- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

We Think Red Rock Resorts (NASDAQ:RRR) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Red Rock Resorts, Inc. (NASDAQ:RRR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Red Rock Resorts

What Is Red Rock Resorts's Net Debt?

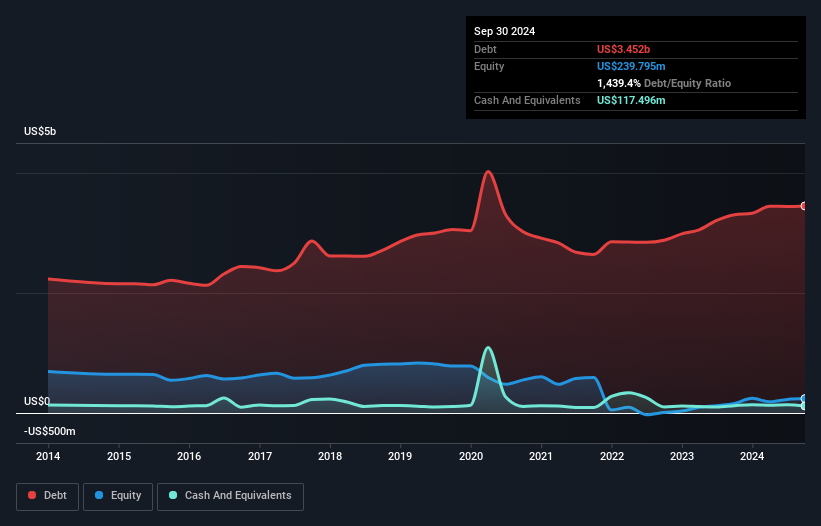

As you can see below, at the end of September 2024, Red Rock Resorts had US$3.45b of debt, up from US$3.31b a year ago. Click the image for more detail. On the flip side, it has US$117.5m in cash leading to net debt of about US$3.33b.

How Healthy Is Red Rock Resorts' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Red Rock Resorts had liabilities of US$261.2m due within 12 months and liabilities of US$3.49b due beyond that. On the other hand, it had cash of US$117.5m and US$69.4m worth of receivables due within a year. So its liabilities total US$3.57b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$5.24b, so it does suggest shareholders should keep an eye on Red Rock Resorts' use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Red Rock Resorts has a debt to EBITDA ratio of 4.4 and its EBIT covered its interest expense 2.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Red Rock Resorts's EBIT was pretty flat over the last year, which isn't ideal given the debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Red Rock Resorts can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Red Rock Resorts reported free cash flow worth 13% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both Red Rock Resorts's net debt to EBITDA and its track record of covering its interest expense with its EBIT make us rather uncomfortable with its debt levels. But at least its EBIT growth rate is not so bad. Overall, we think it's fair to say that Red Rock Resorts has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Red Rock Resorts is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.