- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

Should Bear Cave’s Grey‑Market Critique of Sportradar (SRAD) Require Action From Investors?

Reviewed by Sasha Jovanovic

- Recently, Sportradar Group came under scrutiny after a bearish report on The Bear Cave’s Substack raised concerns about its reliance on clients operating in loosely regulated gambling markets and the resilience of its sports data platform amid intensifying competition.

- This critique shines a light on the quality and durability of Sportradar’s underlying revenue streams, particularly where regulatory standards and enforcement may be weaker.

- We’ll now assess how these concerns about grey‑market exposure could influence Sportradar’s existing investment narrative built around growth and margin expansion.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Sportradar Group Investment Narrative Recap

To own Sportradar, you need to believe that regulated sports betting will keep expanding and that the company’s data and tech platform can hold its ground against rising competition. The Bear Cave’s criticism around grey market exposure directly touches the quality of those revenues but does not obviously change the near term focus on sustaining double digit growth and defending margins, while reinforcing regulatory and competitive pressures as key risks to watch.

The most relevant recent announcement here is Sportradar’s decision to raise its 2025 revenue guidance to at least €1,290 million, implying at least 17% year on year growth. That outlook sits beside the concerns about client mix and regulatory oversight, and puts more emphasis on whether growth is coming from higher quality, well regulated markets or from segments that could face abrupt changes if rules tighten.

Yet behind that stronger revenue outlook, there is a concentration risk in key data rights that investors should be aware of...

Read the full narrative on Sportradar Group (it's free!)

Sportradar Group's narrative projects €1.8 billion revenue and €262.9 million earnings by 2028.

Uncover how Sportradar Group's forecasts yield a $32.92 fair value, a 47% upside to its current price.

Exploring Other Perspectives

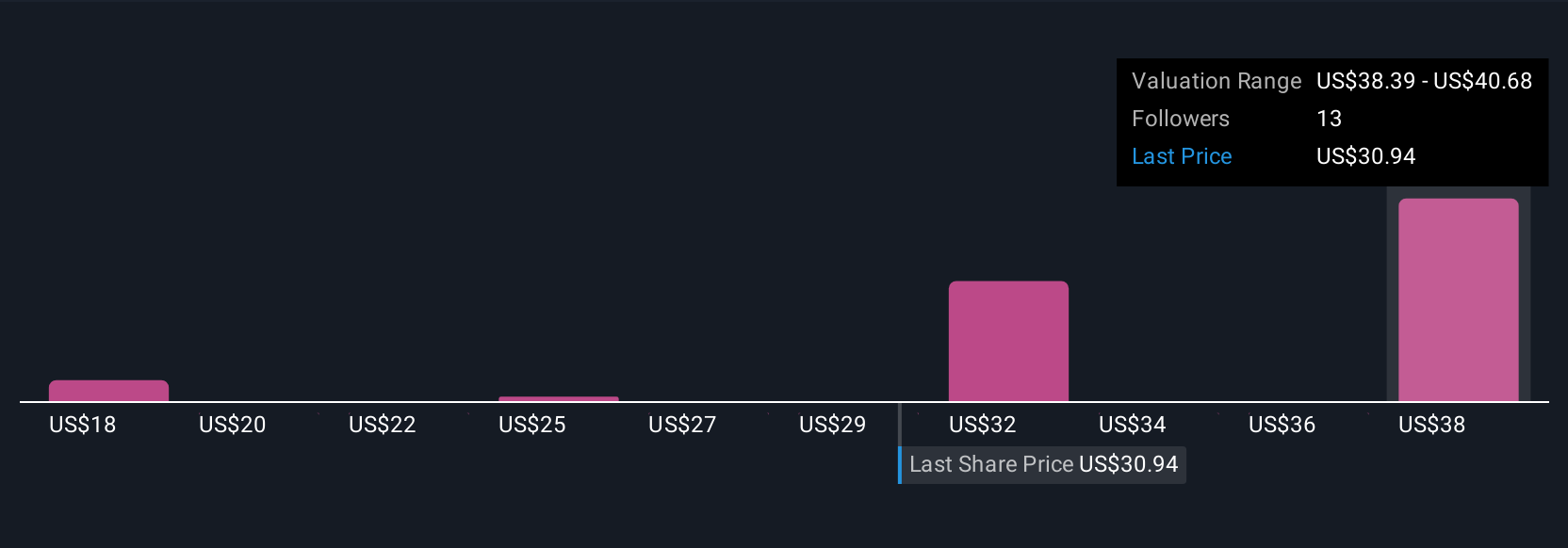

Four members of the Simply Wall St Community currently estimate Sportradar’s fair value between US$17.81 and US$45.83, showing a wide span of opinion. Against that, concerns about reliance on clients in loosely regulated markets raise important questions about how durable today’s reported growth and margins will be if regulatory scrutiny rises, so it is worth reviewing several different viewpoints before forming your own view on the company’s prospects.

Explore 4 other fair value estimates on Sportradar Group - why the stock might be worth 21% less than the current price!

Build Your Own Sportradar Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sportradar Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sportradar Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sportradar Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026