- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Short-Term Headwinds may Give Investors an Opportunity in Starbucks (NASDAQ:SBUX)

Summary:

- Earnings are expected to decline over the next year, but the company is expected to have a steady recovery after that.

- The current PE is above the industry average, indicating that investors may be taking on extra risk.

- The dividend yield is reaching annual highs, but the stock may not have bottomed yet.

Starbucks Corporation (NASDAQ:SBUX) is a $91b market cap company with $4.4b earnings in the last 12 months. The company is recovering from the pandemic, and the change in leadership has investors wondering if there is room to expand in the future. In this analysis, we will review the pricing and fundamental expectations of Starbucks.

The fundamentals show that the company has a good history of positive earnings, with a consistent profit margin of 10%+ in the last 5 years, excluding the pandemic. The free cash flows are an important component of the fundamentals, and Starbucks has managed to keep them close to the value of company earnings. However, in the last 12 months, the company's free cash flows came-in below earnings, at $3.6b. This is in essence how investors get their dividend return and how the company funds future growth projects, so it is important to see free cash flows closely trailing earnings.

As a stable company, some investors are considering Starbucks for its dividend. The company has a history of continuously increasing its dividend per share, and the yield has historically ranged between 1.1% to 2.5%. In fact, the current dividend yield of around 2.5% reached a rare high in the last 10 years.

Besides the current snapshots, investors need to know the future estimated growth rates when considering a company like Starbucks.

Future Estimates

A good way to gauge future expectations for a company is to turn to analysts' estimates for the top and bottom line. We can take the average values of these estimates and form a better picture of the possible future outcomes for the company. The chart below, illustrates how the company's key income metrics might look in the next 3 years:

See our latest analysis for Starbucks

The latest updated numbers for analysts estimates came in on the first of June, so we can still consider them to be fresh, as no major events have impacted the company since then. The latest event which investors are pricing-in for Starbucks is the possible impact of labor union negotiations, but it may be too soon to know how that will turn out in the income statement.

Looking at the future estimates, it seems that analysts are anticipating a 3% increase in revenues, and a decline of earnings to $3.244b on a trailing twelve-month basis ending in Q3 2022.

Now that we have the fundamental estimates, we can make some judgements on the current pricing of the stock.

Starbucks Pricing Analysis

In this segment, we will tackle pricing with three approaches: analyst price targets, the price to earnings ratio vs peers, and the forward price to earnings ratio.

Price Target

Analyst targets are a great reference that tells us how far a stock is from the current PE ratio, as well as relative and forward ratios. Starbucks current price target is set at $92.5, implying a 17.7% upside in the next 12 months.

Relative PE

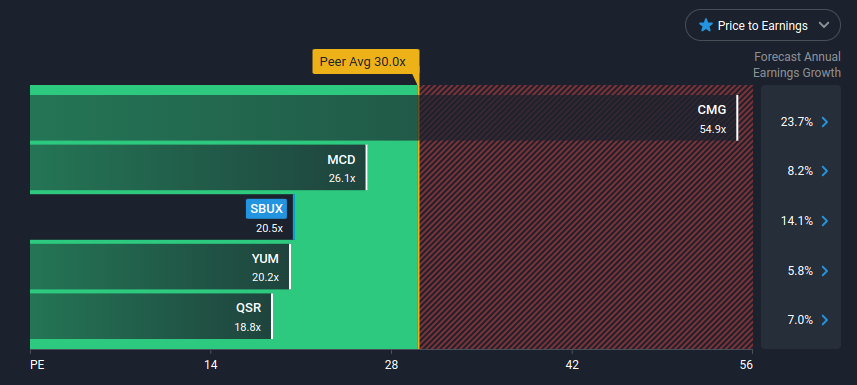

Starbucks has a trailing PE ratio of 20.5x, meaning that investors are paying $20.5 for every $1 of earnings. Some investors like to think of this as the amount of years needed (20) to double an investment, but that is only a rough estimate. While PE ratios change based on the expectations of growth (increase) and the estimates of market risk, investors can compare a stock's PE with that of peers in a way to gauge an industry's average risk appetite. For example, if we take Starbucks' PE of 20.5 and multiply by 1+the expected earnings growth rate, we get a value of 23.4. When we do the same for McDonald's (NYSE:MCD) we get a value of 28. This way, while accounting for growth, we find that the market is willing to buy more risk from MCD, than from SBUX. Investors can use this analysis to make judgements if the additional risk is justified or if a competitor is over or underexposed to risk.

The chart below shows us the relative PE position of Starbucks and key competitors. We can see that the company seems to be below the middle of the pack, implying less risk but also less growth opportunities.

The peer average PE is 30x, while the industry average is lower at 15.9x. Looking at it this way, we might find that the stock is some 30% overpriced.

Forward PE

When we use analysts' projections to get what investors are paying for future earnings, we get a forward PE of 25.3x. This may not be good as the PE is now even further than the industry averages. Given that analysts expect earnings to decline over the next year, we may find that the stock is a bit more exposed to downside risk. Higher PE companies may be appropriate for growing companies, but for stable companies like Starbucks it may just be an indicator of extra risk.

Conclusion

Our analysis shows that while Starbucks has stable fundamentals, and positive future estimates, the stock may be bearing extra risk in the short-term. The earnings are expected to dip in the next period, but the company is expected to recover and grow after that. Investors that believe in the long-term potential of the company, may look for an opportunity around a possible drop in the next few earnings announcements. Putting the stock on a watchlist can help you get notified on significant changes or a target price.

And what about risks? Every company has them, and we've spotted 3 warning signs for Starbucks (of which 2 shouldn't be ignored!) you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives