- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Why Starbucks Corporation (NASDAQ:SBUX) has Limited Avenues for Growth

After Starbucks Corporation ( NASDAQ:SBUX ) announced that Howard Schultz will become interim CEO, investors started wondering if there is a new potential upside under new management. We will explore these possibilities and also analyze the fundamental standing of the stock.

Business Overview

The CEO that is now stepping down, Mr. Johnson, expanded the company on a global scale, now serving 84 markets, and introduced the "charity premium", which is built into the price and tells consumers to which causes they are donating by buying a Starbucks.

Starbucks' business model enables people to enjoy an environment where they can meet, collaborate, work, along a variety of standardized coffee-centered drinks. While it may seem simple on the outside, the construction of the business is smart and internally consistent.

Some engineering examples:

- The prices are higher, which selects for a higher clientele class.

- The coffee includes the mentioned charity premium, which gives clients a rationalization to buy at a higher price. Some people argue that morality beats the checkbook, and if people have a reason, they won't mind the premium.

- Longer stays are accepted within Starbucks culture. While in "standard" cafés you are expected to finish your drink and go, in Starbucks there is no rush, and your time spent is included in the price of the drink. This also makes it acceptable for people to spend solo time at Starbucks while not feeling alone. The company capitalizes on the fact that the space is full and can raise prices to be even more selective for clients.

- The client selection process attracts people that want to signal that they are "worthy" of a Starbucks and accept the price. This makes Starbucks a status symbol for people (especially younger demographics that are still developing their sense of the value of money), further driving up value.

- The space is designed by professionals and has a distinctive look. Everything is meant to be eye candy, even the baristas, which are selected to reflect the clients.

Future Growth

Now let's talk about growth. We will first look at analyst estimates and past performance in order to get a picture of where the company can go.

View our latest analysis for Starbucks

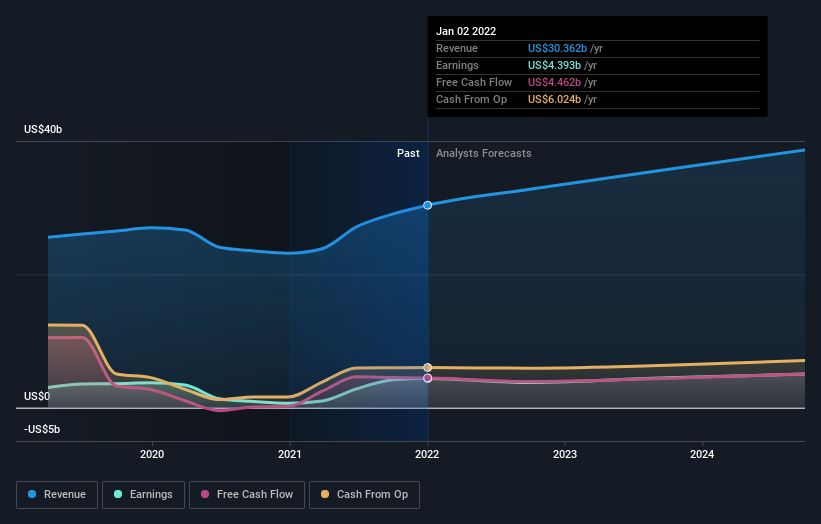

NasdaqGS:SBUX Earnings and Revenue Growth March 24th 2022

As we can see, the company recovered and analysts forecast that it will continue on a steady growth trajectory. This is expected from a large cap stock. However, the question becomes, "if there are any new viable avenues of growth?" Starbucks has already expanded in its target markets, and the company seems to be utilizing a "scalpel" - precision approach regarding where it wants to target new locations. This poses some future limitations, as the premium market may be close to saturation.

Efficiency Growth

Starbucks may opt for more efficiency growth, which means to dive into details, optimize costs and spend some CapEx in order to implement systems that integrate and drive a more efficient workflow. The company may be in an appropriate part of its lifecycle to focus on optimizing the bottom line. This however, also has some constraints. First, an efficiency growth provides a substantial, but one-time boost to the bottom line - this means that investors that catch this train before it sets off, will be the ones that benefit. Efficiency growth is both about adopting cutting edge practices and executing them well - A CRM can be more of an operating expense with a lackluster implementation.

Product Portfolio

Starbucks also licenses and sells coffee under other brands, such as: Teavana, Seattle’s Best Coffee, Evolution Fresh, Ethos, Starbucks Reserve and Princi. They collaborate with Nestlé S.A. ( OTCPK:NSRG.F ) on their "Global Coffee Alliance" from which they offer a variety of tea and coffee products. The company has a chance to drive growth if it discovers different categories of audience to which they can cater to and develop or acquire brands for them. This makes acquisitions a viable option, but more for distribution chains than cafés.

Expansion at Risk

Where investors once saw opportunity, may now start becoming assets at risk. Starbucks aggressively expanded into China over the years and has built up a strong presence there. The company-operated stores in China rose from 4.7k to 5.4k from 2020 to 2021 - a 14.9% increase. While these investments made business sense, the current geopolitical landscape is gradually creating new economic blocks in the world , and their effects may increase in the future. This is one of those issues that can become a "real problem", so analysts opt not to take it into consideration in this phase. For reference, Starbucks has a total of 17k company-operated, and 16.7k licensed stores worldwide.

Bottom Up Integration

The company is primarily a packager and distributor of goods, meaning it buys the coffee from agricultural producers, which it indirectly supports with the "charity premiums" on its coffee. With the current raise in inflation, the value of money decreases, but the value of land-property arguably stays the same in real terms, or may even increase if commodities become more scarce . One way the company might consider improving margins is to become a partial or direct producer of the raw material. This would bring more complexity and increase the country exposure risk for the business, but embracing hard problems like this is a way to drive growth for the large cap corporation. The company already has some farmer support centers that help ensure quality, yield, and these can be slowly transformed into operating centers where viable.

A Notable Risk

While assessing growth potential, we must also mention the forces that might push growth down. Currently, Starbucks is faced with the challenge of balancing out product pricing, by the need to drive up prices, just enough to keep margins but hopefully not over the edge that loses too many clients. Part of the business is highly discretionary, and is the most exposed to inflationary pressures, as consumers start substituting the product with cheaper alternatives. This may pose a substantial, but temporary problem for Starbucks, as the company will have a chance to optimize operations, cut underperforming stores and make room to grow for the future.

Conclusion

It may be a more bumpy ride than analysts anticipate for Starbucks, however the company has significant potential for long-term improvement.

Inflation and the up-front cost for future projects may play out first, which can be good for traders, however investors may need to be a lot more patient before they get significant returns.

While the interim CEO is the founder and highly qualified to run the business, he may find himself a bit limited on the routes he can take to sustain the company and increase shareholder value.

Currently, the company seems to be trading just below intrinsic value , but that might reflect the fact that the market is uncertain on the near-term future for Starbucks.

If you're looking to trade Starbucks, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives