- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Will Melco Resorts (MLCO) Balancing Healthcare Innovation and Debt Reshape Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, Melco Resorts & Entertainment unveiled the world's first integrated resort hospital with advanced MRI and CT facilities through a partnership with iRad Hospital at Studio City in Macau, supporting the region’s ongoing economic diversification efforts.

- This move marks a significant step in combining healthcare and tourism within the gaming sector, though ongoing concerns about Melco’s high debt and Macau’s regulatory outlook remain in sharp focus for investors.

- Now, we’ll explore how mounting investor concerns over Melco’s debt levels continue to shape its overall investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Melco Resorts & Entertainment's Investment Narrative?

Being a shareholder in Melco Resorts & Entertainment requires conviction in both Macau’s transformation into a diversified tourism and healthcare hub, and Melco’s ability to manage its considerable debt burden. The launch of the world’s first integrated resort hospital may help position Melco as a catalyst for medical tourism, a trend that aligns well with local government policy. However, the news has not changed the company’s most pressing near-term challenges, as investors’ concerns remain centered on high leverage, debt-related distress, and Macau’s shifting regulatory climate. Recent share price declines suggest the market views these risks as dominant, with uncertainty around whether the hospital can offset them in the short term. Until more evidence emerges that new ventures meaningfully affect profitability or cash flow, investor focus seems likely to remain on balance sheet strength and regulatory developments.

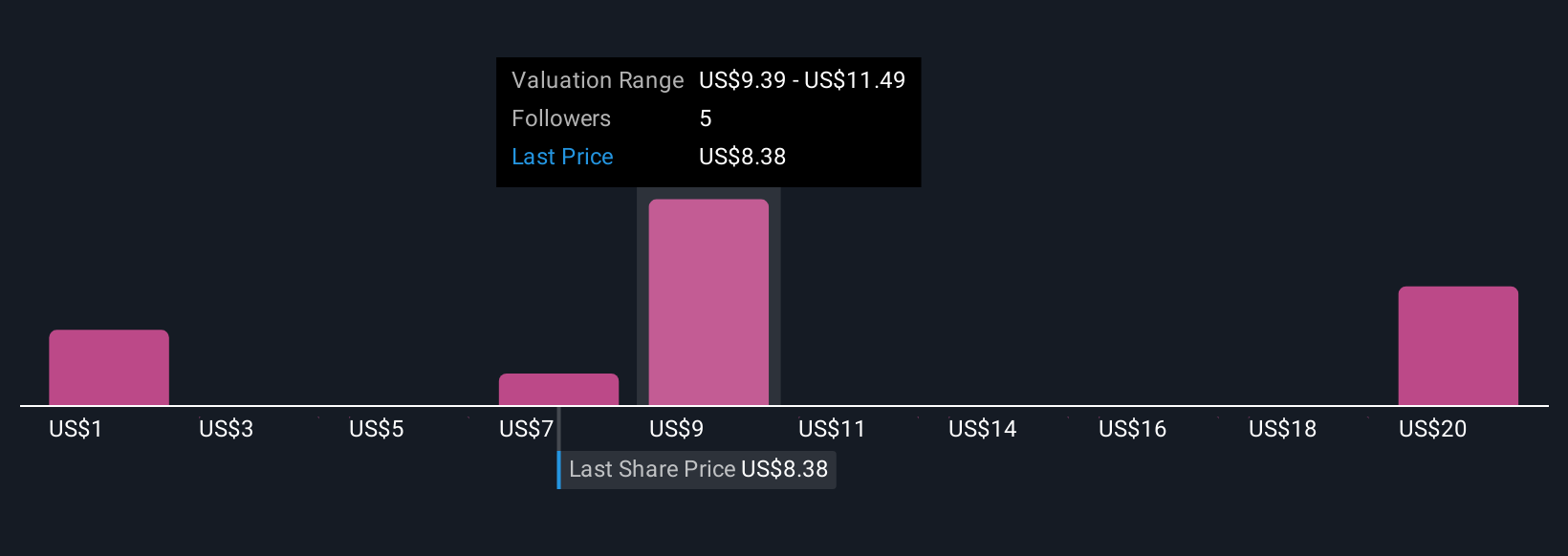

On the flip side, Melco's high debt still casts a long shadow for investors. Despite retreating, Melco Resorts & Entertainment's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Melco Resorts & Entertainment - why the stock might be worth less than half the current price!

Build Your Own Melco Resorts & Entertainment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Melco Resorts & Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Melco Resorts & Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Reasonable growth potential and fair value.

Market Insights

Community Narratives