- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Adtalem Global Education (ATGE): Evaluating Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

Adtalem Global Education (ATGE) has quietly pushed higher, with the stock up about 5% over the past week and modestly positive this month, even after a steep slide in the past 3 months.

See our latest analysis for Adtalem Global Education.

At a share price of $97.76, Adtalem’s recent bounce, including a strong 1 day share price return and a solid year to date share price gain, contrasts with its sharp 90 day share price pullback. At the same time, its multi year total shareholder return points to enduring momentum rather than a short term trade.

If this healthcare education rebound has your attention, it could also be a good moment to scan other opportunities across healthcare stocks for fresh ideas.

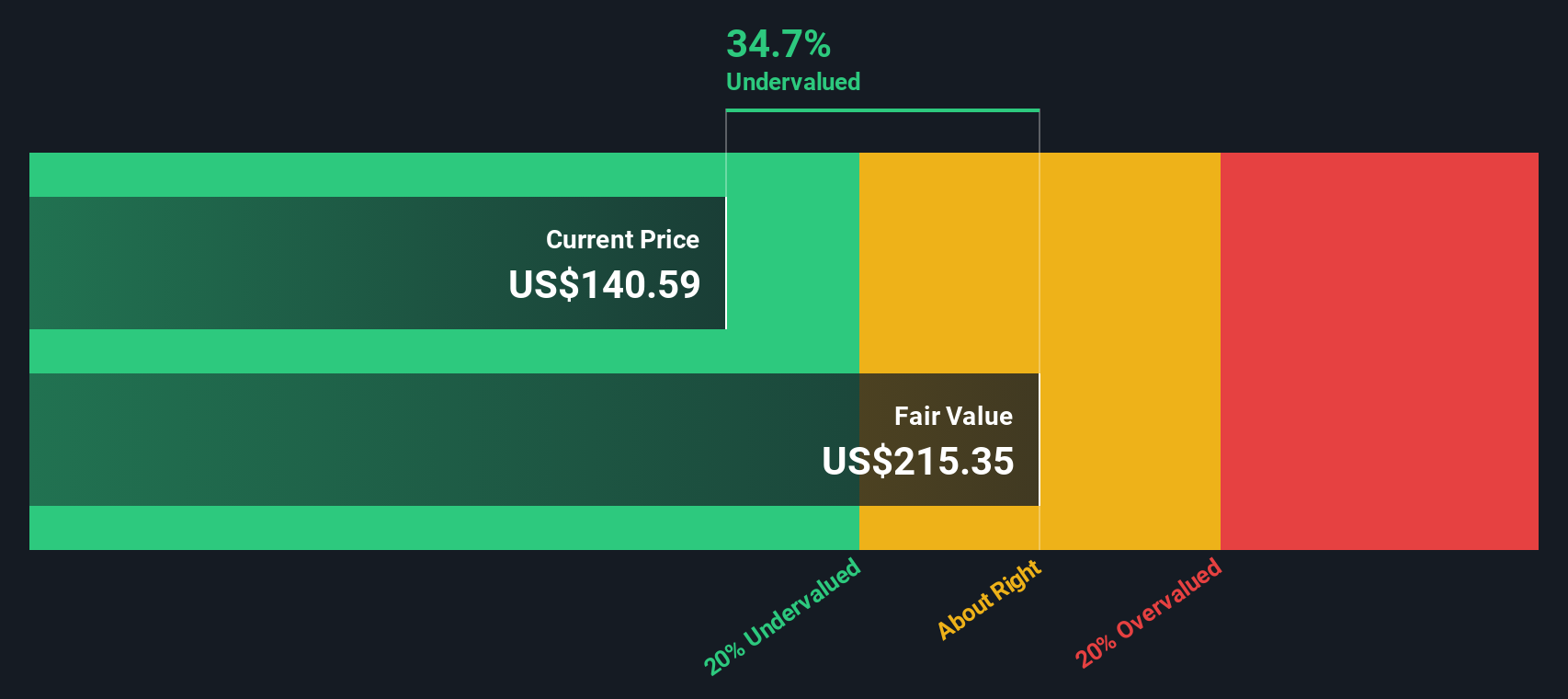

With earnings still growing and the share price trading at a steep discount to analyst targets and intrinsic value estimates, is Adtalem an overlooked compounder, or is the market already factoring in a slower phase of growth ahead?

Price-to-Earnings of 14.3x: Is it justified?

At $97.76 per share, Adtalem trades on a price-to-earnings ratio of 14.3 times. This is described as signaling undervaluation relative to both peers and intrinsic value estimates.

The price-to-earnings ratio compares the current share price to the company’s earnings per share, making it a core gauge of how much investors are willing to pay for each dollar of profit. For a profitable, growing education provider like Adtalem, this multiple helps show whether the market is fully recognizing its earnings strength.

Adtalem’s earnings have grown solidly, with profits reported as compounding at a strong rate over the past five years and accelerating in the most recent year. However, the market is assigning a lower price-to-earnings multiple than both the Consumer Services industry and its direct peer group. Relative to an estimated fair price-to-earnings level of 18.8 times, the current 14.3 times is presented as suggesting meaningful room for the valuation to expand if earnings growth stays on track.

Compared with the broader US Consumer Services industry average of 16.7 times and a peer average of 15.1 times, Adtalem’s 14.3 times earnings multiple is characterized as looking distinctly conservative, which hints that investors may not be fully crediting its recent earnings momentum and quality.

Explore the SWS fair ratio for Adtalem Global Education

Result: Price-to-Earnings of 14.3x (UNDERVALUED)

However, investors should note risks around tighter healthcare education regulation and any slowdown in enrollment growth, which could pressure earnings and limit potential valuation gains.

Find out about the key risks to this Adtalem Global Education narrative.

Another View: What Does Our DCF Say?

While the current 14.3 times earnings multiple looks modest, our DCF model presents a much stronger picture with a fair value estimate of about $201.12 per share. That suggests Adtalem could be trading at roughly a 51% discount, or it may indicate that the model is too optimistic about future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adtalem Global Education for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adtalem Global Education Narrative

If you see the story differently or want to interrogate the numbers yourself, you can easily build a personalized view in minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Adtalem Global Education.

Looking for more investment ideas?

Before you move on, consider your next move by scanning shortlists from the Simply Wall Street Screener, so you are not overlooking potential opportunities.

- Explore these 13 dividend stocks with yields > 3% to review companies that may offer more reliable income streams and help support your portfolio with consistent cash returns.

- Browse these 908 undervalued stocks based on cash flows to find situations where current share prices may not fully reflect a company’s cash flows.

- Review these 26 AI penny stocks to see which businesses are developing products and services around artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)