- United States

- /

- Consumer Services

- /

- NasdaqGS:LOPE

Is Rising Analyst Optimism Shifting the Investment Narrative for Grand Canyon Education (LOPE)?

Reviewed by Simply Wall St

- Earlier in September 2025, Grand Canyon Education received an analyst upgrade to a Zacks Rank #1 (Strong Buy) following a consistent rise in earnings estimates by sell-side analysts.

- This upgrade reflects increasing analyst confidence in Grand Canyon Education’s operational discipline and suggests its management’s investment and cost control strategies are gaining recognition.

- We'll explore how this improved analyst outlook for future earnings could influence Grand Canyon Education’s investment narrative and growth assumptions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Grand Canyon Education Investment Narrative Recap

To be a Grand Canyon Education shareholder right now, you need to believe in the company's ability to harness the continued expansion of fully online programs and leverage scalable technology to drive consistent enrollment and margin gains, especially as traditional campus enrollments face demographic headwinds. The recent Zacks analyst upgrade, reflecting stronger earnings estimates, may support near-term confidence, yet it does not materially shift the fundamental catalyst, which remains the acceleration of online program adoption, or address the company's most significant risks tied to revenue-per-student pressures and changing student preferences.

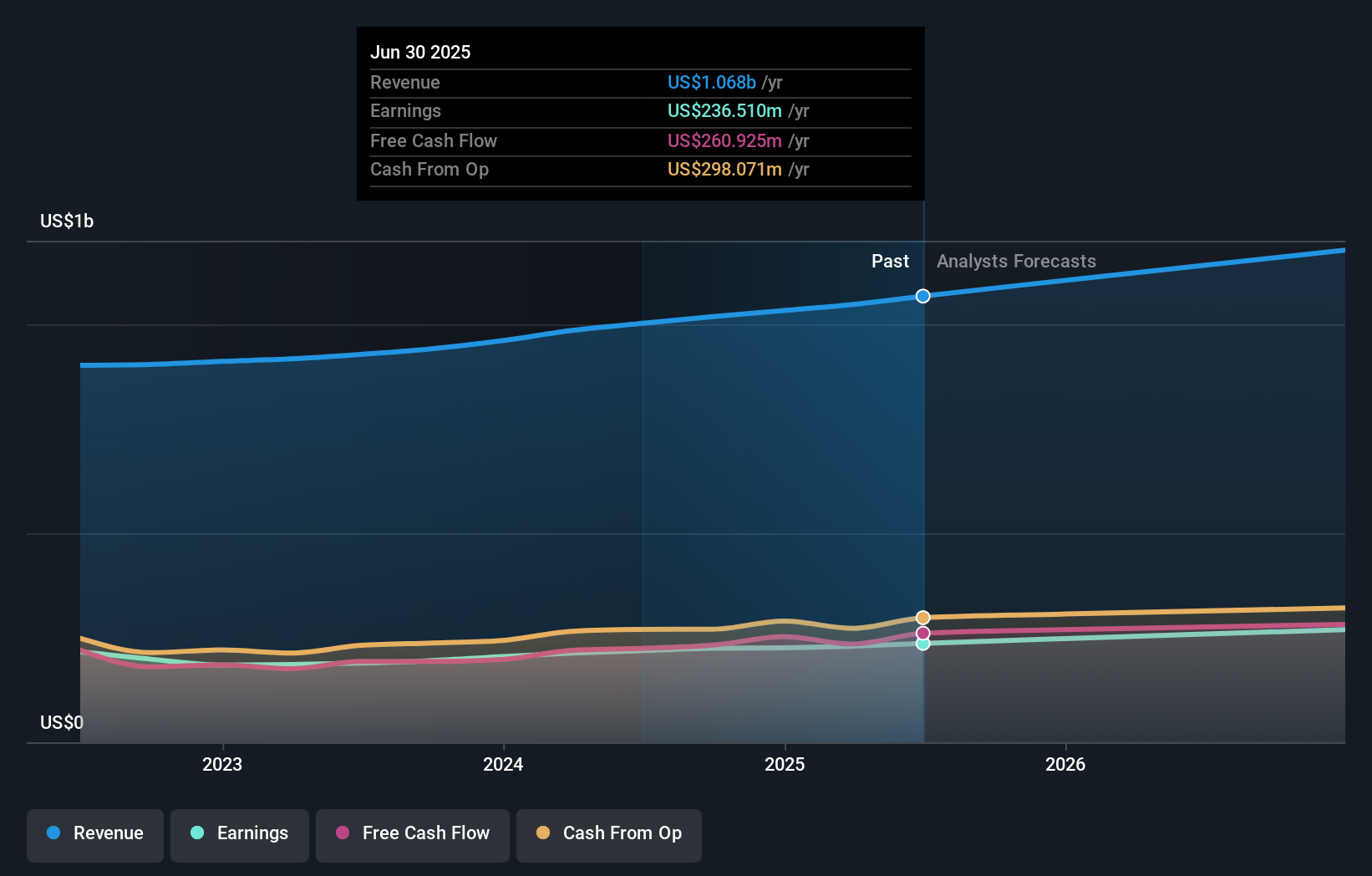

Among recent announcements, Grand Canyon Education’s Q2 2025 earnings results are particularly relevant, with both net income and EPS rising year-over-year. This earnings momentum, paired with analyst upgrades, directly underpins the current positive sentiment but does not negate longer-term concerns around enrollment shifts or evolving regulatory challenges.

In contrast, investors should also be aware that even as online programs grow, lower per-student revenue and persistent contract modifications could continue to weigh on future profitability if not addressed...

Read the full narrative on Grand Canyon Education (it's free!)

Grand Canyon Education's narrative projects $1.3 billion in revenue and $306.2 million in earnings by 2028. This requires 6.7% yearly revenue growth and a $69.7 million earnings increase from the current $236.5 million.

Uncover how Grand Canyon Education's forecasts yield a $222.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Community fair value targets for Grand Canyon Education range from US$222 to US$276, based on two individual investor perspectives from the Simply Wall St Community. Many participants are watching for how enrollment shifts and earnings growth rates will influence the company’s value in the coming quarters.

Explore 2 other fair value estimates on Grand Canyon Education - why the stock might be worth just $222.33!

Build Your Own Grand Canyon Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grand Canyon Education research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Grand Canyon Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grand Canyon Education's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOPE

Grand Canyon Education

Operates as an education services company in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives