- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Will Intensifying Macau Competition Reshape Melco Resorts & Entertainment’s (MLCO) Strategic Ambitions?

Reviewed by Sasha Jovanovic

- Melco Resorts & Entertainment reported a strong recovery in Q2 2025 with 25% year-over-year growth in adjusted property EBITDA and record Macau margins, while advancing property enhancements and new market entries including City of Dreams Sri Lanka.

- Despite this operational momentum, analysts highlighted concerns about weaker-than-expected gaming revenue, intensified competition, and global trade tensions, all influencing a cautious outlook for the company.

- We’ll explore how these mounting competitive pressures in the Macau market are shaping Melco’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Melco Resorts & Entertainment's Investment Narrative?

For someone considering Melco Resorts & Entertainment as an investment, the central narrative depends on confidence in Macau’s long-term potential as a premium gaming hub, Melco’s ability to drive high-margin performance, and disciplined expansion into new markets such as Sri Lanka. The recent Q2 update signals positive momentum, with group-wide adjusted property EBITDA up 25% year-over-year and Macau margins hitting record levels. However, the news also brings new weight to risks that were already surfacing: weaker-than-expected gaming revenues and intensified competition in Macau, fueling analyst caution and a stock price slide. These short-term headwinds may now play a bigger role than previously anticipated, especially given recent property closures and slower-than-hoped revenue growth. Operational momentum is present, but evolving market dynamics are making short-term catalysts like earnings growth and market share recovery more uncertain right now. On the other hand, renewed pressure from competitors could change the story quickly, investors will want to watch closely.

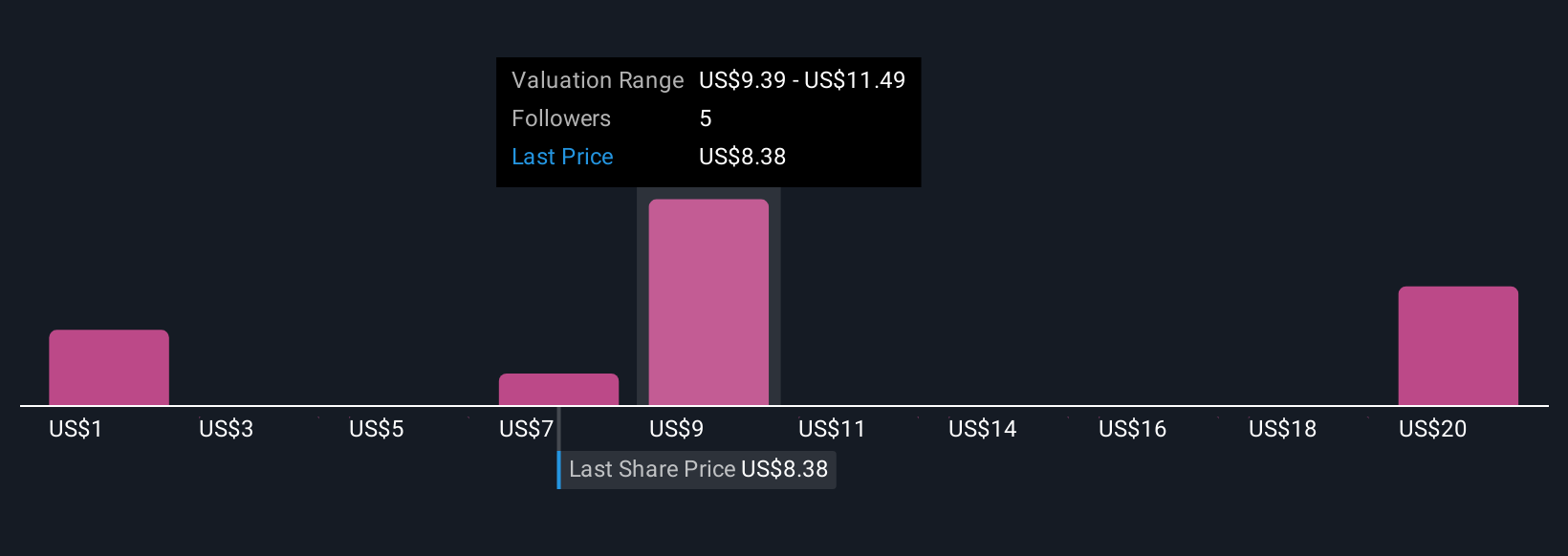

Despite retreating, Melco Resorts & Entertainment's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on Melco Resorts & Entertainment - why the stock might be worth over 2x more than the current price!

Build Your Own Melco Resorts & Entertainment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Melco Resorts & Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Melco Resorts & Entertainment's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Reasonable growth potential and fair value.

Market Insights

Community Narratives