- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Starbucks (NASDAQ:SBUX) Is now Trading at a Reasonable Price Relative to Growth Forecasts

Shares of Starbucks Corporation ( NASDAQ:SBUX ) came under pressure on Friday after the company announced fourth quarter and full year financial results. While investors were disappointed with the results, the lower price means the stock is now more reasonably valued and there is less downside risk. The recovery in earnings has also brought the price-to-earnings ratio back to the long term average.

Key points from the result and earnings call:

- Quarterly EPS up 96% year on year to $1.00, in line with consensus.

- Revenue up 31.5% year on year to $8.15 billion, $70 million lower than consensus estimates.

- Global comparable store sales up 17% year on year, 2% lower than estimates.

- China comparable store sales down 7% year on year, slightly better than expected.

- 2022 Full year revenue expected to be between $32.5 and $33 billion, 12 to 13% higher than 2021

- 2022 Full year EPS expected to be up at least 10%

- Share buyback plan reinstituted, with $20 billion in share repurchases planned for next three years.

The weaker revenue number was impacted by both US and China same store sales, but the impact in China has been widely anticipated since Yum China ( NYSE:YUMC ) warned third quarter profits would fall as a result of Covid-19 Delta restrictions.

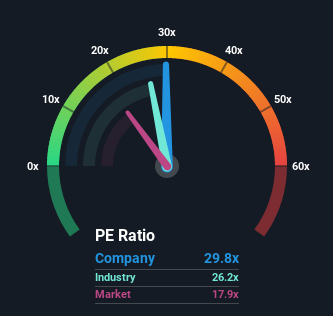

Starbucks’ P/E ratio

In September we pointed out that the stock’s high price-to-earnings ratio meant the stock price may be at risk if fourth quarter results disappointed . Now that the stock price is lower, and the weakest quarters of 2020 are no longer included in the trailing 12-month period, the P/E ratio is falling back to the long term average.

Ahead of these results, Starbuck’s price-to-earnings (or "P/E") ratio was 47.2x based on trailing 12-month earnings to June. Now that 4th quarter earnings have been released, trailing 12-month EPS have risen from $2.40 to $3.54, and the P/E ratio is now 29.8.

View our latest analysis for Starbucks

Keen to find out how analysts think Starbucks' future stacks up against the industry? In that case, our free report is a great place to start .

Is There Enough Growth For Starbucks?

2020 was understandably a tough year for companies like Starbucks, and also set a very low base for 12-month growth rates. The result was that full year revenue has increased by 26% and net income has increased by 350% year-on-year.

To give the current valuation more context we can compare the company to where it was two years ago. Back in September 2019, the price-to-earnings ratio and price-to-sales ratios were 29.5x and 4x respectively - pretty much where they are now.

| 2018-2019 Growth | 2019-2021 Growth | 2021-2022 Growth | |

| (12 months) | (24 months) | (12 month est.) | |

| Revenue: | 7.2% | 9.6% | 12.7% |

| EPS: | -9.9% | 21.2% | 10% |

Despite the weak performance in 2020, the company has still managed to grow revenue and EPS by 9.6% and 21.2% respectively over the last two years. If the company delivers on its guidance, revenue growth will be higher than normal, while EPS will grow at a more modest 10%. The company has emphasised that 2022 will be an investment year, so the modest EPS growth is to be expected. But the increased spedning may set the company up for higher earnings growth beyond 2022.

Weighing up the Valuation and Growth Prospects

The current P/E ratio is in line with Starbucks’ long term average of 29.5x. The market has a P/E ratio of 17.8x, so Starbucks’ valuation still implies it is expected to grow earnings faster than the market over the next few years.

Our estimate of the intrinsic value also suggests the stock is now fairly valued - more on that here . This estimate is based on analyst forecasts which may be changed as analysts adjust their models, so you may want to check back here in a few days time.

Although Starbucks now appears to be reasonably valued, the path ahead may depend on how expectations for 2023 and 2024 change through the course of next year. Lower earnings growth in 2022 could weigh on sentiment, but the market may look past that if it appears growth will accelerate more than expected in the following years.

This article only touches on the current valuation and growth expectations for Starbucks. If you are interested in understanding the company at a deeper level, take a look at our full analysis which includes some of the other factors to consider.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives