- United States

- /

- Hospitality

- /

- NasdaqCM:FLL

Full House Resorts, Inc. (NASDAQ:FLL) Might Not Be As Mispriced As It Looks

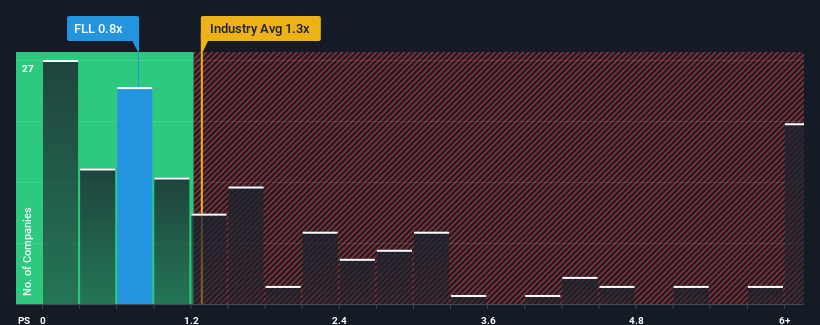

When close to half the companies operating in the Hospitality industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, you may consider Full House Resorts, Inc. (NASDAQ:FLL) as an attractive investment with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Full House Resorts

How Has Full House Resorts Performed Recently?

Full House Resorts certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Full House Resorts.Is There Any Revenue Growth Forecasted For Full House Resorts?

Full House Resorts' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 52% last year. Pleasingly, revenue has also lifted 90% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 22% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this information, we find it odd that Full House Resorts is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Full House Resorts' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Full House Resorts' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Full House Resorts that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FLL

Full House Resorts

Owns, leases, operates, develops, manages, and invests in casinos, and related hospitality and entertainment facilities in the United States.

Fair value low.

Market Insights

Community Narratives