- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

Can First Watch (FWRG) Leverage Its Top Workplace Ranking Into Sustainable Expansion and Operational Excellence?

Reviewed by Sasha Jovanovic

- First Watch Restaurant Group was recently recognized as the #1 Most Loved Workplace® in America for the second consecutive year, with employee engagement and innovative benefits cited as key drivers across more than 600 restaurants in 32 states.

- This distinction underscores the company’s continued success in fostering a strong employee-centric culture, which may support expansion and operational consistency.

- We'll explore how ongoing recognition for employee satisfaction may reinforce First Watch's investment thesis focused on growth and execution.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

First Watch Restaurant Group Investment Narrative Recap

To own shares of First Watch Restaurant Group, investors should have confidence in the company’s ability to drive sustained unit expansion and leverage a distinctive, employee-focused culture to fuel growth within the highly competitive daytime dining segment. The recent Most Loved Workplace® recognition reflects internal strengths but is unlikely to have a material impact on the company's primary short-term catalyst, accelerating store openings and sales growth, or its biggest risk, ongoing food and labor cost inflation pressuring profit margins.

Among recent announcements, First Watch's plan to open nearly 60 new company-owned locations in 2025 is especially relevant. This ambitious expansion strategy aligns directly with the company’s key growth catalyst, but also extends exposure to input cost volatility, which remains a pressing concern as overall profit margins have been squeezed by persistent commodity and wage inflation.

Yet, investors should also be aware that, despite cultural accolades, persistent cost pressures behind the scenes could...

Read the full narrative on First Watch Restaurant Group (it's free!)

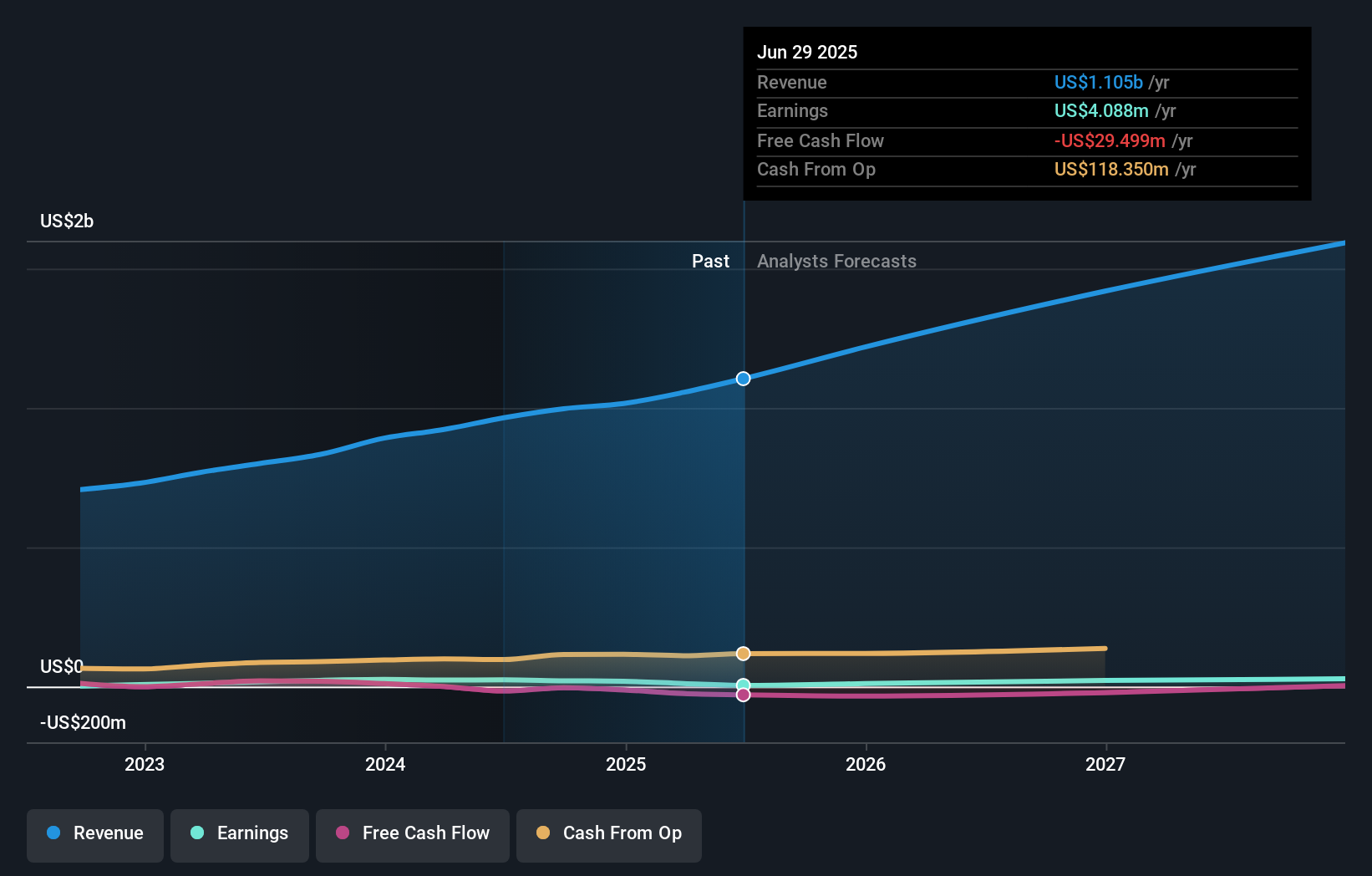

First Watch Restaurant Group's outlook projects $1.7 billion in revenue and $33.8 million in earnings by 2028. This reflects a required annual revenue growth rate of 15.1% and a $29.7 million increase in earnings from the current $4.1 million level.

Uncover how First Watch Restaurant Group's forecasts yield a $22.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$7.27 to US$22, reflecting two distinct approaches to First Watch’s future growth. While opinions are divided, the company’s aggressive expansion plans carry broad implications for both revenue potential and exposure to margin risks.

Explore 2 other fair value estimates on First Watch Restaurant Group - why the stock might be worth as much as 25% more than the current price!

Build Your Own First Watch Restaurant Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free First Watch Restaurant Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Watch Restaurant Group's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives