- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (NASDAQ:EXPE) is Navigating Through Conflicting Signals

Facing a broad market weakness, many investors turned to thematic opportunities in the first half of the year. This included bets on travel recovery, prompting the stocks like Expedia Group, Inc. (NASDAQ: EXPE) to outperform.

Yet, the optimism wasn't warranted, as Hilton's latest forecast sent ripples through the sector.

Check out our latest analysis for Expedia Group

First-quarter 2022 results

- US$0.78 loss per share (up from US$4.17 loss in 1Q 2021).

- Revenue: US$2.25b (up 81% from 1Q 2021).

- Net loss: US$122.0m (loss narrowed 80% from 1Q 2021).

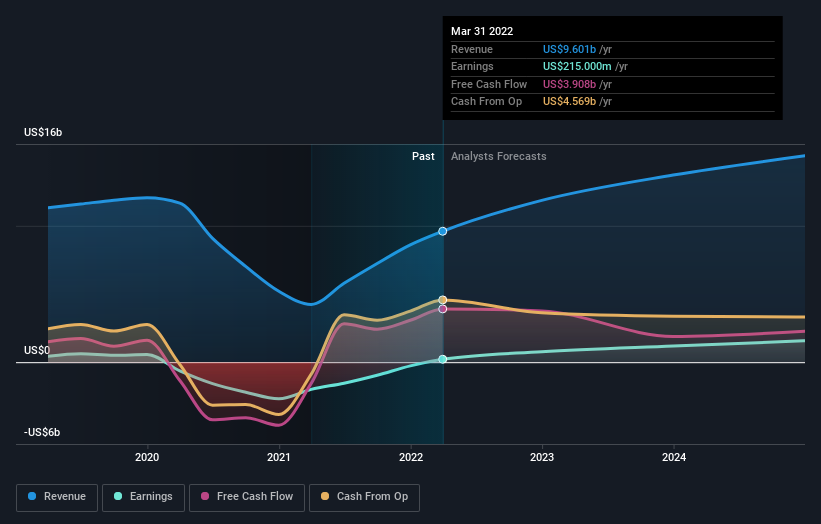

Earnings per share (EPS) surpassed analyst estimates by 30%. Over the next year, revenue is forecast to grow 28%, compared to a 103% growth forecast for the industry in the US.

Over the last 3 years, on average, earnings per share have fallen by 43% per year, but its share price has increased by 7% per year, which means it is well ahead of earnings.

What does the future of Expedia Group look like?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

Expedia Group's earnings over the next few years are expected to double, indicating an optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

Conflicting Signals Raise Caution

After 2020 skewed the benchmarks, many companies started to compare the latest results to 2019 levels. In the latest quarter, Expedia marked total gross bookings of US$24.4b, just 17% down compared to the first quarter of 2019.

Expedia operates as an online travel agency, enabling visitors to book flights, hotels, cruises, car rentals, and other connected services. Thus, when a global hotel chain issues lackluster guidance, the investors get skeptical about the short-term opportunity in the sector.

While airline executives have been commenting about record demand in Q2, Hilton (NYSE: HLT) gave a modest full-year EPS projection at US$0.98-US$1.03 per share, well below the expectation of US$1.07. On the other hand, Airbnb (Nasdaq: ABNB) issued positive guidance, expecting Q2 revenue to be above the consensus.

These are contradictory statements, but we have to point out one fact. Suppose one issued guidance is enough to push the entire sector deep into the red. In that case, the market is obviously so unstable that investments in speculative, unprofitable growth stocks should be under extra scrutiny.

So while earnings are important, it's equally important to consider the risks facing Expedia Group at this point. Be aware that Expedia Group is showing 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

If you are no longer interested in Expedia Group, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.