- United States

- /

- Hospitality

- /

- NasdaqGS:MMYT

A Look at MakeMyTrip (NasdaqGS:MMYT) Valuation as Investors Await Earnings Report and Growth Forecasts

Reviewed by Kshitija Bhandaru

MakeMyTrip (NasdaqGS:MMYT) has lagged behind broader market gains in recent weeks. Investors are closely watching for the company’s upcoming earnings report, which is expected to show strong year-over-year growth in profit and revenue.

See our latest analysis for MakeMyTrip.

Despite anticipation for its upcoming earnings, MakeMyTrip’s share price has slipped lately, posting a 21% decline year-to-date and a 4% dip over the past month. While momentum has clearly faded in the short term, the bigger story is its outstanding long-run performance, with a total shareholder return of over 400% in the past five years.

If these shifts in sentiment have you rethinking your approach, it could be the perfect time to discover fast growing stocks with high insider ownership.

With earnings growth and revenue momentum on the horizon, is the recent pullback a sign that MakeMyTrip is undervalued? Or is the market already pricing in all the future upside?

Most Popular Narrative: 24.2% Undervalued

At $91.66 per share, MakeMyTrip sits well below the most widely followed narrative fair value estimate of $121, signaling a sharp disconnect in growth expectations versus current price. This sets the stage for a closer look at the assumptions powering analyst conviction about MakeMyTrip’s future runway.

Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage.

What is the engine behind that heady target? Maybe it is turbocharged revenue growth, fatter profit margins, or bold leaps in long-range earnings. Find out which game-changing projections shape this bullish story.

Result: Fair Value of $121 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from domestic and global online travel agents, as well as persistent high customer acquisition costs, could challenge MakeMyTrip’s ambitious growth outlook.

Find out about the key risks to this MakeMyTrip narrative.

Another View: Multiples Send a Different Signal

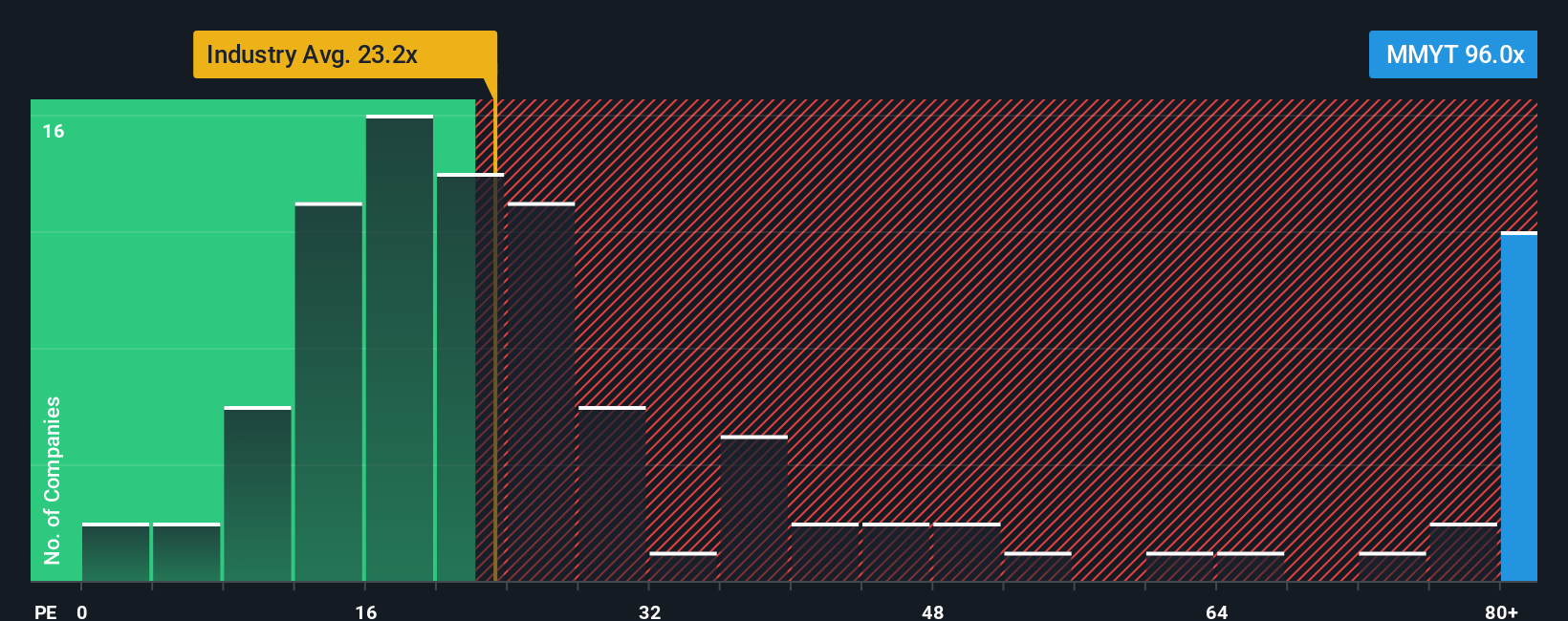

While the most popular model calls MakeMyTrip undervalued, a look at its price-to-earnings ratio tells a different story. At 87.2x, it is much higher than the US Hospitality industry average of 24.1x, the peer average of 21.2x, and the market’s fair ratio of 38.6x. This big gap raises questions about how much optimism is already priced in. Does it reflect a unique advantage, or signal valuation risk that could catch investors off guard?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If you have your own perspective or want to dig into the numbers yourself, you can craft a personal narrative for MakeMyTrip in just a few minutes, shaping the story your way. Do it your way.

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Push your portfolio further by tapping into fast-moving trends and emerging opportunities. Take the next step with these hand-picked ideas before others catch on.

- Maximize your income by pursuing potential returns above 3% with these 19 dividend stocks with yields > 3%, which features stable yields and solid fundamentals.

- Tap into the future of medicine and explore advances in diagnostics and healthcare innovation through these 33 healthcare AI stocks.

- Ride the digital frontier and discover new possibilities in blockchain and decentralized finance by starting with these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMYT

MakeMyTrip

Operates as a travel service provider in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, Cambodia, and Indonesia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives