- United States

- /

- Hospitality

- /

- NYSE:CAVA

CAVA Group (NYSE:CAVA) Shares Drop 17% As $227M Sales Reported For Fourth Quarter

Reviewed by Simply Wall St

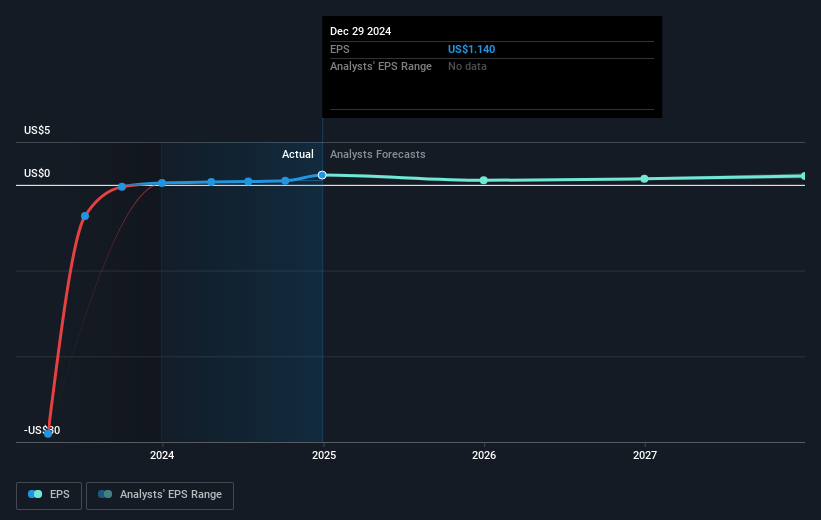

CAVA Group (NYSE:CAVA) recently reported strong financial results for the fourth quarter and full year of 2024, with sales rising to $227 million and net income improving significantly from the previous year. Despite this robust performance and positive earnings guidance projecting sales and profit margin growth for 2025, the company's share price dropped 17% last week. This decline may be partly explained by the broader market context, where U.S. stock indexes experienced a mixed performance amid economic uncertainties and new tariff announcements. The market has dropped 4% over the same period, influenced by factors such as anticipated tariffs announced by President Trump, impacting investor sentiment. The overall market downturn could overshadow CAVA's optimistic outlook, suggesting that market dynamics may play a significant role in the recent share price movements despite the company's impressive financial achievements.

Navigate through the intricacies of CAVA Group with our comprehensive report here.

Over the last year, CAVA Group's total return, including dividends, reached an impressive 73.92%. This exceptional performance significantly outpaced both the US Hospitality industry, which returned 15.7%, and the broader US Market, with a return of 16.7% over the same period. Noteworthy growth was fueled by several key developments, including substantial earnings growth for 2024. Full-year sales soared to US$963.71 million, while net income rose to US$130.32 million, reflecting a considerable increase from the previous year.

Additionally, CAVA's corporate guidance revisions in November and February outlined optimistic sales forecasts, while quarterly earnings consistently showed substantial year-over-year improvements. The announcement of 56 to 58 new restaurant openings for 2025 further bolstered investor confidence earlier long-term. Despite its relatively high Price-To-Earnings Ratio compared to industry averages, CAVA's strong growth expectations provided compelling support, contributing to its robust total shareholder return over the past year.

- See how CAVA Group measures up with our analysis of its intrinsic value versus market price.

- Explore the potential challenges for CAVA Group in our thorough risk analysis report.

- Hold shares in CAVA Group? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives