- United States

- /

- Hospitality

- /

- NasdaqGS:WING

Can Wingstop's (WING) Football Season Menu Play Reinforce Its Brand-Driven Growth Narrative?

Reviewed by Simply Wall St

- Wingstop recently launched its limited-time Smoky Chipotle Rub flavor on September 3, offering fans a new dry rub inspired by smoky BBQ with hints of honey and paprika, alongside a game day promotion of free wings with qualifying orders.

- This targeted menu innovation, released specifically for football season kickoff, highlights how Wingstop aims to boost customer excitement and traffic during peak demand periods.

- We'll explore how this menu launch, designed to increase engagement and game day sales, could impact Wingstop's broader growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Wingstop Investment Narrative Recap

To be a shareholder in Wingstop, you need to believe in its ability to keep driving traffic and sales through innovation, digital engagement, and expansion, despite pressures on consumer demand and an already premium valuation. The new Smoky Chipotle Rub and related football season promotion could energize near-term sales and engagement; however, this appears unlikely to meaningfully alter the key catalyst of digital and menu innovation or the big risk of slowing same-store sales if consumer demand doesn't rebound.

Among recent announcements, the BOGO event on chicken tenders is especially relevant. Both this and the limited-time smokey flavor reinforce Wingstop’s ongoing efforts to attract guests and increase ticket size during competitive periods, connecting directly to the critical catalysts around menu innovation and value-driven promotions.

But in contrast, investors should be particularly focused on signs that core demand softness persists, especially among value-conscious consumers and in key demographics...

Read the full narrative on Wingstop (it's free!)

Wingstop's narrative projects $1.1 billion in revenue and $200.9 million in earnings by 2028. This requires 18.9% yearly revenue growth and a $29.4 million earnings increase from $171.5 million today.

Uncover how Wingstop's forecasts yield a $399.91 fair value, a 29% upside to its current price.

Exploring Other Perspectives

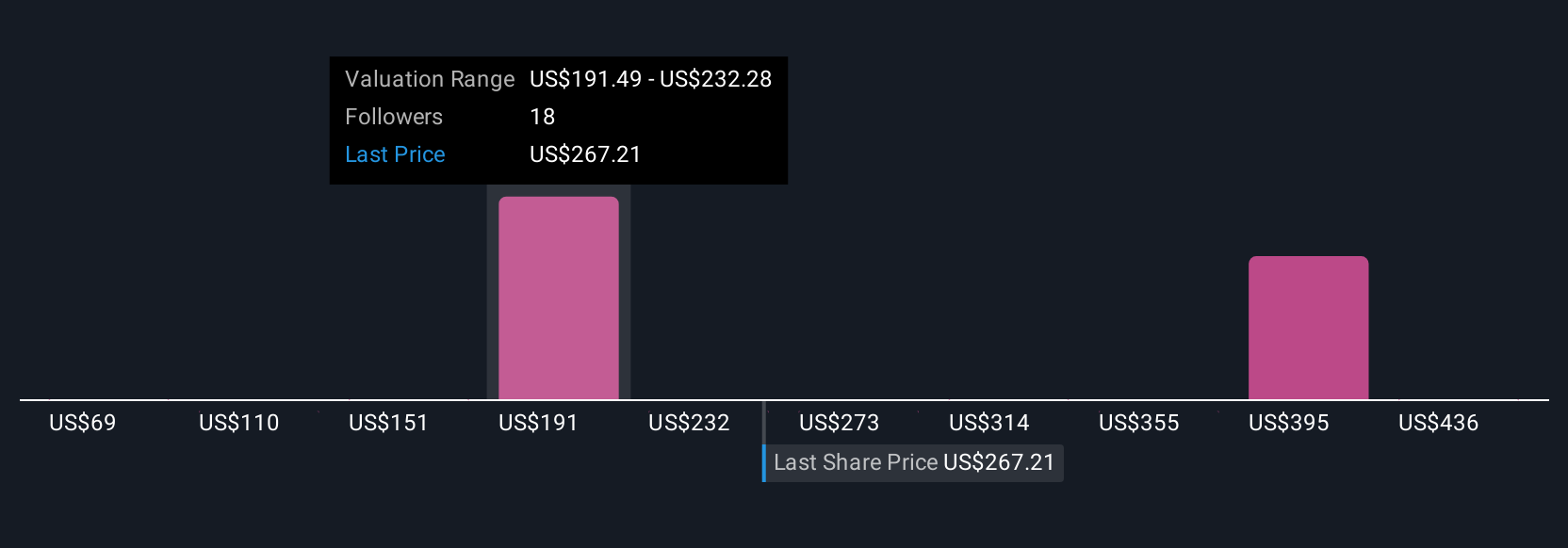

Eight members of the Simply Wall St Community place Wingstop’s fair value between US$69.13 and US$477, reflecting a wide spectrum of confidence and caution. As menu innovation and targeted promotions remain a central catalyst, take a closer look at this variety of investor perspectives before making up your mind.

Explore 8 other fair value estimates on Wingstop - why the stock might be worth less than half the current price!

Build Your Own Wingstop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Wingstop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wingstop's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with slight risk.

Market Insights

Community Narratives