickly, or seen as safer bets, tend to command higher PE ratios. Conversely, slower growth or higher perceived risks typically mean investors are only willing to pay a lower multiple of earnings.

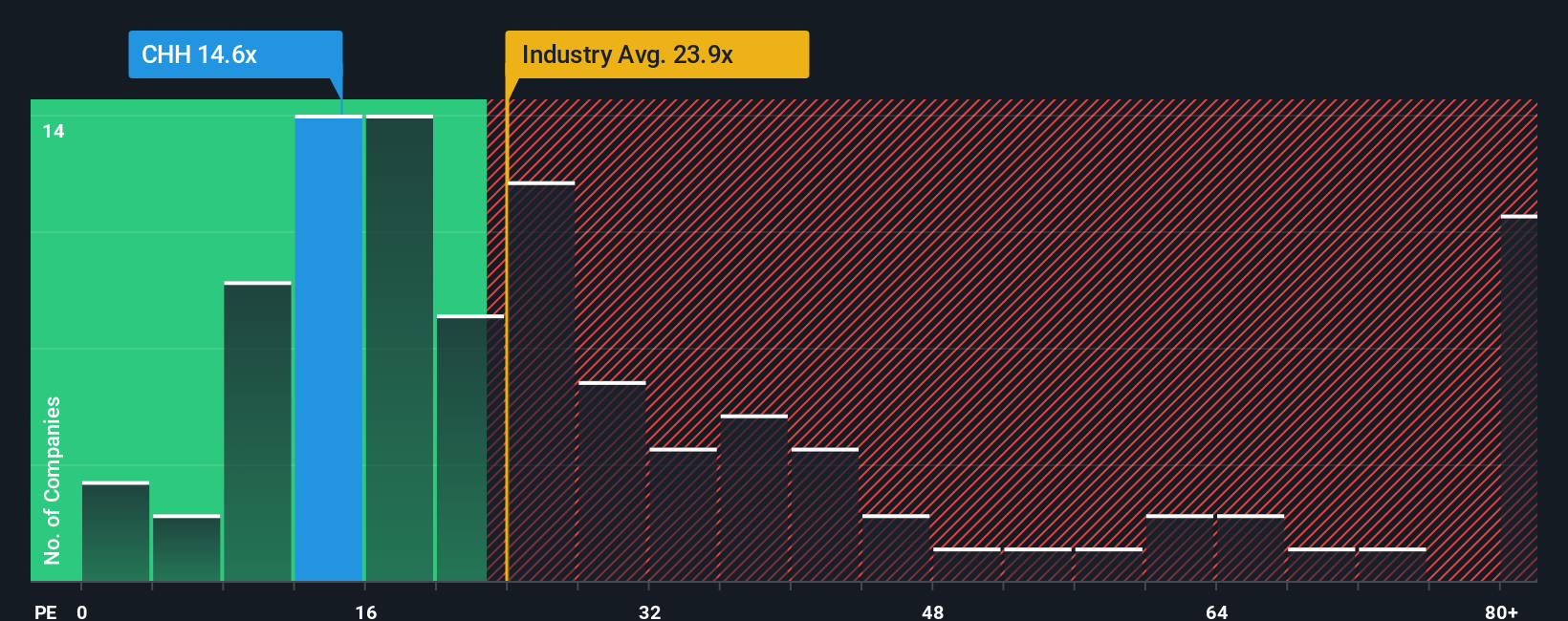

Right now, Choice Hotels International trades at a PE of 15.63x. For context, the Hospitality industry average sits higher, at 24.37x, and the peer group hovers around 26.36x. However, comparing only to industry or peers does not always capture the full picture of what the business genuinely deserves, given its individual strengths and risks.

This is where the Simply Wall St “Fair Ratio” comes in. This proprietary metric factors in CHH’s earnings growth, profit margins, sector trends, market size, and unique risk profile to pin down what an appropriate multiple should be. In this case, the Fair Ratio is 19.48x. This tailored approach gives a more relevant valuation reference point than a simple peer or industry average.

