- United States

- /

- Hospitality

- /

- NYSE:BYD

Is Boyd Gaming a Smart Bet After a 33.7% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about adding Boyd Gaming to your portfolio, or wondering if it is time to cash in? You are not alone. Boyd Gaming, trading most recently at $85.49, has been at the center of many investor conversations. The stock is one of those names that tends to fly under the radar until, seemingly out of nowhere, it delivers head-turning performance numbers.

Just in the past year, shares are up a stellar 33.7%. Even with some recent choppiness, like a -2.2% dip over the past week and a slight -1.1% move in the last month, the longer-term chart is hard to ignore, with gains of 19.0% year-to-date, 75.4% over three years, and a remarkable 173.5% in five years. These numbers point towards both resilience and growth potential, fueled by ongoing market trends in gaming and hospitality that are bringing new attention, and sometimes new risks, to sector leaders like Boyd Gaming.

But impressive price returns do not always mean a stock is a solid deal right now. That is where valuation comes into play, and based on our comprehensive score, where 1 point is awarded for each check indicating undervaluation out of 6 possible, Boyd Gaming comes in at 4. This suggests it stacks up well against most criteria, though there are still a couple of areas where the market may be less convinced it is a value buy.

So how does this valuation score really break down, and what do the traditional valuation approaches reveal? In the next section, we will dive deeper into the numbers and methods to hint at an even smarter way to judge whether Boyd is truly undervalued.

Approach 1: Boyd Gaming Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today's value. This approach helps investors gauge what a business is fundamentally worth, regardless of short-term market noise.

For Boyd Gaming, the current Free Cash Flow (FCF) stands at $520.5 million. Analyst estimates provide projections for the next five years, and from there, further figures are extrapolated based on expected industry trends. In 2027, the company is projected to generate $558.7 million in FCF. Looking out ten years, extrapolated forecasts suggest FCF could reach roughly $725 million by 2035.

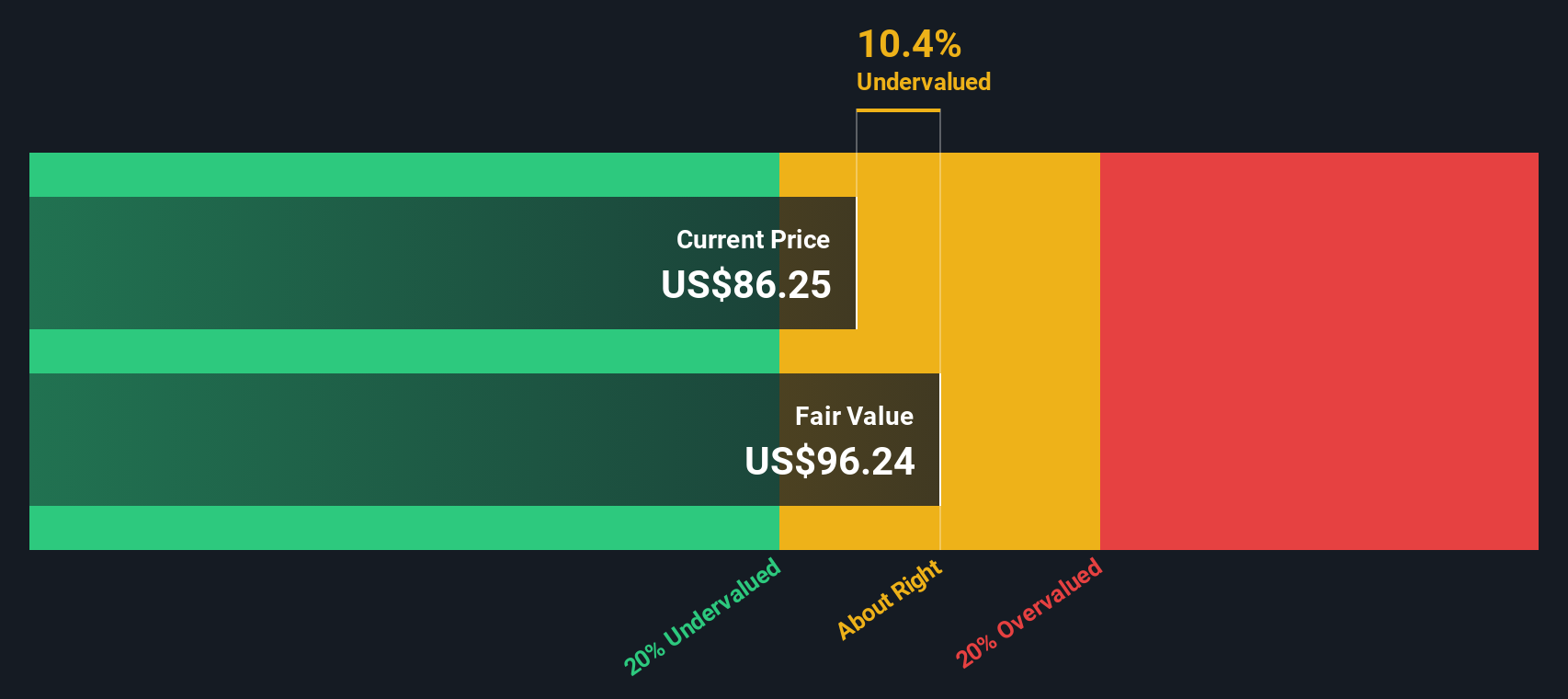

Using these figures and a 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $98.12 per share. This is about 12.9% higher than Boyd's recent share price of $85.49, which suggests the stock is currently undervalued according to this fundamental approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boyd Gaming is undervalued by 12.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Boyd Gaming Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the go-to valuation metric for established, profitable companies like Boyd Gaming. It measures how much investors are willing to pay for each dollar of earnings, providing a clear snapshot of how the market values the company’s current and future profit potential.

Growth expectations and risk both play a key role in what constitutes a "normal" or "fair" PE ratio. Companies with higher expected earnings growth and lower risk typically command higher PE multiples, while slower-growing or riskier businesses generally see lower valuations. This context makes benchmark comparisons important when judging value.

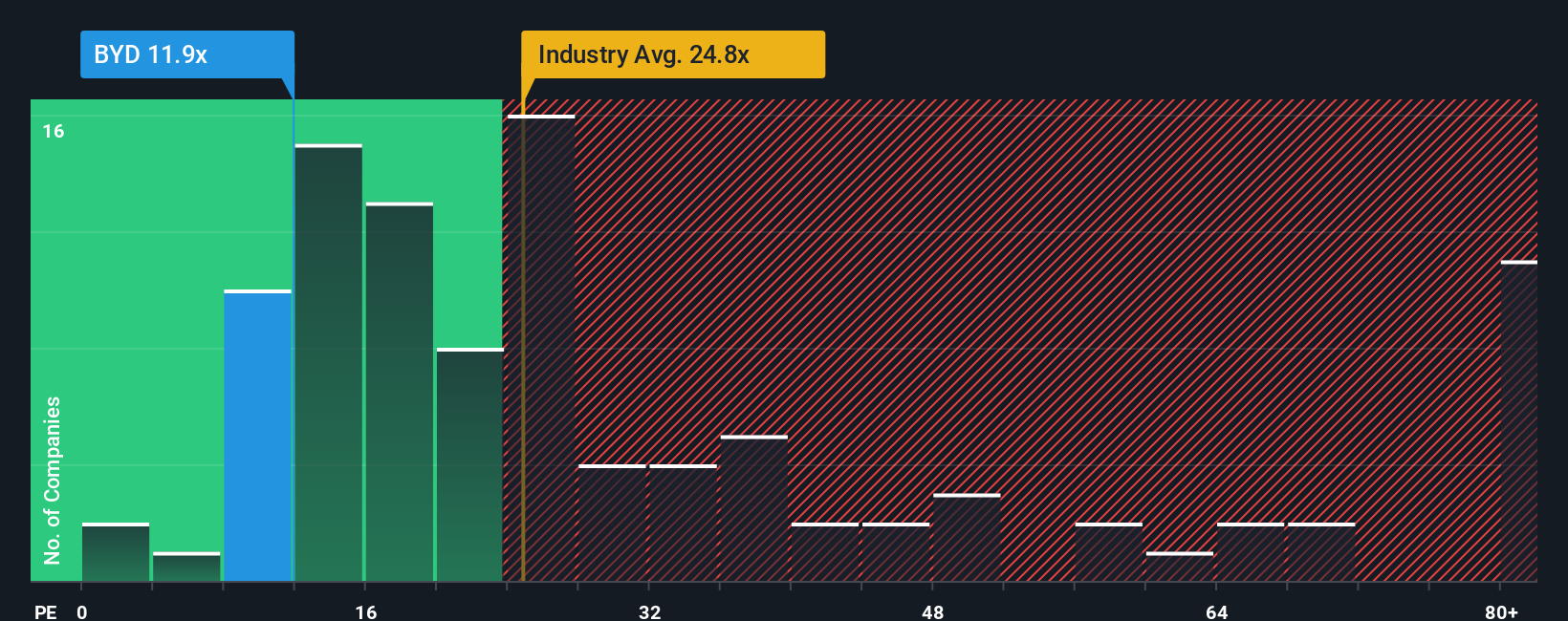

Boyd Gaming currently trades at a PE ratio of 12.1x. This is notably lower than both the Hospitality industry average of 24.9x and the average of its listed peers at 25.7x. On the surface, this steep discount might suggest a bargain, but raw comparisons do not always account for company-specific factors.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio for Boyd Gaming is 18.0x, calculated by weighing everything from the company’s earnings growth outlook and profit margin to its size, sector, and risk profile. Unlike standard peer or industry averages, the Fair Ratio is specifically tailored to reflect the company’s individual prospects and challenges, offering a more accurate yardstick for fair value.

Comparing Boyd Gaming’s actual PE of 12.1x to the Fair Ratio of 18.0x shows that the stock appears undervalued based on this more holistic approach. The significant gap suggests the current market price underappreciates the company’s earnings power relative to what would be expected for a business of Boyd’s profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boyd Gaming Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a dynamic tool that lets you capture the story behind Boyd Gaming's numbers and transform your outlook into a concrete financial forecast and fair value estimate.

Narratives bridge the gap between financials and perspective by allowing investors to build their own clear story for a company. This is done by mapping out beliefs about future revenue, profit margins, and ultimate company potential, and then instantly seeing what that means for fair value today.

This feature, easily accessible on Simply Wall St's Community page and used by millions of investors, helps you decide whether to buy or sell by constantly comparing your Narrative’s Fair Value to the latest share price. This process is dynamically updated whenever news or results hit the market.

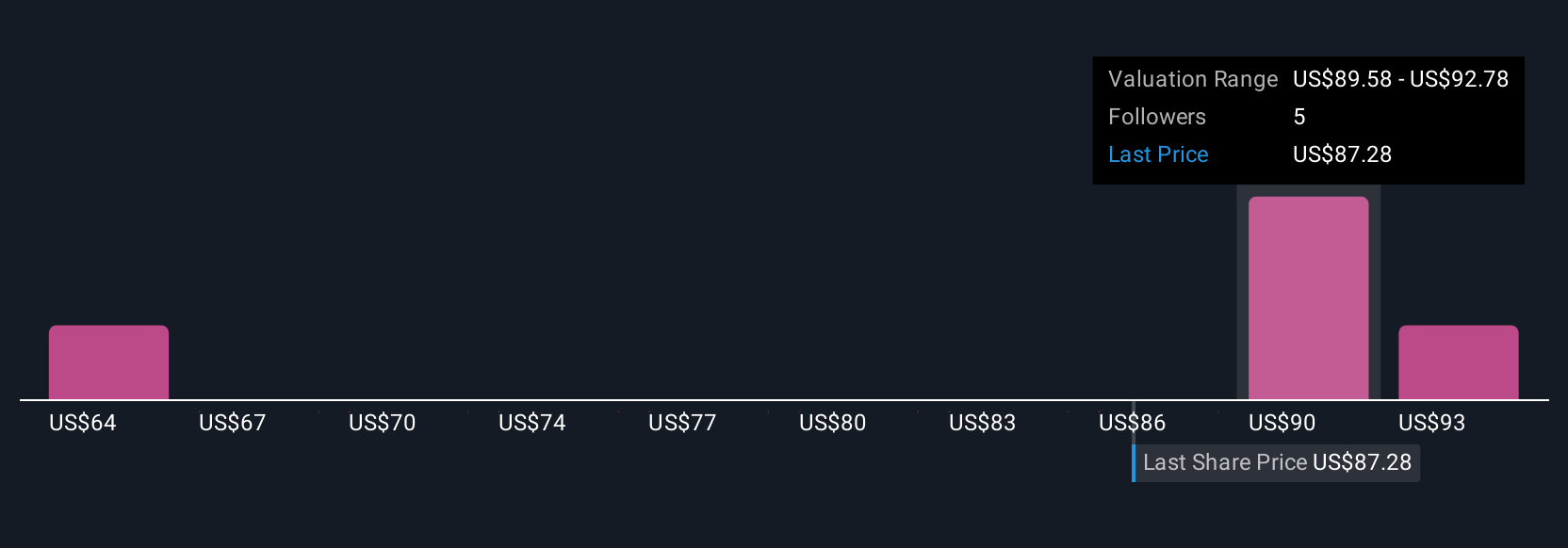

For example, two investors might look at Boyd Gaming and see very different futures. One sees expansion projects and digital growth driving fair value as high as $101.0, while another, concerned about competition and economic risk, sets a price target as low as $80.0. This demonstrates how Narratives make it easier to match your investment decisions to what you believe, not just to averages or static forecasts.

Do you think there's more to the story for Boyd Gaming? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BYD

Boyd Gaming

Operates as a multi-jurisdictional gaming company in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives