- United States

- /

- Hospitality

- /

- NasdaqGS:NAVN

Assessing Navan (NAVN) Valuation After A Sharp Multi‑Week Share Price Pullback

What recent returns suggest about Navan’s profile

Navan (NAVN) has drawn attention after a sharp share price pullback, with the stock down about 9% over the past day, 21% over the past week, and roughly 41% over the past month.

Over the past 3 months, the decline sits near 44%, while the year-to-date move is about 38% lower, putting the current share price around US$10.02 and prompting closer scrutiny of the company’s fundamentals.

See our latest analysis for Navan.

Put simply, Navan’s recent slide, including the 41.1% 30 day share price return and 38.4% year to date share price return, points to fading momentum as investors reassess growth prospects and risk around its AI powered travel and expense platform.

If this kind of sharp pullback has you looking around the market for other ideas, it could be a good moment to scan 33 AI infrastructure stocks as a fresh starting list of AI infrastructure names.

With Navan trading near US$10.02 and showing an intrinsic discount of about 32.6% plus a sizeable gap to the average analyst price target of US$24.17, is this a genuine entry point, or is future growth already priced in?

Most Popular Narrative: 60.1% Undervalued

Compared with Navan’s last close around $10.02, the most followed narrative points to a fair value close to $25.08, which is a big gap that rests on some ambitious business assumptions.

Accelerating shift of global enterprises away from fragmented, legacy travel and expense stacks toward unified, AI powered platforms positions Navan to keep taking share in a $185 billion market, supporting sustained double digit revenue growth and higher net revenue retention.

Curious what kind of revenue trajectory and margin reset could support that fair value, and why it implies a premium earnings multiple years from now? The full narrative sets out a detailed growth runway, margin swing and discount rate that together need to line up for that $25.08 figure to make sense.

Result: Fair Value of $25.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on business travel holding up and on Navan defending its AI edge, since weaker demand or stronger rivals could quickly challenge that upbeat scenario.

Find out about the key risks to this Navan narrative.

Another angle on Navan’s valuation

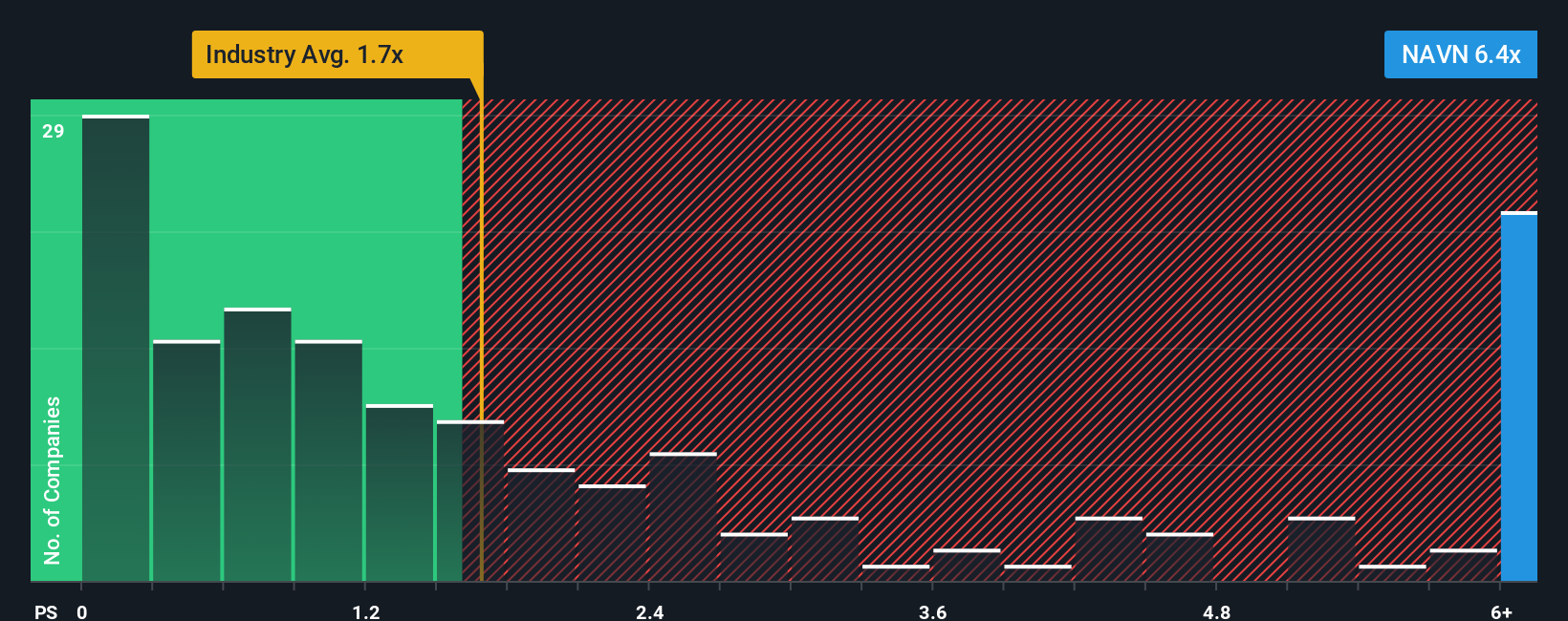

While the AI driven fair value narrative points to upside, the current P/S ratio of 3.8x is higher than both peers at 2.3x and the US Hospitality industry at 1.6x. That gap suggests the market is already paying up for Navan’s story, which raises the question of how much cushion remains if expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Navan Narrative

If you are not fully on board with this view or just prefer to weigh the numbers yourself, you can shape your own narrative in a few minutes: Do it your way

A great starting point for your Navan research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Navan has sharpened your focus, do not stop here. Broaden your watchlist now so you are not chasing ideas after they move.

- Spot potential value candidates early by running your eye over companies in our 55 high quality undervalued stocks and see which names stand out on price versus quality.

- Prioritise resilience by scanning the 81 resilient stocks with low risk scores for businesses with characteristics that may appeal if you want to limit downside surprises.

- Hunt for under the radar stories through the screener containing 25 high quality undiscovered gems, where you can source fresh ideas before they sit on everyone else’s list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVN

Navan

Operates an AI-powered software platform to simplify the travel and expense experience, benefiting users, customers, and suppliers.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion