- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

A Look at Starbucks (SBUX) Valuation Following Major Store Closures, Workforce Cuts, and Dividend Adjustment

Reviewed by Kshitija Bhandaru

Starbucks (SBUX) kicked off the week by announcing a major $1 billion restructuring that includes closing 1% of stores across North America and reducing its corporate workforce by about 900 roles. Alongside these operational changes, the company approved a slight increase to its quarterly dividend, signaling a recalibrated focus on both capital allocation and core store performance.

See our latest analysis for Starbucks.

Starbucks shares briefly jumped on news of the restructuring and dividend hike, but that momentum faded as the reality of persistent challenges sank in. The total shareholder return over the past year stands at -8.2%, reflecting ongoing pressure on both growth expectations and sentiment. Although the company’s multi-year returns remain positive thanks to earlier expansion, challenges persist.

If this kind of strategic overhaul has you wondering what else is unfolding across the market, this could be an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with the stock down over 8% in the past year and trading about 13% below analyst price targets, the question is whether Starbucks now represents an undervalued opportunity for investors, or if the market is already anticipating stalled growth.

Most Popular Narrative: 13% Undervalued

With Starbucks closing at $86.42 and the most popular narrative setting fair value at $99.38, the market may be overlooking key drivers supporting a higher price target. Fresh initiatives and shifting profit expectations are creative forces shaping the way this number is calculated.

The Back to Starbucks strategy aims to improve partner engagement and reduce turnover. These efforts are expected to enhance the customer experience and drive higher quality transactions, which could potentially increase revenue and net margins. Plans to reestablish Starbucks as a third place by evolving coffee house designs and expanding in attractive growth markets may result in increased customer visits and improved unit economics, further boosting revenue.

Want to know what powers the bold price set by consensus? This narrative is built on a combination of revitalized operations, a proven global playbook, and ambitious optimism for revenue and margin expansion. Curious how those drivers translate into concrete numbers? Explore the assumptions that could change how you value Starbucks.

Result: Fair Value of $99.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower comparable sales growth and persistent margin pressures could outweigh the benefits of new strategies. This highlights key risks for Starbucks’ bullish narrative.

Find out about the key risks to this Starbucks narrative.

Another View: Is Starbucks Really a Bargain?

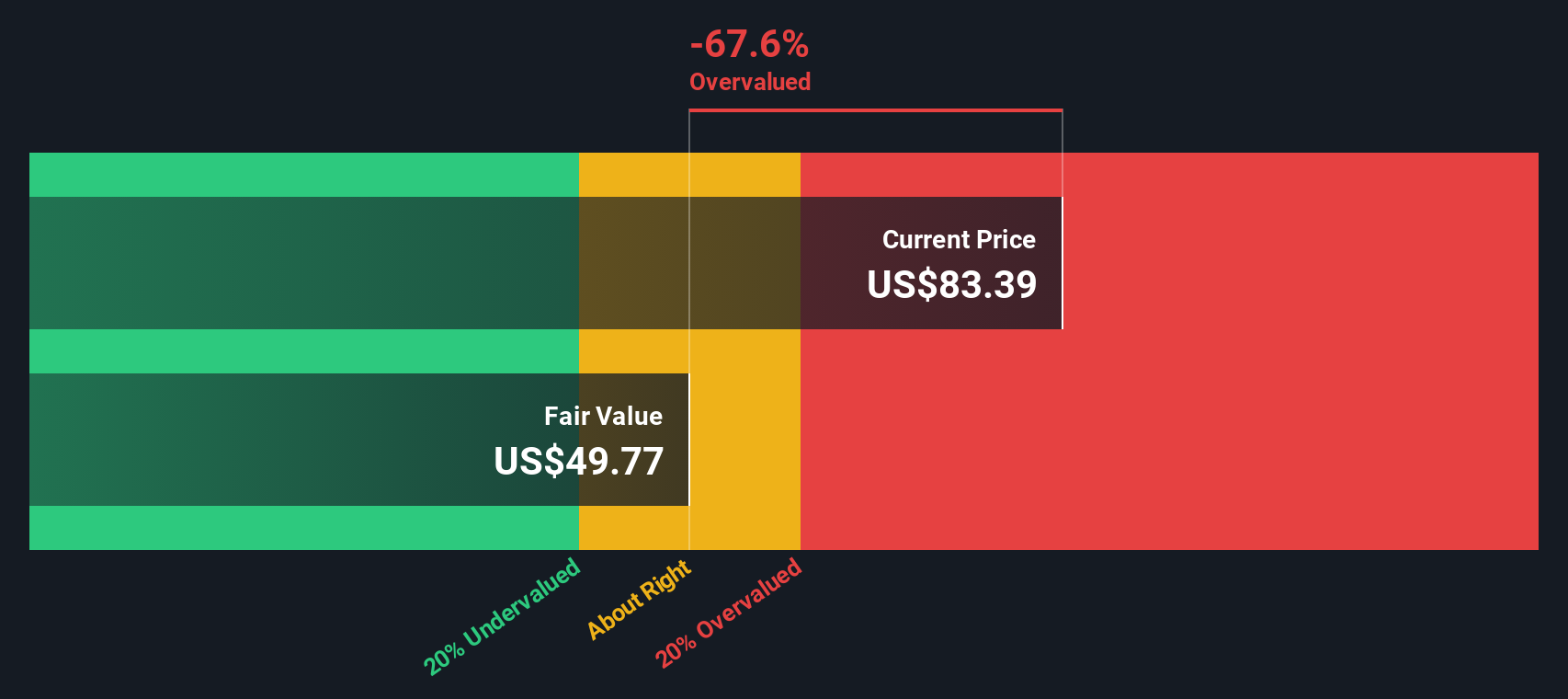

Looking through our DCF model, the outlook is less optimistic. Starbucks is currently trading above our calculated fair value of $50.38. This suggests that the shares may be overvalued, despite what consensus targets say. Could the market be pricing in more risk than the headline numbers reveal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Starbucks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Starbucks Narrative

If you want to challenge these conclusions or prefer the hands-on approach, it takes just a few minutes to assemble your own view using the available data: Do it your way

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Active investors never wait on the sidelines. Your next smart move could be one click away. Get ahead by checking out high-potential stocks spotlighted right now by our screeners.

- Boost your income strategy and check out these 19 dividend stocks with yields > 3% offering solid payouts and reliable returns in today’s yield-hungry market.

- Seize the future by targeting these 26 quantum computing stocks that are unlocking powerful breakthroughs at the edge of computing and security.

- Catch the tailwind of next-generation healthcare with these 32 healthcare AI stocks transforming diagnostics, patient care, and medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives