- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (EXPE): Reassessing Valuation After Strong Q3 Earnings Beat and Improving Growth Outlook

Reviewed by Simply Wall St

Expedia Group (EXPE) is back on investors radar after a stronger than expected third quarter, where earnings and demand outpaced forecasts and helped drive a 17.6% jump in the stock over the past month.

See our latest analysis for Expedia Group.

That surge has capped a strong run, with a roughly 16% 30 day share price return and a robust 1 year total shareholder return of about 62%, suggesting momentum is clearly building as investors reassess Expedia Group’s growth prospects and perceived risks.

If this travel rebound has you rethinking your watchlist, it could be a good moment to explore auto manufacturers as another way to spot where consumer demand is shifting next.

With earnings beating expectations, demand accelerating, and the stock already delivering outsized returns, is Expedia Group still trading at a discount to its intrinsic value, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 4.7% Overvalued

With Expedia Group last closing at $282.82 against a narrative fair value of about $270, the current price sits slightly ahead of long run expectations.

Unified global technology platform and greater automation (including AI powered developer tools and personalized insurance products) are already producing faster feature delivery, improved customer experience, and reduced operating costs, which are expected to further expand EBITDA margins and benefit earnings over the next several years.

Curious how modest revenue growth, rising margins, and a leaner share count can still justify a premium price tag? The full narrative unpacks the math, step by step.

Result: Fair Value of $270.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution is not risk free, with softer US travel demand and rising AI enabled competition both capable of pressuring growth assumptions that underpin today’s valuation.

Find out about the key risks to this Expedia Group narrative.

Another Lens on Value

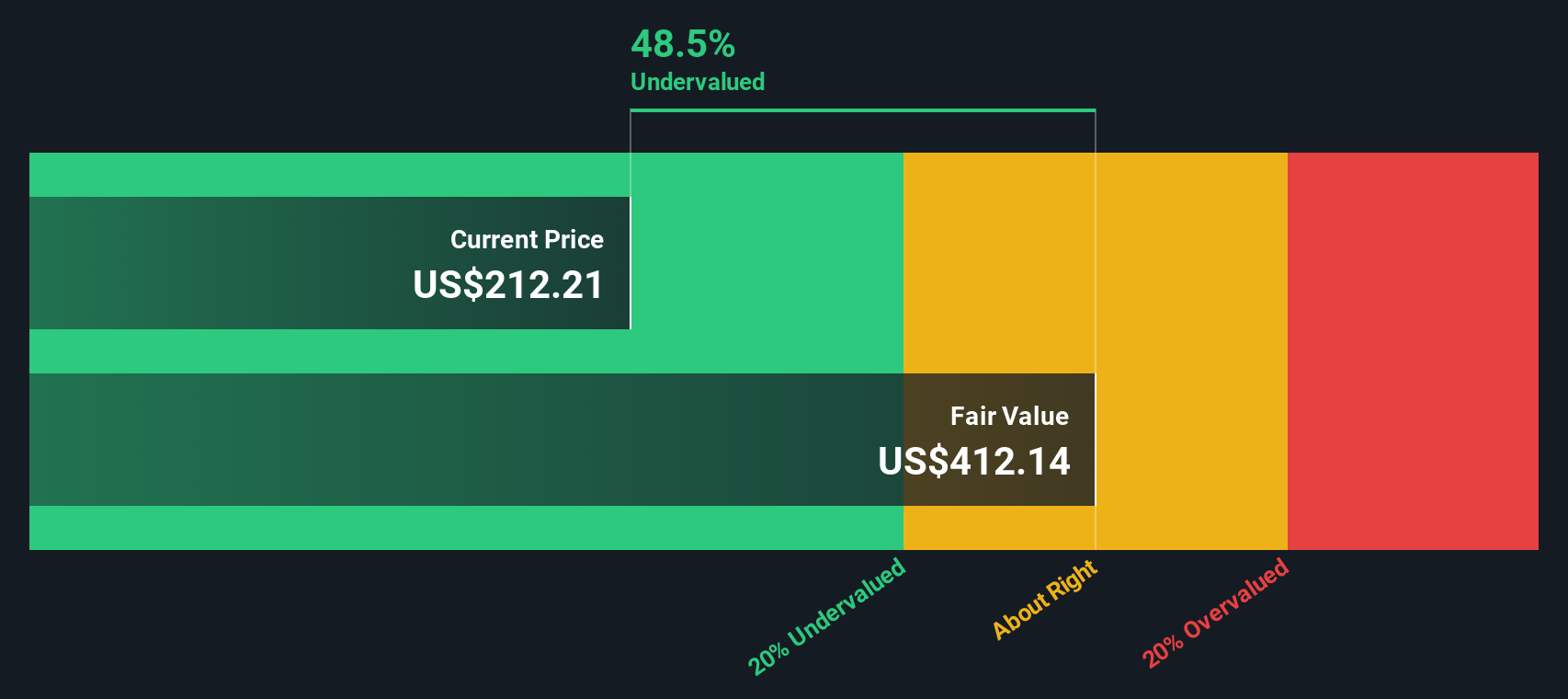

While consensus narratives see Expedia Group as about 4.7% overvalued versus a $270 fair value, our SWS DCF model paints a very different picture, suggesting intrinsic value closer to $519, or roughly 46% above today’s price. Is the market underestimating the cash flow story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expedia Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expedia Group Narrative

If you see the story differently or simply prefer digging into the numbers yourself, you can craft a complete view in minutes with Do it your way.

A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Use the Simply Wall Street Screener to pinpoint fresh opportunities before they hit the mainstream, so you are not left watching from the sidelines.

- Capture emerging value by targeting companies trading below their cash flow potential with these 913 undervalued stocks based on cash flows.

- Capitalize on rapid innovation by focusing on leaders at the forefront of machine learning and automation through these 26 AI penny stocks.

- Boost your income strategy by filtering for reliable payers offering attractive yields via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)