Comparing the Fair Ratio to CHH’s actual PE, the current 15.63x multiple is noticeably below its Fair Ratio of 19.48x. This individualized analysis points to Choice Hotels International being meaningfully undervalued using the preferred PE metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Choice Hotels International Narrative

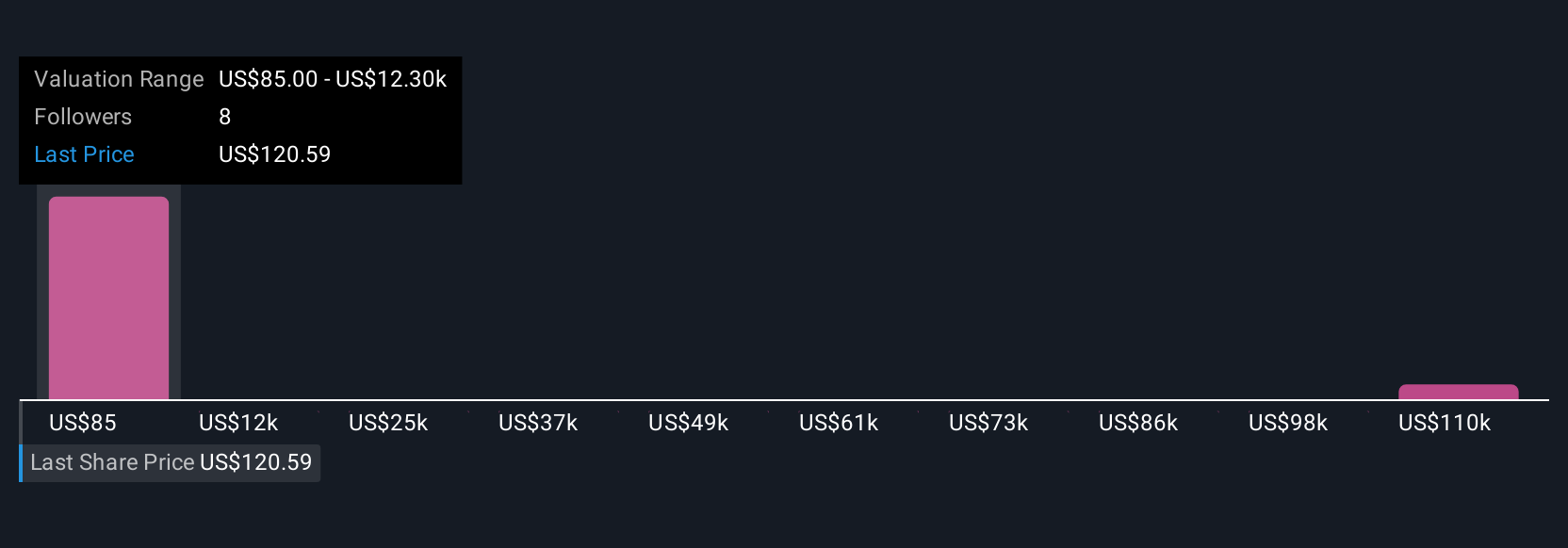

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way for you to connect your perspective or story about Choice Hotels International to a transparent financial forecast and a calculated fair value. Rather than relying solely on one-size-fits-all models, Narratives allow users to define their own assumptions for key drivers such as future revenue growth, profit margins, and valuation multiples so their fair value actually reflects what they believe about the business.

On Simply Wall St’s Community page, millions of investors use Narratives to see and share how varying assumptions change what a stock is really worth. This helps you decide whether it's time to buy, hold, or sell by comparing Fair Value to the current stock Price. The best part is that Narratives automatically update as new company news, earnings results, or industry data emerge, keeping your outlook relevant and dynamic.

For example, with Choice Hotels International, one Narrative might center on rapid international expansion and digital transformation, projecting higher earnings and a fair value of $160 per share. A more cautious perspective could factor in risks to margin or industry softness, leading to a fair value closer to $117 per share. Which story do you believe, and more importantly, what does that mean for your next move?

Do you think there's more to the story for Choice Hotels International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHH

Choice Hotels International

Operates as a hotel franchisor in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives