- United States

- /

- Hospitality

- /

- NasdaqGS:PLAY

If EPS Growth Is Important To You, Dave & Buster's Entertainment (NASDAQ:PLAY) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Dave & Buster's Entertainment (NASDAQ:PLAY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Dave & Buster's Entertainment

How Fast Is Dave & Buster's Entertainment Growing Its Earnings Per Share?

Dave & Buster's Entertainment has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Dave & Buster's Entertainment boosted its trailing twelve month EPS from US$2.55 to US$3.03, in the last year. There's little doubt shareholders would be happy with that 19% gain. EPS has grown further thank to a share buyback. A great indicator of a healthy balance sheet.

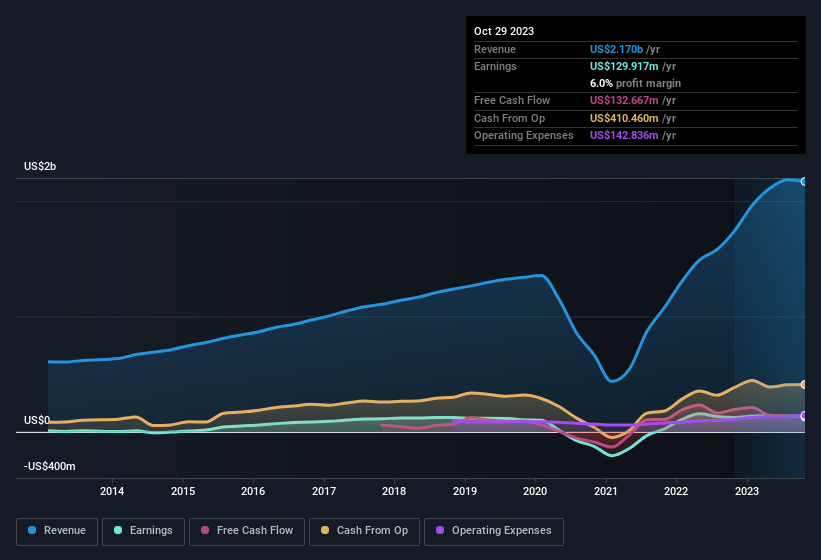

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Dave & Buster's Entertainment remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to US$2.2b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Dave & Buster's Entertainment's future EPS 100% free.

Are Dave & Buster's Entertainment Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The US$228k worth of shares that insiders sold during the last 12 months pales in comparison to the US$1.2m they spent on acquiring shares in the company. This adds to the interest in Dave & Buster's Entertainment because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Senior VP and Chief Technology & Information Officer Steven Klohn for US$503k worth of shares, at about US$35.22 per share.

The good news, alongside the insider buying, for Dave & Buster's Entertainment bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$60m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Should You Add Dave & Buster's Entertainment To Your Watchlist?

As previously touched on, Dave & Buster's Entertainment is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Dave & Buster's Entertainment (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

The good news is that Dave & Buster's Entertainment is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLAY

Dave & Buster's Entertainment

Owns and operates entertainment and dining venues for adults and families in North America.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives