- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Lindblad Expeditions Holdings (NASDAQ:LIND) Will Be Hoping To Turn Its Returns On Capital Around

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Lindblad Expeditions Holdings (NASDAQ:LIND), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Lindblad Expeditions Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.021 = US$11m ÷ (US$831m - US$319m) (Based on the trailing twelve months to December 2023).

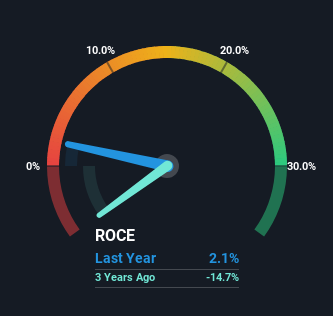

Thus, Lindblad Expeditions Holdings has an ROCE of 2.1%. Ultimately, that's a low return and it under-performs the Hospitality industry average of 9.6%.

See our latest analysis for Lindblad Expeditions Holdings

Above you can see how the current ROCE for Lindblad Expeditions Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Lindblad Expeditions Holdings .

What The Trend Of ROCE Can Tell Us

On the surface, the trend of ROCE at Lindblad Expeditions Holdings doesn't inspire confidence. Around five years ago the returns on capital were 8.1%, but since then they've fallen to 2.1%. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

What We Can Learn From Lindblad Expeditions Holdings' ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Lindblad Expeditions Holdings is reinvesting for growth and has higher sales as a result. However, despite the promising trends, the stock has fallen 45% over the last five years, so there might be an opportunity here for astute investors. As a result, we'd recommend researching this stock further to uncover what other fundamentals of the business can show us.

One more thing to note, we've identified 1 warning sign with Lindblad Expeditions Holdings and understanding it should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026