- United States

- /

- Hospitality

- /

- NYSE:CCL

Does Carnival Cruise Stock Have More Room to Run After Earnings Beat in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with your Carnival Corporation & shares, or whether now is the time to jump on board? You are definitely not alone. After all, the stock’s journey over the last few years has been anything but boring. Despite some rough seas in the short term, including a dip of 0.7% in the past week and a 9.1% drop over the last month, Carnival Corporation & is still riding a wave that has lifted it 14.8% year-to-date. Looking further back, the returns are even more impressive, with a rally of 52.1% over the last year and a stunning 332.4% surge in the past three years. Even over five years, the stock has climbed 104.6% from its previous levels.

This recent volatility seems to reflect shifting investor perceptions around the travel industry and changing views on risk, set against the backdrop of global market movements. While some headlines have spurred cautious trading, others hint at brighter days ahead with increasing consumer demand for leisure travel.

So, is Carnival Corporation & actually undervalued right now? According to a valuation score that measures the company across six different undervaluation checks, Carnival nabs a 5 out of 6, suggesting there could still be some upside for investors looking for value. In the next section, we’ll break down those valuation approaches, and later in the article, explore whether there is an even more insightful way to judge if Carnival is a smart buy today.

Approach 1: Carnival Corporation & Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and then discounting them back to today's dollars using a chosen rate. This helps investors determine what a business may really be worth, beyond just its current stock price.

For Carnival Corporation &, the model starts with its latest reported Free Cash Flow, which stood at $1.46 billion. Looking ahead, analysts project Free Cash Flow to reach as high as $3.94 billion by 2029. Extended forecasts suggest a steady, if somewhat conservative, outlook for the following years. These projections incorporate both analyst estimates and long-range extrapolations to provide a comprehensive view.

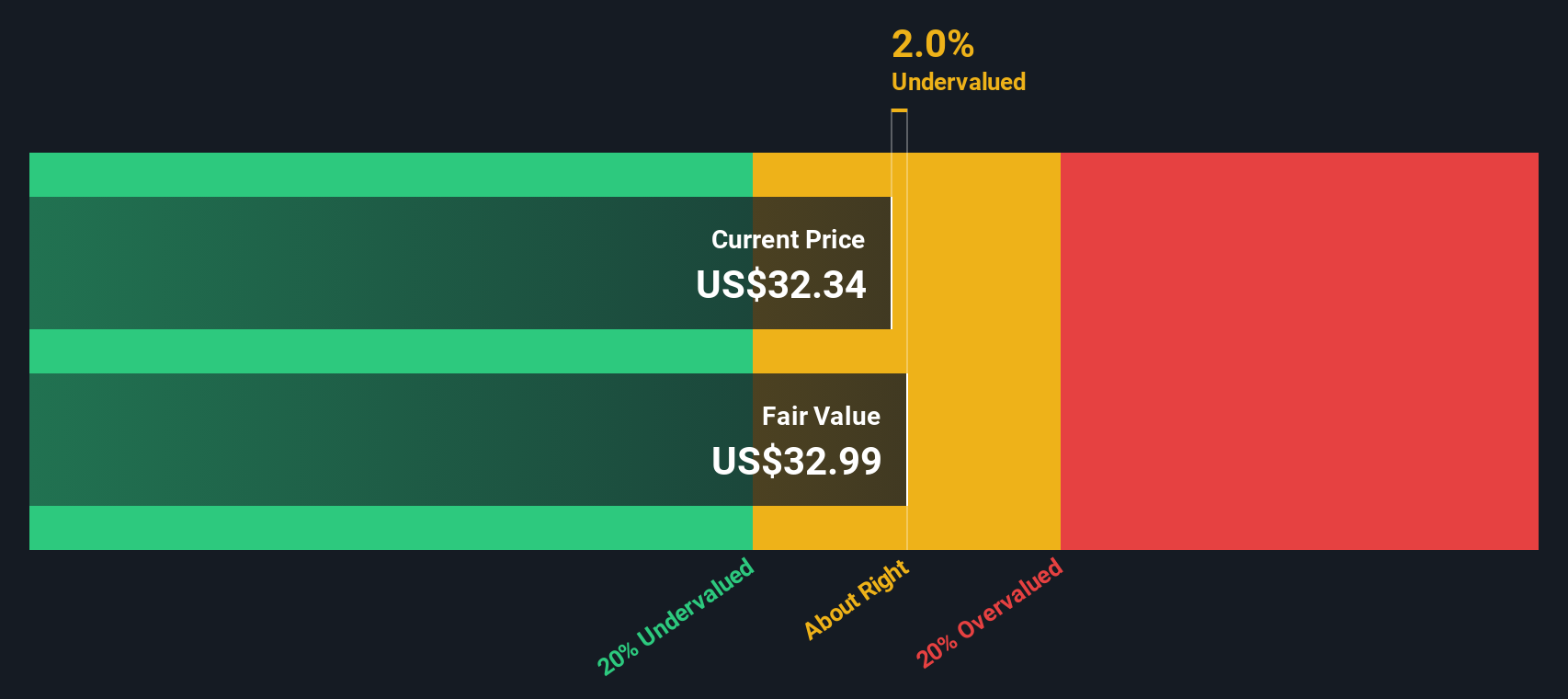

After adding up all of these future cash flows and discounting them accordingly, Carnival's estimated intrinsic value lands at $30.04 per share. With the current stock price trading about 4.4% below this level, the DCF analysis indicates the stock is trading ABOUT RIGHT relative to its long-term cash flow potential.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Carnival Corporation &'s valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Carnival Corporation & Price vs Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio is one of the most widely used metrics for valuing established, profitable companies like Carnival Corporation &. Because it links a company’s stock price to its actual earnings, the P/E ratio can give investors a sense of whether a stock is attractively priced relative to the business’s underlying profitability.

Determining what constitutes a "normal" or "fair" P/E ratio depends largely on how fast the company is expected to grow and what risks it faces. Companies with strong growth potential or lower risk usually command higher P/E multiples, while those with slower growth or elevated uncertainty are expected to trade at a discount.

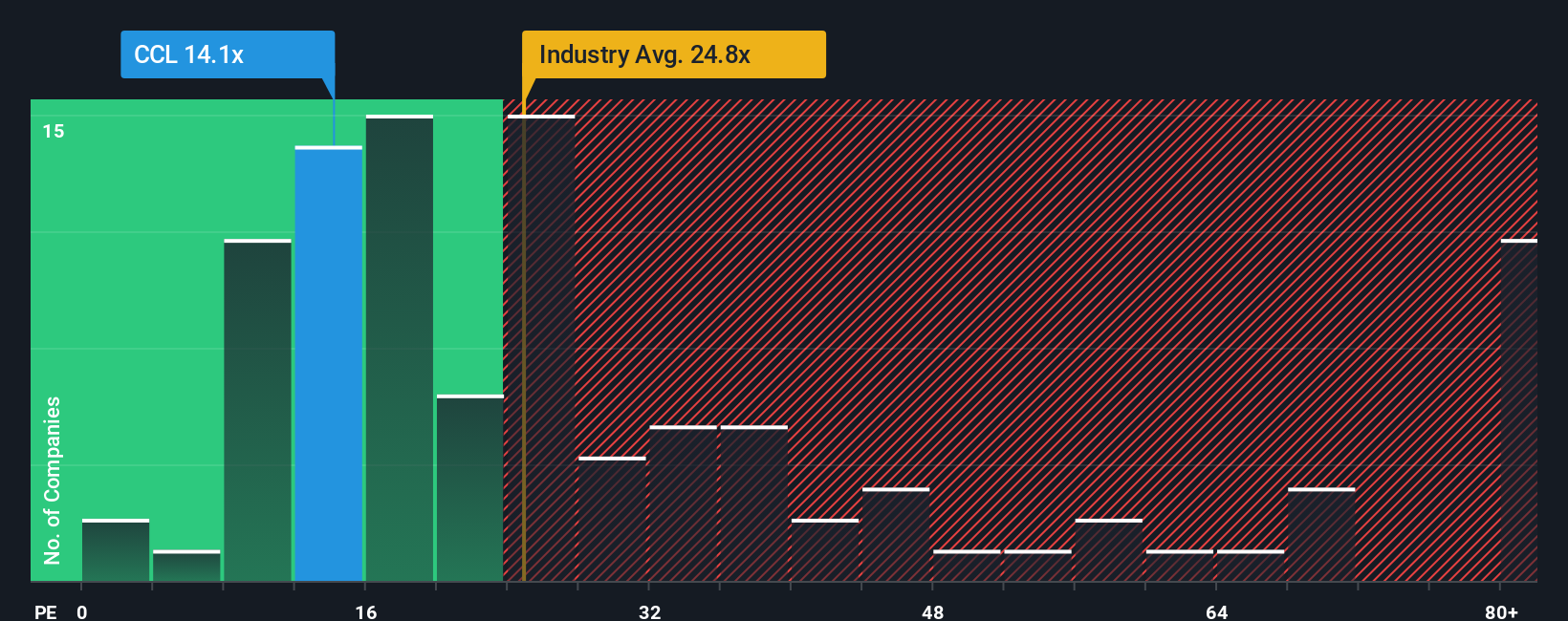

Currently, Carnival’s P/E ratio stands at 14.3x, noticeably below the Hospitality industry average of 24.8x and the peer group average of 26.1x. On paper, this suggests Carnival is cheaper than many of its competitors. However, Simply Wall St's proprietary Fair Ratio offers a more tailored benchmark by factoring in Carnival’s unique earnings growth outlook, profit margins, market cap, industry conditions and risk profile. The Fair Ratio for Carnival is estimated at 29.0x, indicating the market is pricing Carnival's earnings well below what may be warranted considering these fundamentals. This approach is often a superior assessment compared to simple peer or industry comparisons because it takes into account the specific attributes and prospects of the business rather than broad averages.

With Carnival’s P/E ratio of 14.3x versus a Fair Ratio of 29.0x, the stock currently appears significantly undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carnival Corporation & Narrative

Earlier, we mentioned that there is an even better way to truly understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you attach your own story and perspective to Carnival Corporation &, connecting the company’s real-world journey with your own financial forecasts, such as expected fair value, future revenues, profits, and margins.

By building a Narrative, you map out why you believe in a company’s future, linking its business momentum, industry changes, and key assumptions directly to numbers that matter for valuation. Narratives transform investing from following abstract metrics to creating your own evidence-based roadmap for buying, holding, or selling. They are easily accessible to anyone on Simply Wall St’s Community page, where millions of investors share their unique perspectives.

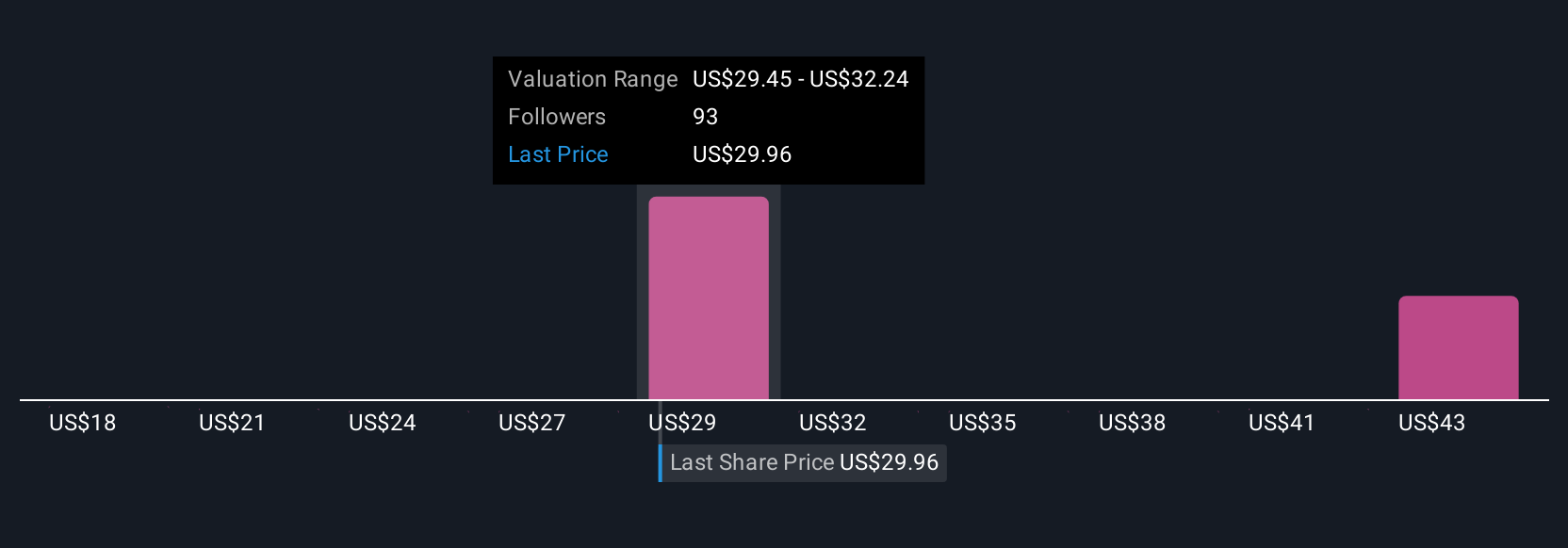

Whenever new events or financial results emerge, Narratives are updated dynamically, so your investment view is always up to date. For example, with Carnival Corporation &, some investors see the fair value as high as $43.00 thanks to recent revenue growth and private destination launches, while the most cautious see it as low as $24.00, focusing on risks like debt, modernization costs, and regulatory changes. Narratives make it easy for you to compare your assumptions to others, so you can decide if now is the right time to invest.

Do you think there's more to the story for Carnival Corporation &? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives