- United States

- /

- Hospitality

- /

- NasdaqCM:INSE

Take Care Before Jumping Onto Inspired Entertainment, Inc. (NASDAQ:INSE) Even Though It's 37% Cheaper

Inspired Entertainment, Inc. (NASDAQ:INSE) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

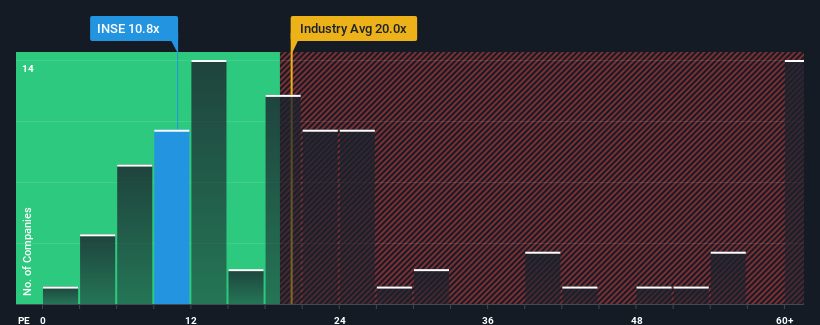

Following the heavy fall in price, Inspired Entertainment may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.8x, since almost half of all companies in the United States have P/E ratios greater than 16x and even P/E's higher than 30x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Inspired Entertainment could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Inspired Entertainment

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Inspired Entertainment's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the four analysts following the company. With the market predicted to deliver 12% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Inspired Entertainment's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Inspired Entertainment's P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Inspired Entertainment currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Inspired Entertainment (including 2 which are a bit concerning).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INSE

Inspired Entertainment

A gaming technology company, supplies content, platform, and other products and services to online and land-based regulated lottery, betting, and gaming operators in the United Kingdom, Greece, and internationally.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives