- United States

- /

- Consumer Services

- /

- NasdaqCM:VSA

VisionSys AI (VSA): Losses Cut 30% Annually, But Negative Equity Clouds Value Narrative

Reviewed by Simply Wall St

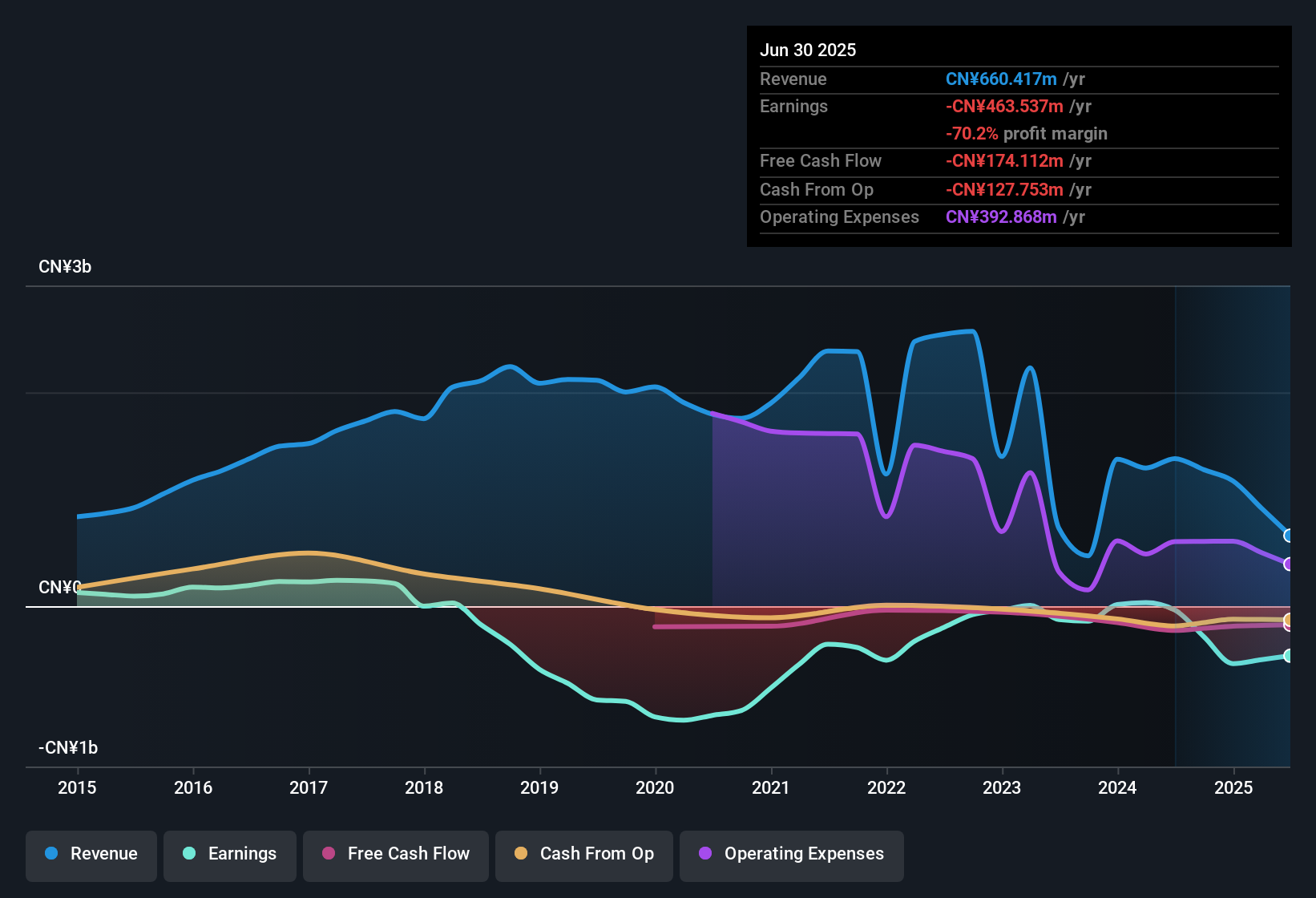

VisionSys AI (VSA) continues to operate at a loss, but over the past five years, the company has managed to cut its losses by an average of 30.3% per year. While its Price-to-Sales Ratio stands at 1.6x, matching the US Consumer Services industry average and notably lower than the peer group’s 5.8x, there is still no clear sign of profit growth momentum or improvement in net profit margins. Investors are left weighing a steadily improving loss profile and apparently attractive valuation against lingering concerns about the company’s equity position, dilution, and recent share price volatility.

See our full analysis for VisionSys AI.The next section dives straight into how these headline numbers compare to the prevailing narratives, highlighting where the story aligns and where market expectations might diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Balance Sheet Still Shows Negative Equity

- VisionSys AI continues to operate with negative equity as reported in recent filings, underscoring that liabilities exceed assets and highlighting a key financial risk that persists despite recent operating improvements.

- What is surprising about the prevailing market view is that, even as losses shrink at an average pace of 30.3% per year, many investors may underestimate the importance of negative equity for future capital needs and potential shareholder dilution.

- Negative equity leaves little room for financial flexibility and can lead to further share dilution, as was noted in the last year.

- This ongoing structural weakness tempers optimism about loss reductions, especially when the company is not generating positive net margins.

Share Dilution and Capital Concerns

- Share dilution has occurred over the past twelve months, which means more shares have been issued and existing shareholders now own a smaller percentage of VisionSys AI.

- Bears argue that this dilution, combined with the company’s lack of a strong financial position, could limit the upside from any operational progress.

- The recent uptick in the number of shares may signal ongoing capital needs, making it harder for per-share value to recover in the near future.

- Bears highlight that unless VisionSys AI can transition toward positive net profit margins, additional shareholder dilution could continue, further weighing on the stock.

Valuation Metrics Look Attractive, but Volatility Remains

- The price-to-sales ratio of 1.6x sits well below the peer group’s 5.8x, offering VisionSys AI an apparent value advantage relative to similar companies in the US Consumer Services space.

- The prevailing market analysis notes that while VisionSys AI screens as relatively inexpensive, the recent instability in its share price and lack of proof of high-quality past earnings may be limiting investor enthusiasm.

- Despite that valuation discount, the absence of evidence for profit growth acceleration means many investors are cautious about treating VSA as a bargain.

- Short-term share price volatility over the last three months is likely a direct reflection of these unresolved tensions between value metrics and financial risks.

- Investors watching for a fundamental shift may want to see more consistent profitability before relying too much on valuation ratios to guide their next move. See our latest analysis for VisionSys AI.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on VisionSys AI's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

VisionSys AI continues to struggle with negative equity, recurring dilution, and inconsistent profit margins. This exposes investors to considerable financial and operational risk. If you’d prefer companies with sturdier finances and resilience, search for firms featuring a solid balance sheet and fundamentals stocks screener to minimize exposure to ongoing balance sheet pressure and dilution risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VSA

VisionSys AI

Through its subsidiaries, engages in the provision of STEM education services in Mainland China.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)