- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Lindblad Expeditions Holdings, Inc. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

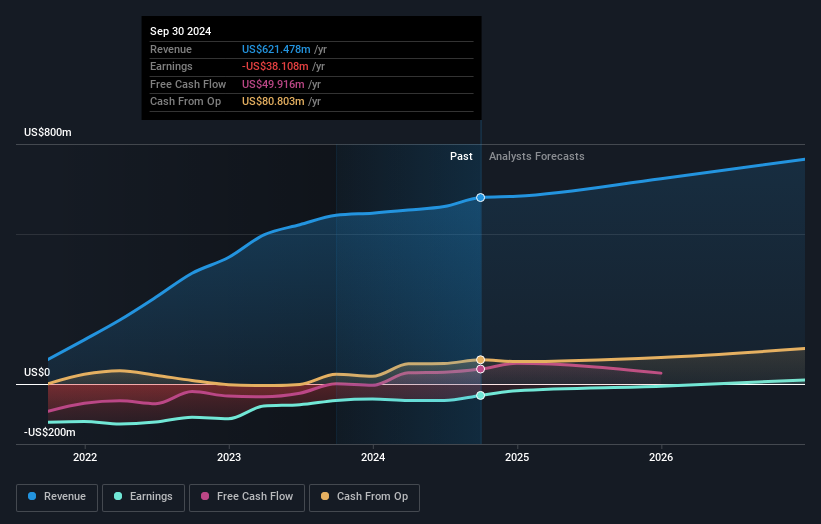

Lindblad Expeditions Holdings, Inc. (NASDAQ:LIND) investors will be delighted, with the company turning in some strong numbers with its latest results. It was overall a positive result, with revenues beating expectations by 6.3% to hit US$206m. Lindblad Expeditions Holdings also reported a statutory profit of US$0.36, which was an impressive 96% above what the analysts had forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Lindblad Expeditions Holdings after the latest results.

View our latest analysis for Lindblad Expeditions Holdings

Taking into account the latest results, the consensus forecast from Lindblad Expeditions Holdings' four analysts is for revenues of US$684.4m in 2025. This reflects a decent 10% improvement in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 85% to US$0.11. Before this latest report, the consensus had been expecting revenues of US$683.7m and US$0.097 per share in losses. While next year's revenue estimates held steady, there was also a considerable increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

Despite expectations of heavier losses next year,the analysts have lifted their price target 13% to US$15.00, perhaps implying these losses are not expected to be recurring over the long term. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Lindblad Expeditions Holdings, with the most bullish analyst valuing it at US$18.00 and the most bearish at US$10.00 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Lindblad Expeditions Holdings shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Lindblad Expeditions Holdings' past performance and to peers in the same industry. It's pretty clear that there is an expectation that Lindblad Expeditions Holdings' revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 8.0% growth on an annualised basis. This is compared to a historical growth rate of 28% over the past five years. Compare this to the 167 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 9.6% per year. Factoring in the forecast slowdown in growth, it looks like Lindblad Expeditions Holdings is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Lindblad Expeditions Holdings analysts - going out to 2026, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Lindblad Expeditions Holdings (including 1 which is a bit concerning) .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.