- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

Expedia Group (EXPE) Raises Revenue Guidance And Declares US$0.40 Dividend

Reviewed by Simply Wall St

Expedia Group (EXPE) recently raised its revenue guidance and affirmed its quarterly dividend of $0.40 per share, which aligns with the company's focus on enhancing shareholder value. The recent quarter witnessed an encouraging 20% rise in Expedia's share price, likely supported by a boost in international revenue, despite a decline in net income compared to the previous year. In a quarter marked by mixed company earnings and overall market gains, the strengthened guidance and substantial dividend announcements provided substantial weight to Expedia's stock movement, highlighting a positive investor sentiment amidst generally stabilizing market conditions.

Buy, Hold or Sell Expedia Group? View our complete analysis and fair value estimate and you decide.

The recent upward shift in Expedia Group's share price, fueled by raised revenue guidance and a confirmed dividend, aligns with its strategic focus on enhancing shareholder value. Over the past five years, Expedia's total shareholder return including dividends was 116.69%. This longer-term outperformance contrasts with its 1-year return, which beat both the broader US market and the Hospitality industry, further validating investor confidence in its path forward. The current share price shows a subtle discount to the consensus price target of $193.88, suggesting a general alignment in analyst expectations regarding fair value.

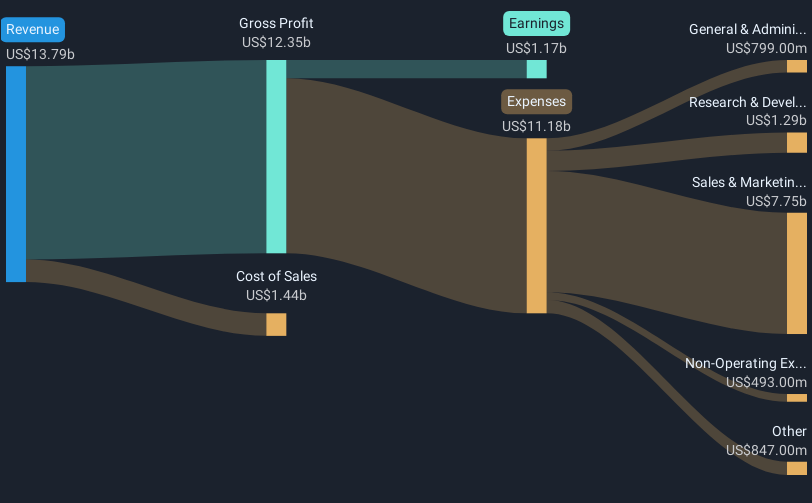

The focus on AI investments and global expansion is expected to support revenue and earnings forecasts. Analysts project revenue to climb from $13.79 billion, with earnings potentially doubling over the next few years. These initiatives might solidify revenue streams and improve margins, despite inherent risks. By boosting international revenues and B2B growth, Expedia seems positioned to utilize high-margin advertising streams. The market's response to the guidance and dividend indicates that investors are optimistic about the company overcoming competitive and operational challenges, potentially maintaining its standing and growth trajectory beyond 2025.

Our valuation report here indicates Expedia Group may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives