- United States

- /

- Hospitality

- /

- NasdaqGS:RUTH

Ruth's Hospitality Group (NASDAQ:RUTH) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Ruth's Hospitality Group, Inc. (NASDAQ:RUTH) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ruth's Hospitality Group

What Is Ruth's Hospitality Group's Debt?

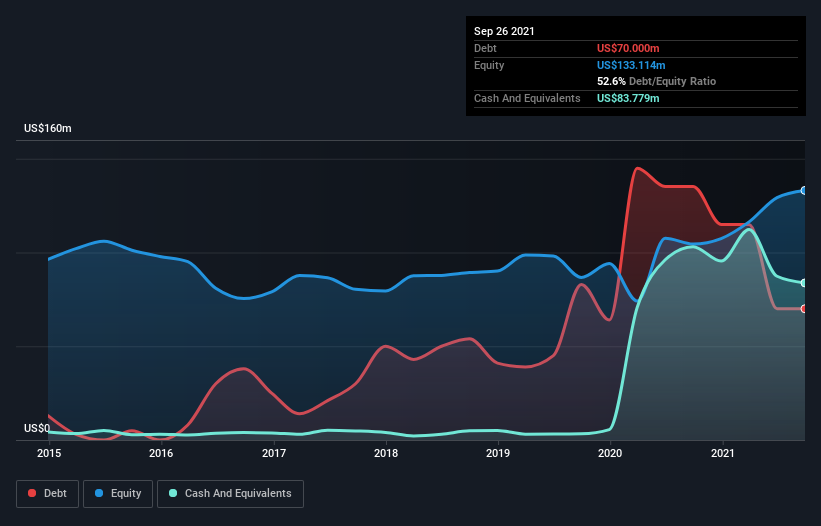

You can click the graphic below for the historical numbers, but it shows that Ruth's Hospitality Group had US$70.0m of debt in September 2021, down from US$135.2m, one year before. However, its balance sheet shows it holds US$83.8m in cash, so it actually has US$13.8m net cash.

How Healthy Is Ruth's Hospitality Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ruth's Hospitality Group had liabilities of US$106.6m due within 12 months and liabilities of US$261.6m due beyond that. On the other hand, it had cash of US$83.8m and US$16.8m worth of receivables due within a year. So its liabilities total US$267.6m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Ruth's Hospitality Group is worth US$683.9m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Ruth's Hospitality Group boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Ruth's Hospitality Group grew its EBIT by 2,270% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ruth's Hospitality Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Ruth's Hospitality Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Ruth's Hospitality Group actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While Ruth's Hospitality Group does have more liabilities than liquid assets, it also has net cash of US$13.8m. And it impressed us with free cash flow of US$53m, being 122% of its EBIT. So is Ruth's Hospitality Group's debt a risk? It doesn't seem so to us. Another factor that would give us confidence in Ruth's Hospitality Group would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RUTH

Ruth's Hospitality Group

Ruth's Hospitality Group, Inc., together with its subsidiaries, develops, operates, and franchises fine dining restaurants under the Ruth’s Chris Steak House name.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives