- United States

- /

- Hospitality

- /

- NasdaqGS:WING

Wingstop (WING): Assessing Valuation After Recent 16% Share Price Pullback

Reviewed by Kshitija Bhandaru

Wingstop (WING) shares have come under pressure lately, falling 16% in just the past month. Investors are watching closely to see if this trend signals a change in appetite for the fast-casual chicken chain.

See our latest analysis for Wingstop.

Wingstop’s recent 5.7% one-month share price slide comes after a year marked by choppy trading, which has overshadowed earlier successes. Even with the stock pulling back this year, long-term investors have seen a total shareholder return topping 112% over three years. While near-term momentum is clearly fading, the bigger picture is one of impressive long-term growth.

If the current shift in sentiment has you curious about what else is delivering big moves, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares sliding and valuation metrics in focus, the question for investors is clear: is Wingstop undervalued after its recent pullback, or is the market already pricing in all the growth ahead?

Most Popular Narrative: 35.5% Undervalued

Compared to Wingstop’s latest close at $246.27, the narrative’s fair value estimate of $381.83 stands out, suggesting a valuation well above current market levels and shifting the conversation to what could be driving such optimism.

The rapid roll-out and full system implementation of the Wingstop Smart Kitchen platform is significantly improving operational efficiency, order throughput, guest satisfaction, speed of service, and consistency. This is expected to drive higher same-store sales, increased delivery frequency, and better net margins as restaurants ramp to the new model.

Curious what bold growth assumptions power this valuation? Behind the headline is a deep belief in expansion and digital transformation, but the real secret is in analyst forecasts. Ready to unravel the numbers and see what sets this narrative apart from the market buzz?

Result: Fair Value of $381.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand softness and slowing menu innovation could quickly dampen Wingstop’s growth story if these headwinds intensify in coming quarters.

Find out about the key risks to this Wingstop narrative.

Another View: Can Market Multiples Tell a Different Story?

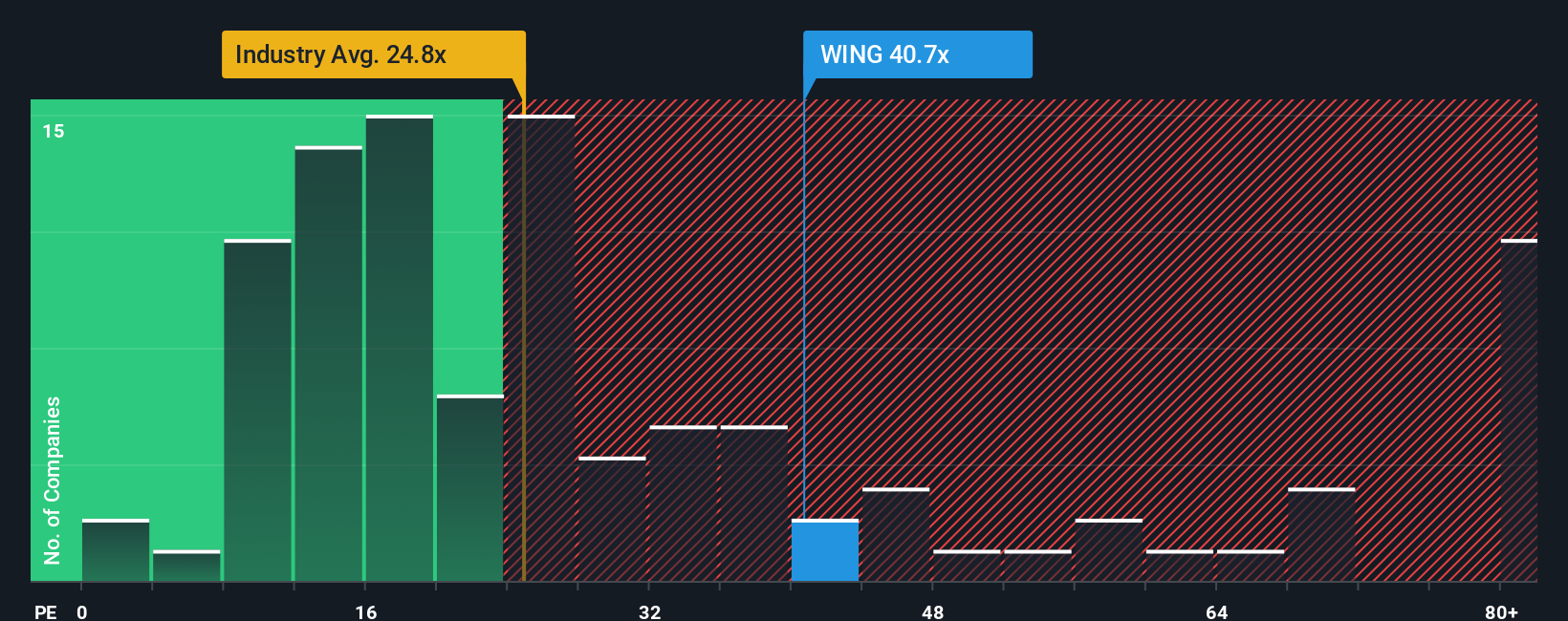

While the fair value narrative points to Wingstop as meaningfully undervalued, a look at its price-to-earnings ratio tells a different tale. At 40.1x, its valuation is far higher than the US Hospitality industry average of 23.8x and even above the fair ratio of 21.1x. This kind of premium may signal investor optimism, or it could expose the stock to valuation risk if growth stalls. Is the market right to price in so much future success, or could a reversion to the fair ratio mean a painful reset ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wingstop for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wingstop Narrative

If you see the numbers differently or want to chart your own path, it takes just a few minutes to craft a unique perspective. Do it your way.

A great starting point for your Wingstop research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio an edge and spot untapped opportunities before the crowd by using these hand-curated stock lists. Don’t let the next big winner pass you by.

- Unlock the potential of future tech by checking out these 26 quantum computing stocks. This list highlights innovation in quantum computing and explores new possibilities in data and security.

- Capitalize on life-changing healthcare breakthroughs and see which companies stand out among these 33 healthcare AI stocks. These firms are harnessing artificial intelligence to advance medical science and patient care.

- Benefit from steady income streams with these 20 dividend stocks with yields > 3%, which offers high yields and strong fundamentals for investors focused on sustainable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with slight risk.

Market Insights

Community Narratives