- United States

- /

- Hospitality

- /

- NYSE:CCL

How Investors May Respond To Carnival (CCL) Record Profits, Higher Guidance, and $2.5B Debt Offerings

Reviewed by Sasha Jovanovic

- Carnival Corporation & plc recently achieved record third-quarter revenues and profits, raising its full-year earnings guidance after reporting US$8.15 billion in quarterly revenue and announcing new fixed-income offerings totaling US$2.5 billion.

- This strong financial performance has been supported by resilient booking trends, all-time high customer deposits, and proactive debt refinancing to lower interest expenses and support future growth.

- We'll explore how Carnival's record-breaking net income and revised full-year outlook further reinforce its evolving investment narrative and long-term appeal.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Carnival Corporation & Investment Narrative Recap

To be a shareholder in Carnival Corporation & plc, you need to believe in the ongoing recovery and future growth of the cruise industry, supported by strong demand, full ships, and steadily improving financials. While record Q3 earnings and raised 2025 guidance highlight Carnival's success at driving revenue and managing costs, the high debt load remains the largest near-term risk due to its potential impact on margins and flexibility. The recent refinancing deals, while positive, do not materially change this risk right now.

The recently completed US$2.5 billion fixed income offerings are particularly relevant, as they represent Carnival's active steps to manage and refinance debt at more favorable rates. This action directly supports near-term profitability by reducing interest expenses, but it also reinforces that careful debt management is crucial to the company's continued recovery, especially with significant refinancing obligations ahead.

Yet, despite consistent profit growth, investors should be aware that Carnival’s substantial debt from pandemic-era borrowing still looms large...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s outlook foresees $29.0 billion in revenue and $3.7 billion in earnings by 2028. This scenario assumes 3.8% annual revenue growth and a $1.2 billion increase in earnings from the current $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $35.75 fair value, a 25% upside to its current price.

Exploring Other Perspectives

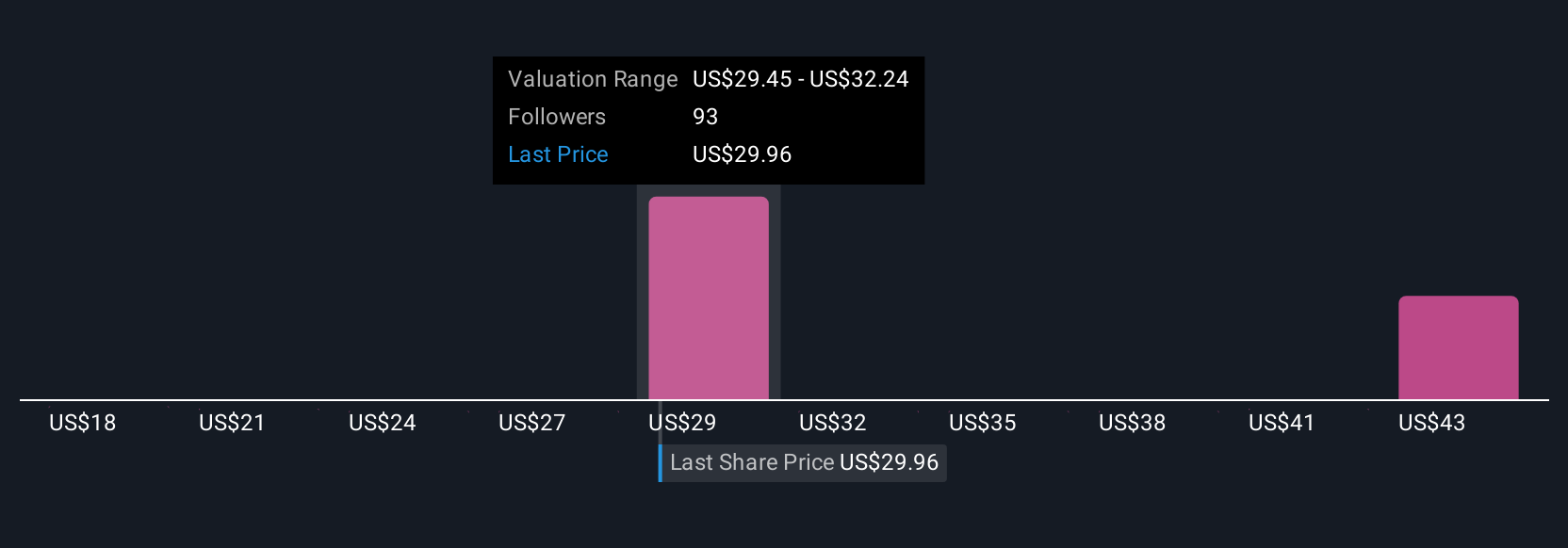

Ten fair value estimates from the Simply Wall St Community for Carnival range from US$21.99 to US$41.57 per share. While investors see opportunity in Carnival’s revenue growth, the wide range shows opinions on the company’s debt burden and future earnings can differ sharply, explore several perspectives before forming your own view.

Explore 10 other fair value estimates on Carnival Corporation & - why the stock might be worth 23% less than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives