- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Will Insider Confidence and Margin Gains Sustain Adtalem Global Education's (ATGE) Momentum Amid Shifting Sector Winds?

Reviewed by Sasha Jovanovic

- In recent news, BMO Capital Markets expressed continued optimism for education sector stocks and specifically maintained a positive outlook on Adtalem Global Education, citing minimal regulatory impact expected until 2026 and highlighting the company’s improved profitability and strong earnings growth.

- Insider ownership of US$122 million underscores management’s confidence, while upward-trending revenues and higher EBIT margins suggest ongoing operational improvements at Adtalem.

- We’ll explore how Adtalem’s earnings momentum and strengthened insider alignment influence its current investment narrative amid shifting sector sentiment.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Adtalem Global Education's Investment Narrative?

To be a shareholder in Adtalem Global Education, you’d need to believe in the staying power of for-profit education, the company’s ability to keep growing earnings and revenues, and management’s long-term alignment with shareholders. The recent BMO Capital Markets update affirms that sector-wide regulatory risks, particularly from the One Big Beautiful Bill Act, are unlikely to be material until 2026, letting near-term results hinge more on Adtalem’s own operational execution. With ongoing revenue and margin improvement, alongside large insider ownership, the main catalysts remain upcoming earnings and evidence of sustained enrollment growth, not immediate policy shifts. One risk that stands out is the company’s premium valuation compared to peers, which could attract scrutiny if growth slows or sector sentiment changes. The update from BMO offers some cushion, but investors should still pay attention to short-term volatility following recent index exclusions and insider share sales. On the flipside, valuation pressures compared to peers and industry averages are something investors should be aware of.

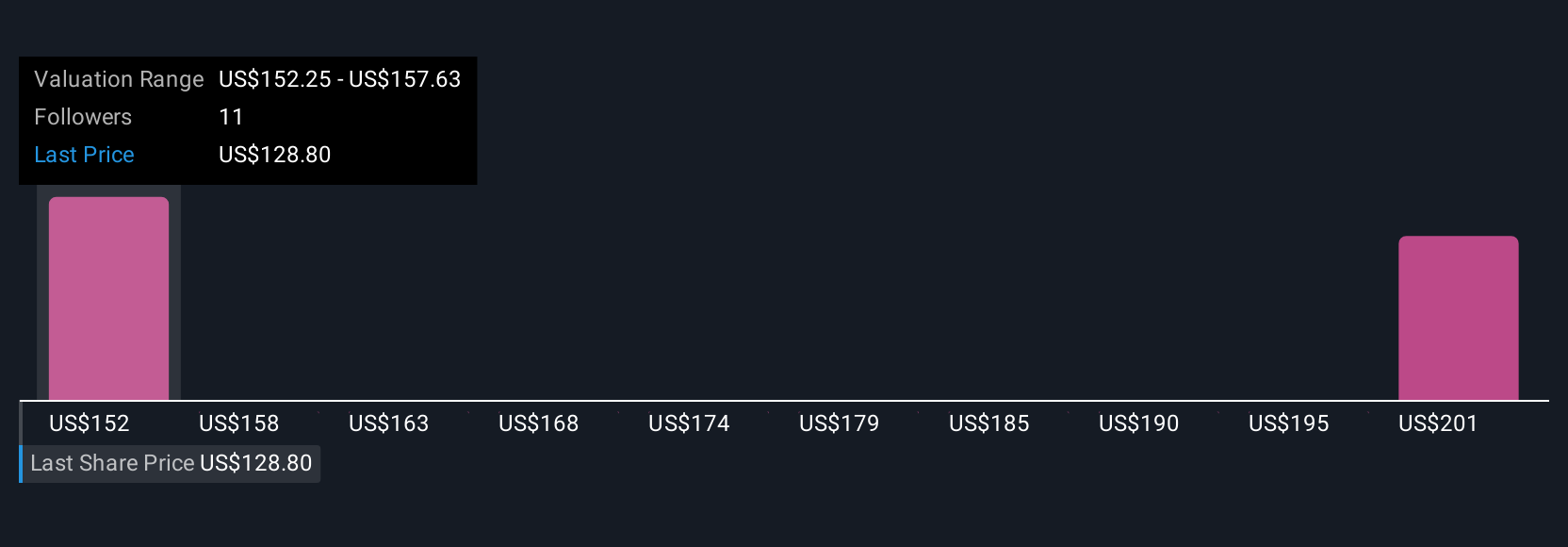

Despite retreating, Adtalem Global Education's shares might still be trading 32% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 47% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Solid track record and fair value.

Market Insights

Community Narratives