- United States

- /

- Hospitality

- /

- NasdaqGS:PBPB

There's No Escaping Potbelly Corporation's (NASDAQ:PBPB) Muted Revenues

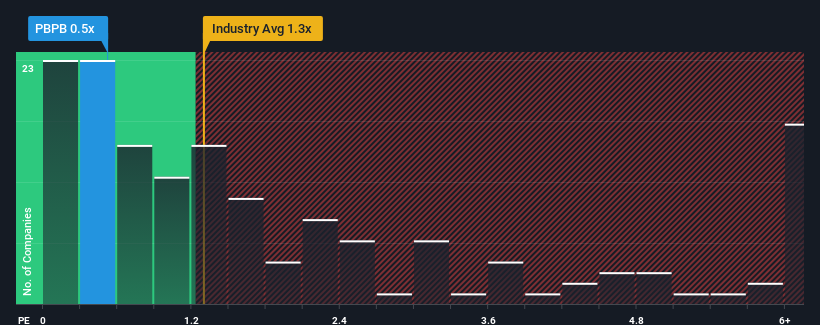

Potbelly Corporation's (NASDAQ:PBPB) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Hospitality industry in the United States have P/S ratios greater than 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Potbelly

How Has Potbelly Performed Recently?

Recent times haven't been great for Potbelly as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Potbelly's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Potbelly?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Potbelly's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The strong recent performance means it was also able to grow revenue by 38% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 1.6% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 14% each year, which paints a poor picture.

With this information, we are not surprised that Potbelly is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Potbelly's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Potbelly's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Potbelly's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Potbelly (1 is potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Potbelly's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PBPB

Potbelly

Through its subsidiaries, owns, operates, and franchises Potbelly sandwich shops in the United States.

Solid track record and fair value.