- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Papa John’s (PZZA): Evaluating Valuation After Recent Decline in Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Papa John's International.

Papa John's recent share price weakness reflects fading momentum, with a 1-month share price return of -17.5% as investors weigh growth prospects against shifting risks. Over the past year, the 12.4% total shareholder return highlights the stock's broader challenges despite steady business fundamentals.

If you're looking to expand your investing radar beyond familiar names, now’s a great moment to discover fast growing stocks with high insider ownership

Following the recent pullback and with shares currently trading at a notable discount to analyst targets, is Papa John’s an undervalued opportunity? Or has the market accurately priced in the company's future growth prospects?

Most Popular Narrative: 20% Undervalued

With Papa John's International's most popular narrative suggesting a fair value of $52.10 versus the latest close of $41.59, the stock trades at a marked discount. This valuation invites attention to the major catalysts shaping the business outlook right now.

Papa John's strategic focus on product innovation and enhancing the menu with new offerings is expected to boost revenue growth by increasing customer engagement and driving higher ticket sales. The investment of up to $25 million in marketing, including CRM capabilities and the Papa Rewards loyalty program, aims to drive greater customer loyalty and frequency, which should positively impact revenue.

Curious how bold product launches and aggressive marketing investments could transform this valuation outlook? Find out which financial targets, margin assumptions, and expansion bets anchor the strong fair value projection. Can Papa John’s deliver on these ambitious goals or is there a hidden twist in the numbers? See the full story inside.

Result: Fair Value of $52.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pressure on operating margins and lackluster sales growth in key regions could quickly jeopardize the bullish valuation outlook for Papa John’s.

Find out about the key risks to this Papa John's International narrative.

Another View: What Do Company Ratios Tell Us?

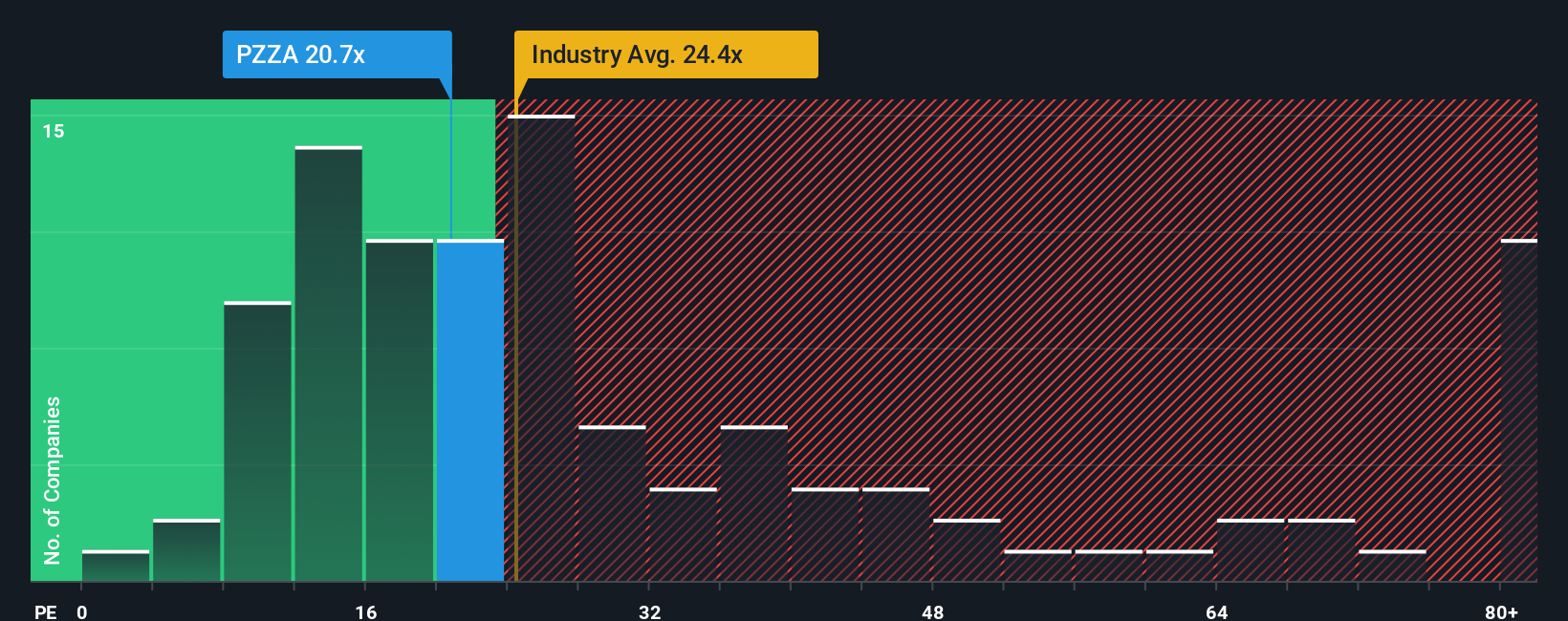

While analysts see upside based on future growth, comparing Papa John's price-to-earnings ratio of 18.2x to the industry average of 16x and a fair ratio of 15.5x implies the shares are not cheap by traditional standards. This gap suggests investors may be paying up for anticipated improvement. Could valuation risk outweigh the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Papa John's International Narrative

If you see the story differently or want to test your own assumptions, you can explore the data and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Papa John's International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want real opportunities on your radar, don't miss these smart stock picks handpicked by Simply Wall St’s Screener. The next big move could be just a click away.

- Uncover generous income streams by getting started with these 19 dividend stocks with yields > 3% and find companies offering market-beating dividend yields.

- Catch game-changing trends shaping the global economy by scanning these 897 undervalued stocks based on cash flows with solid potential, all trading at attractive valuations right now.

- Experience the innovation boom and spot tomorrow's tech leaders through these 25 AI penny stocks, where advanced artificial intelligence is at the heart of rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026