- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

The 13% return this week takes Lindblad Expeditions Holdings' (NASDAQ:LIND) shareholders one-year gains to 40%

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Lindblad Expeditions Holdings, Inc. (NASDAQ:LIND) share price is up 40% in the last 1 year, clearly besting the market return of around 25% (not including dividends). So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 23% in three years.

Since the stock has added US$83m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Lindblad Expeditions Holdings

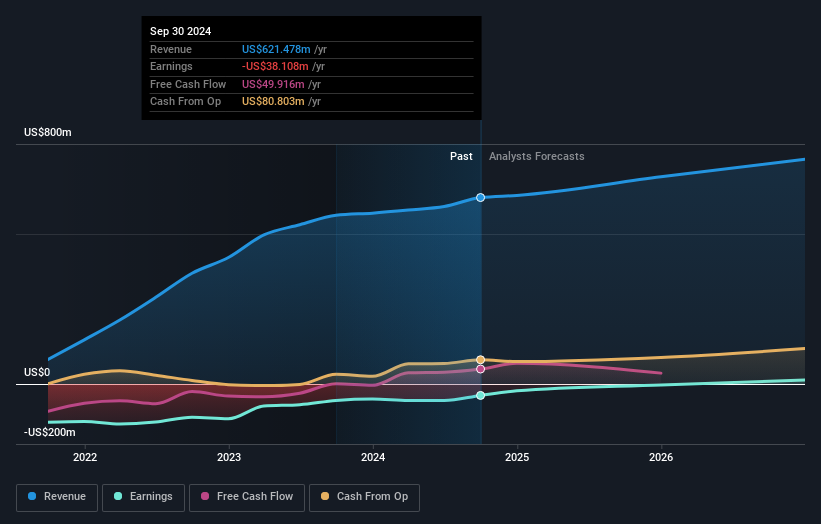

Given that Lindblad Expeditions Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Lindblad Expeditions Holdings saw its revenue grow by 11%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 40%. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Lindblad Expeditions Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Lindblad Expeditions Holdings shareholders have received a total shareholder return of 40% over one year. That certainly beats the loss of about 4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Lindblad Expeditions Holdings , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Lindblad Expeditions Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives