- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (NasdaqGS:DUOL) Sees 14% Drop Despite US$89 Million Net Income Growth

Reviewed by Simply Wall St

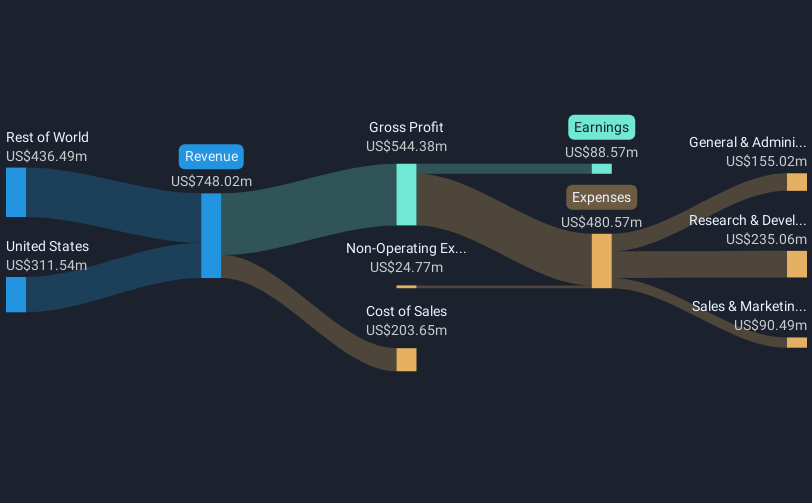

Duolingo (NasdaqGS:DUOL) has seen a significant share price decline of 14% over the last quarter, despite reporting robust fourth-quarter 2024 earnings with sales rising to $210 million and net income increasing to $14 million. The full-year results reflected an impressive increase in sales to $748 million and net income to $89 million. The company's positive financial performance was further reinforced by optimistic guidance for 2025, projecting revenue between $962 million and $979 million. Nevertheless, broader market conditions likely influenced the stock's movement. The Nasdaq Composite's 3% drop in February could have exacerbated investor concerns amid economic uncertainty, including weak manufacturing data and inflation worries. While Duolingo's new product features—like the expanded video call offerings—are promising, overall market caution and fluctuating investor sentiment regarding technology stocks, illustrated by declines in tech giants like Nvidia, likely contributed to Duolingo's share price decline.

Dig deeper into the specifics of Duolingo here with our thorough analysis report.

Over the last three years, Duolingo's total shareholder returns reached an impressive 294.88%. This significant increase reflects the company's robust growth trajectory, especially in comparison to the broader market and Consumer Services industry over the past year. Duolingo has consistently exceeded industry and market expectations, with earnings growing very large compared to the previous year.

Noteworthy developments contributing to this performance included the successful launch of multi-subject apps like Music and Math in November 2023, catering to expanding user interests. Further enhancing user engagement, Duolingo's partnership with Sony Music in August 2024 introduced popular songs into its Music courses. Additionally, executive changes such as the appointment of Bonnie Ross to the board in December 2024 signaled continued strategic expansion. Recent video call feature expansions to Android in January 2025 also showcased Duolingo's commitment to enhancing user experience across platforms.

- Unlock the insights behind Duolingo's valuation and discover its true investment potential

- Gain insight into the risks facing Duolingo and how they might influence its performance—click here to read more.

- Invested in Duolingo? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives