- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (NasdaqGS:DUOL) Sees 18% Stock Surge Ahead Of Q4 2024 Earnings Call

Reviewed by Simply Wall St

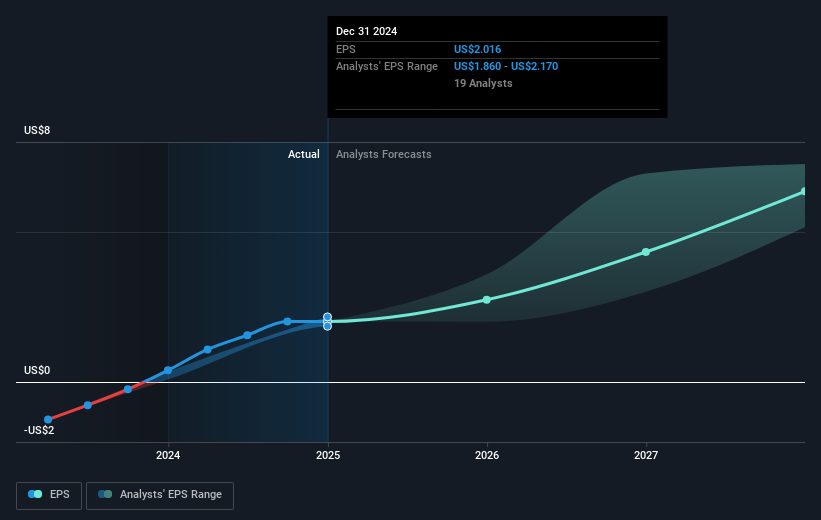

Duolingo (NasdaqGS:DUOL) announced its upcoming Q4 2024 earnings call, scheduled for February 27, 2025, just as the company experienced an 18% price increase over the past month. This surge occurred against a backdrop of mixed performance in major U.S. stock indexes, with the Dow Jones gaining 0.7% while the Nasdaq Composite fell 0.6%. The broader market witnessed a 3.6% decline in the last 7 days due to economic uncertainties linked to tariff announcements. However, Duolingo's significant price movement suggests investor anticipation of positive financial updates. Meanwhile, the tech sector, particularly semiconductor stocks, saw a downturn, with Nvidia dropping over 3% despite strong earnings, reflecting broader volatility in tech stocks. This contrast highlights Duolingo's distinct performance trend, driven possibly by its strategic market positioning and investor expectations tied to the forthcoming earnings report amidst the sector's otherwise challenged climate.

Navigate through the intricacies of Duolingo with our comprehensive report here.

Over the past three years, Duolingo's shareholders enjoyed a total return of 402.22%, a significant appreciation when compared to the broader market. This robust performance can be attributed to several key developments. After becoming profitable this year, the company has consistently reported increased revenues and net income, such as the Q3 2024 earnings with sales reaching US$192.59 million, up from US$137.62 million year-over-year. Additionally, Duolingo's entry into the Russell Midcap Growth Index in July 2024 reflected its growing market recognition, further propelling investor interest.

The introduction of innovative features, like the multi-subject app with new music and updated math courses in November 2023, likely contributed to user engagement and growth. Moreover, strategic partnerships, such as their August 2024 collaboration with Sony Music Entertainment, integrated popular songs into their music courses, enhancing the platform's appeal. These developments have helped Duolingo outperform the US Consumer Services industry, which returned 9.1% over the last year.

- See whether Duolingo's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Duolingo's market positioning with our detailed risk analysis report.

- Are you invested in Duolingo already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives